Question: Anita Lopez operates a full-time law practice in eastern Ontario. In her spare time, she maintains a small rural acreage for the purpose of

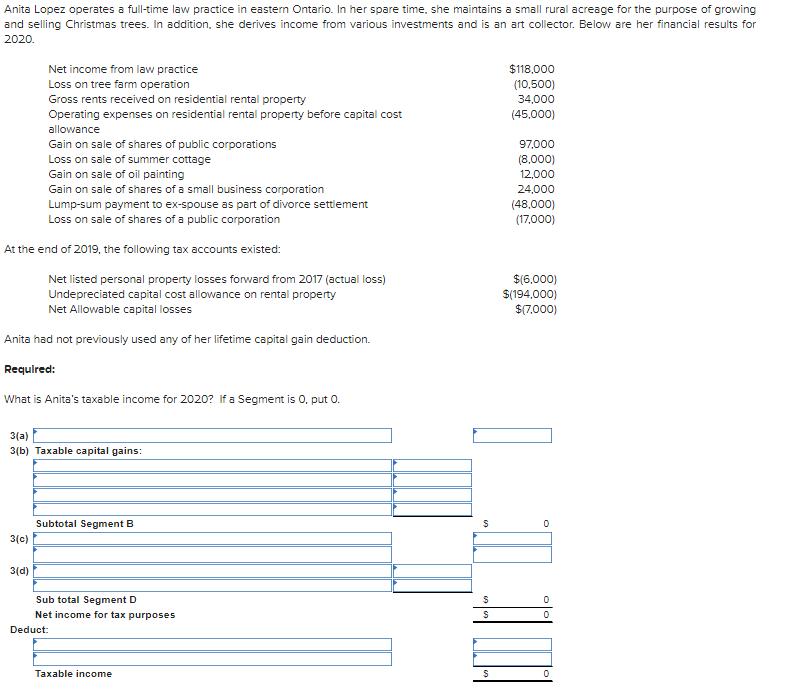

Anita Lopez operates a full-time law practice in eastern Ontario. In her spare time, she maintains a small rural acreage for the purpose of growing and selling Christmas trees. In addition, she derives income from various investments and is an art collector. Below are her financial results for 2020. $118,000 Net income from law practice Loss on tree farm operation Gross rents received on residential rental property Operating expenses on residential rental property before capital cost (10,500) 34,000 (45,000) allowance Gain on sale of shares of public corporations Loss on sale of summer cottage Gain on sale of oil painting Gain on sale of shares of a small business corporation Lump-sum payment to ex-spouse as part of divorce settiement Loss on sale of shares of a public corporation 97.000 (8,000) 12,000 24,000 (48,000) (17,000) At the end of 2019, the following tax accounts existed: Net listed personal property losses forward from 2017 (actual loss) Undepreciated capital cost allowance on rental property Net Allowable capital losses $(6,000) S(194,000) $(7.000) Anita had not previously used any of her lifetime capital gain deduction. Requlred: What is Anita's taxable income for 2020? if a Segment is 0. put 0. 3(a) 3(b) Taxable capital gains: Subtotal Segment B 3(c) 3(d) Sub total Segment D Net income for tax purposes Deduct: Taxable income

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Explanation 1 The divorce settlement is not deductible because it is not a periodic payment ITA 60b ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

6361ebb7615d8_234022.pdf

180 KBs PDF File

6361ebb7615d8_234022.docx

120 KBs Word File