Question

Ann Litigate is updating her bookkeeping records in preparation for the monthly meeting with her accountant. She has the following transactions to enter in

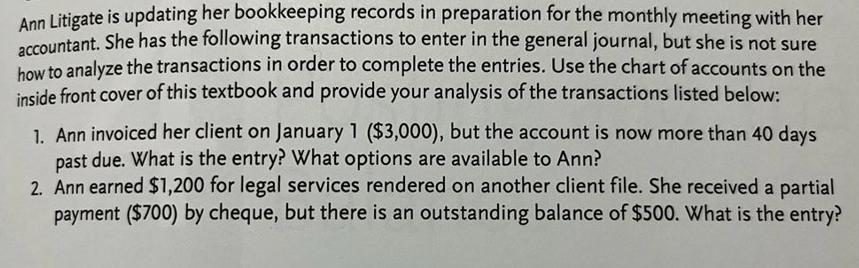

Ann Litigate is updating her bookkeeping records in preparation for the monthly meeting with her accountant. She has the following transactions to enter in the general journal, but she is not sure how to analyze the transactions in order to complete the entries. Use the chart of accounts on the inside front cover of this textbook and provide your analysis of the transactions listed below: 1. Ann invoiced her client on January 1 ($3,000), but the account is now more than 40 days past due. What is the entry? What options are available to Ann? 2. Ann earned $1,200 for legal services rendered on another client file. She received a partial payment ($700) by cheque, but there is an outstanding balance of $500. What is the entry?

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting A Contemporary Approach

Authors: David Haddock, John Price, Michael Farina

3rd edition

77639731, 978-0077639730

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App