Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Angostura is one of the Caribbean's leading rum producers with a superb collection of rum brands and is the world's market leader for bitters.

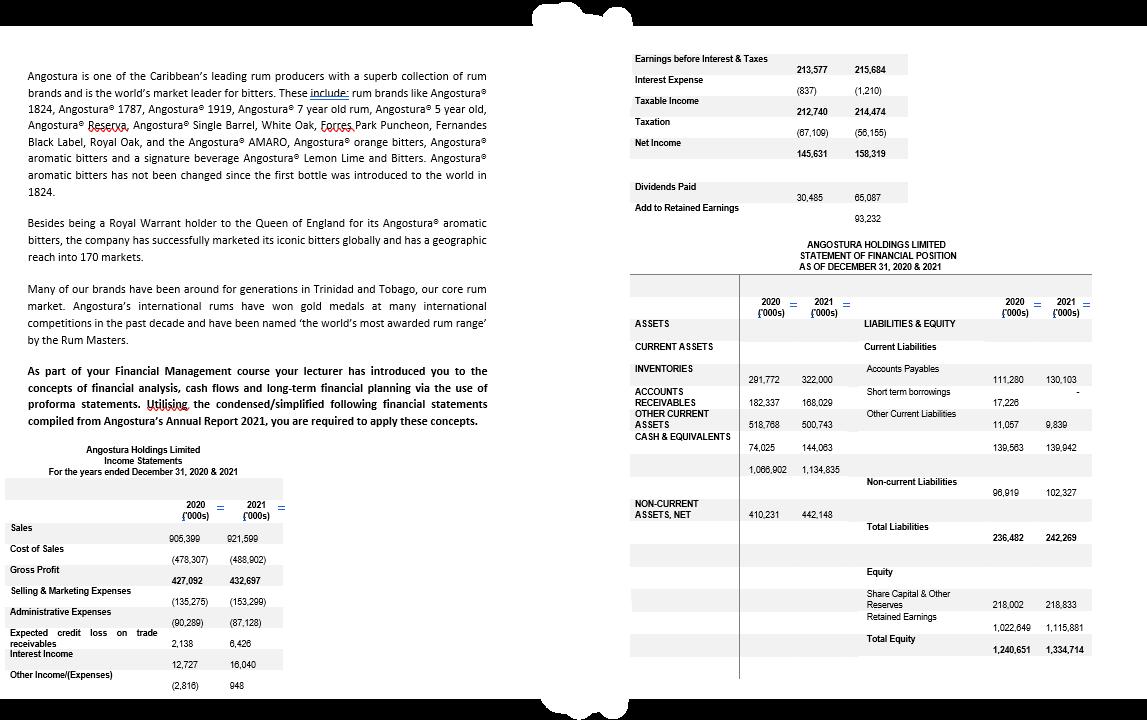

Angostura is one of the Caribbean's leading rum producers with a superb collection of rum brands and is the world's market leader for bitters. These include: rum brands like Angostura 1824, Angostura 1787, Angostura 1919, Angostura 7 year old rum, Angostura 5 year old, Angostura Reserva, Angostura Single Barrel, White Oak, Forres, Park Puncheon, Fernandes Black Label, Royal Oak, and the Angostura AMARO, Angostura orange bitters, Angostura aromatic bitters and a signature beverage Angostura Lemon Lime and Bitters. Angostura aromatic bitters has not been changed since the first bottle was introduced to the world in 1824. Besides being a Royal Warrant holder to the Queen of England for its Angostura aromatic bitters, the company has successfully marketed its iconic bitters globally and has a geographic reach into 170 markets. Many of our brands have been around for generations in Trinidad and Tobago, our core rum market. Angostura's international rums have won gold medals at many international competitions in the past decade and have been named 'the world's most awarded rum range' by the Rum Masters. As part of your Financial Management course your lecturer has introduced you to the concepts of financial analysis, cash flows and long-term financial planning via the use of proforma statements. Utilising the condensed/simplified following financial statements compiled from Angostura's Annual Report 2021, you are required to apply these concepts. Angostura Holdings Limited Income Statements For the years ended December 31, 2020 & 2021 Sales Cost of Sales Gross Profit Selling & Marketing Expenses Administrative Expenses Expected credit loss on trade receivables Interest Income Other Income (Expenses) 2020 ('000s) 2021 F000s) 905,399 921,599 (478,307) (488,902) 427,092 432,697 (135,275) (153,299) (90,289) (87,128) 2,138 6,426 12,727 16,040 (2,816) 948 Earnings before Interest & Taxes Interest Expense Taxable Income Taxation Net Income Dividends Paid Add to Retained Earnings ASSETS CURRENT ASSETS INVENTORIES ACCOUNTS RECEIVABLES OTHER CURRENT ASSETS CASH & EQUIVALENTS NON-CURRENT ASSETS, NET 213,577 (837) 212,740 (67,109) 145,631 30,485 2020 = 2021 (000s) (000s) ANGOSTURA HOLDINGS LIMITED STATEMENT OF FINANCIAL POSITION AS OF DECEMBER 31, 2020 & 2021 291,772 182,337 168,029 518,768 500,743 74,025 1,066,902 144,083 1,134,835 322,000 410.231 442.148 215,684 (1,210) 214,474 (56,155) 158,319 = 65,087 93,232 LIABILITIES & EQUITY Current Liabilities Accounts Payables Short term borrowings Other Current Liabilities Non-current Liabilities Total Liabilities Equity Share Capital & Other Reserves Retained Earnings Total Equity 2020 = (000s) 111,280 17,226 11,057 139.563 96,919 236,482 2021 ('000s) 130,103 9,830 139,942 102,327 242,269 218,002 218,833 1,022,649 1,240,651 1,334,714 1,115,881 As part of your analysis, you have decided to investigate Angostura's cash flows. (a) Using the financial statements and additional notes provided, calculate the following for 2021: i. Operating Cash Flow ii. Net Capital Spending iii. Change in Net Working Capital iv. Cash Flow from assets v. Cash Flow to creditors vi. Cash Flow to stockholders (b) Prepare Angostura's Statement of Cash Flow for the year ended December 31, 2021. (c) What is the purpose and importance of the Cash Flow Statement?

Step by Step Solution

★★★★★

3.59 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Operating Cash Flow Net Income Depreciation Amortization Change in Working Capital 143631 12727 17228 139130 Net Capital Spending Capital Expenditures Depreciation Amortization 15051 12727 2324 Change ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started