Question

Ann would like to buy a house. It costs $2,500,000. Her down payment will be $50,000. She will take out a mortgage for the

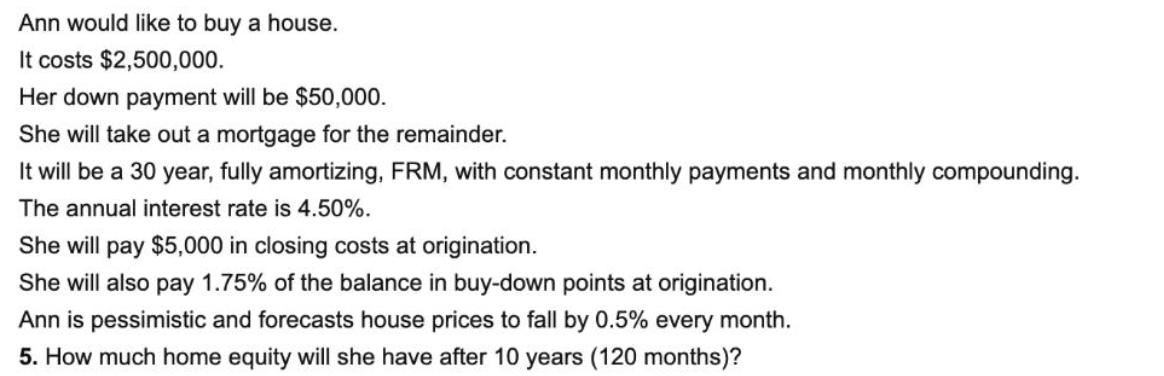

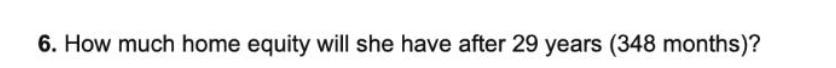

Ann would like to buy a house. It costs $2,500,000. Her down payment will be $50,000. She will take out a mortgage for the remainder. It will be a 30 year, fully amortizing, FRM, with constant monthly payments and monthly compounding. The annual interest rate is 4.50%. She will pay $5,000 in closing costs at origination. She will also pay 1.75% of the balance in buy-down points at origination. Ann is pessimistic and forecasts house prices to fall by 0.5% every month. 5. How much home equity will she have after 10 years (120 months)? 6. How much home equity will she have after 29 years (348 months)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Personal Finance An Integrated Planning Approach

Authors: Ralph R Frasca

8th edition

136063039, 978-0136063032

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App