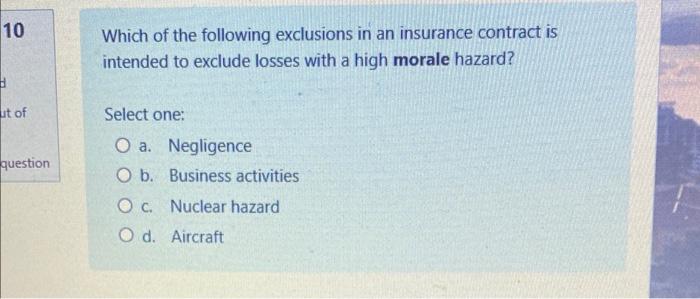

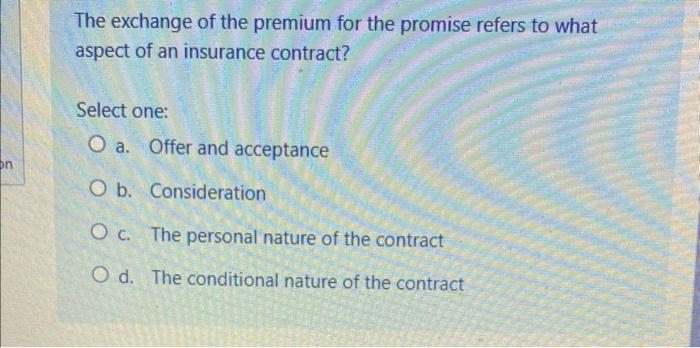

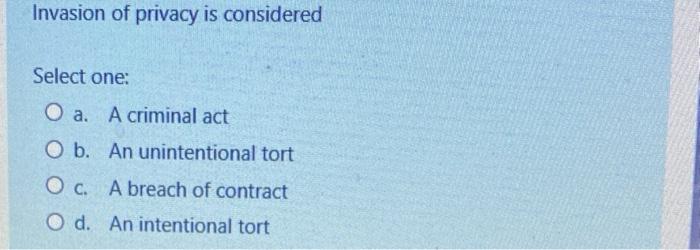

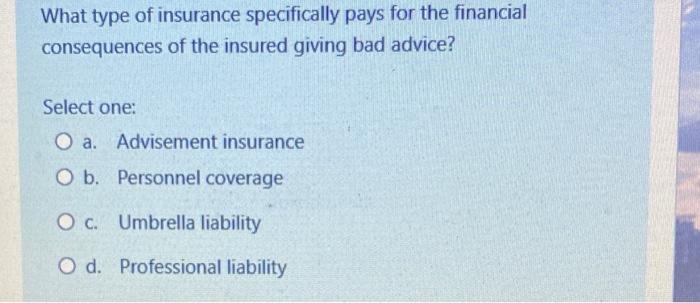

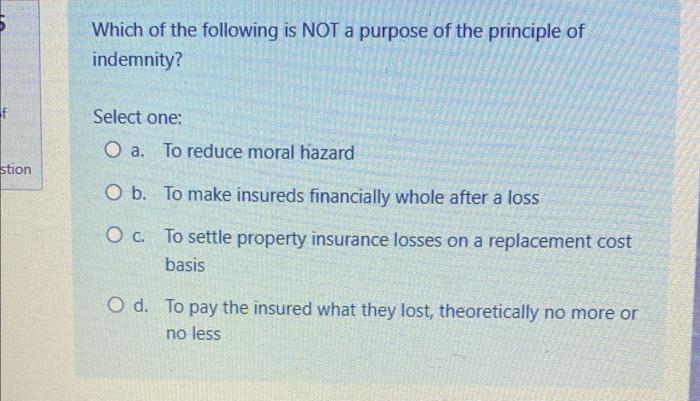

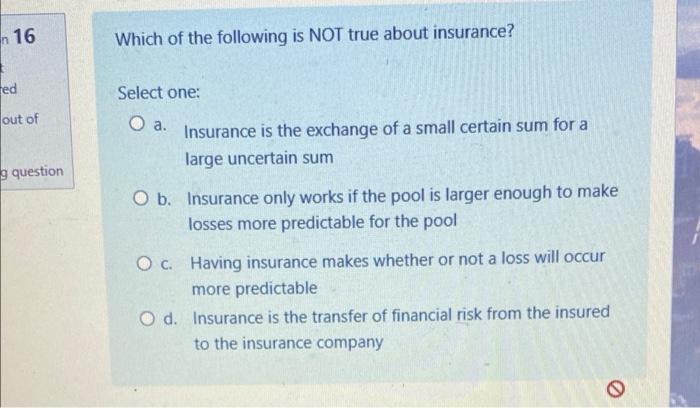

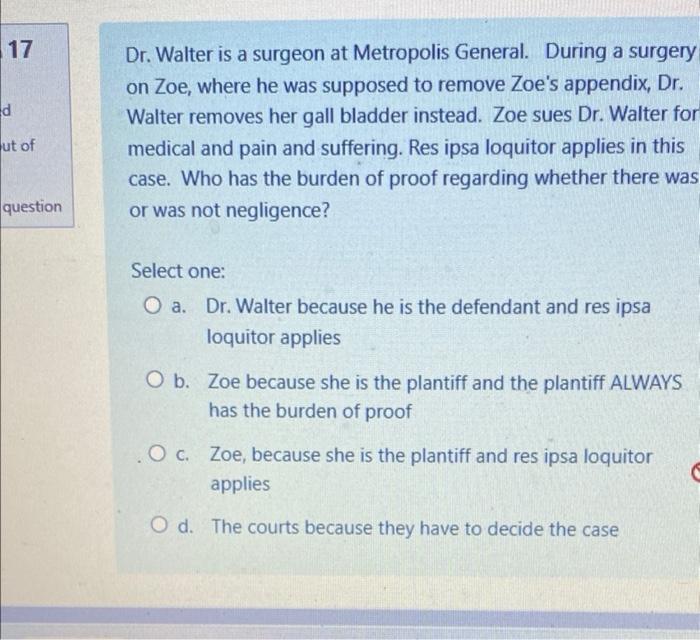

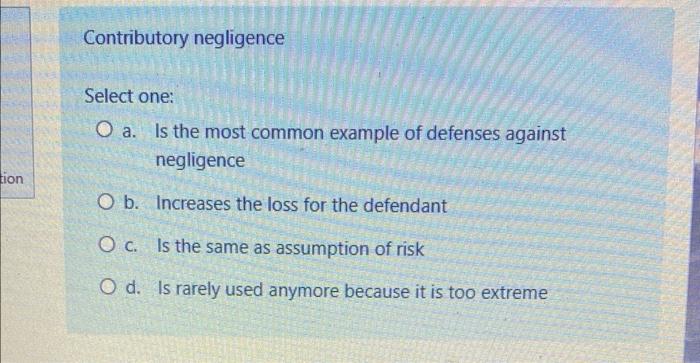

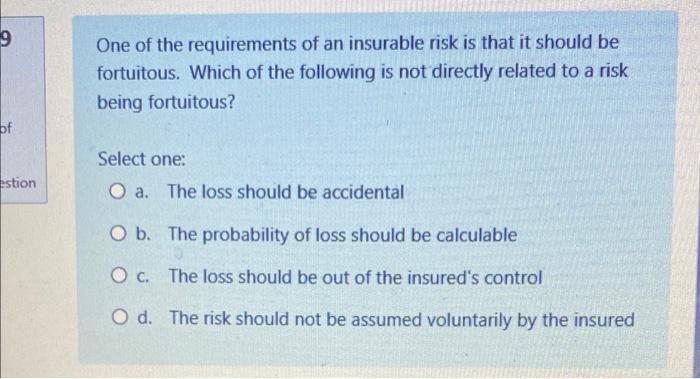

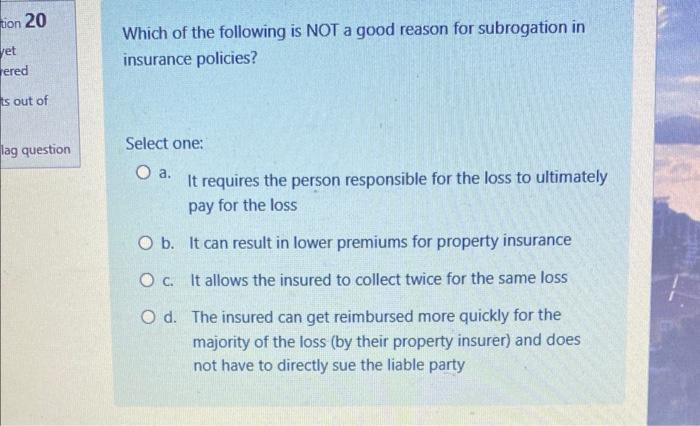

Anna has a fire in her home and some of her furniture is destroyed. Under her insurance policy, her furniture is valued on an actual cash value basis. How much will Anna receive for her furniture (ignoring any deductibles)? Select one: a. The replacement cost of the furniture less depreciation b. The amount it would cost to buy furniture that is the same age c. The amount the furniture could have been sold before the fire damage d. What she paid for the furniture Jay buys property insurance for a home he now owns but plans to renovate and sell. Once he renovates it, he tries to include the property insurance as part of the deal to resell the home without asking the insurance company. Jay cannot do this because insurance contracts are Select one: a. Personal b. Contracts of adhesion c. Aleatory d. Unilateral What is now referred to as open-perils policies had to be changed because what they used to be called (and still