Question

Anna bought 100 shares of Red Rocks Corp.'s stock at $50 per share on February 1, 2020 and sold them for $70 on February 5,

Anna bought 100 shares of Red Rocks Corp.'s stock at $50 per share on February 1, 2020 and sold them for $70 on February 5, 2021.

Red Rocks Corp. has not paid any dividends until 2021. The first dividend was announced on 12/7/2020.

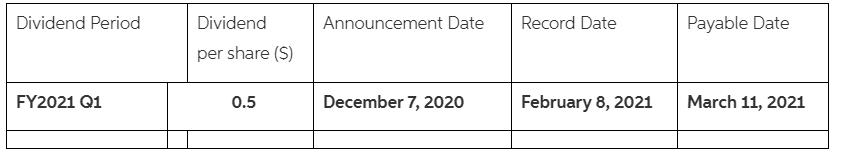

The dividend payment schedule is listed in the table below:

Anna's ordinary income tax rate is 28%. The capital gain and dividend are taxed at the same rate of 15%.

Q) How much total return in dollar amount would Anna receive from the transaction?

Dividend Period FY2021 Q1 Dividend per share (S) 0.5 Announcement Date December 7, 2020 Record Date February 8, 2021 Payable Date March 11, 2021

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER To calculate Annas total return we need to consider the capital gain from selling the stock a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Federal Taxation 2016 Comprehensive

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

29th Edition

134104374, 978-0134104379

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App