sometimes are by some people) was confusing. What did open-perils used to be called? Select one: a. Full-peril b. All-risks c. Broad perils d. Total coverage Andrea runs into Nia and does $12,000 damage to Nia's car. Nia collects the $12,000 less her $500 deductible (or $11,500 ) from her own insurer. Nia's insurer then subrogates against Andrea's insurance to recover its loss. Assuming the subrogation is successful, what happens next? Select one: a. Nia's insurer gets the $11,500 and that's all b. Nia's insurer collects $12,000 and keeps it all c. Nia's insurer collects $12,000 and gives it all to Nia d. Nia's insurer collects $12,000 and gives $500 of it to Nia Malia is seriously injured when she slips on a wet floor in a home hardware store. The store owner is found to be liable for the accident. In addition to lost wages and medical bills, Malia undergoes rehabilitation. The cost of the rehabilitation would be considered Select one: a. Economic damages b. Punitive damages c. Mental damages d. General damages Kamron plans to open a business in a relatively high-crime area. He found an insurer willing to write property insurance coverage on the business, but only if he maintains a security system. Keeping the security system fully operational is a condition of having the insurance coverage stay in force. This condition, which helps to enforce utmost good faith, is known as a Select one: a. Subrogation b. Warranty c. Representation d. Binder If you have an open perils property insurance policy Select one: a. You pick your own perils from a list of options b. You have coverage for every cause of loss to property no matter what caused it c. You must pay particular attention to the exclusions in the policy d. The insurance company doesn't tell you what perils you are covered for before a loss Words are defined in the definitions page for which UNE of the following reasons? Select one: a. Most people do not understand insurance and, therefore, need definitions to understand the policy b. So the insured doesn't have to read the rest of the policy c. To confuse the policyholder so they are less likely to make a claim d. The definition of the word (or word combination) is too long to include throughout the contract Which of the following exclusions in an insurance contract is intended to exclude losses with a high morale hazard? Select one: a. Negligence b. Business activities c. Nuclear hazard d. Aircraft The exchange of the premium for the promise refers to what aspect of an insurance contract? Select one: a. Offer and acceptance b. Consideration c. The personal nature of the contract d. The conditional nature of the contract Invasion of privacy is considered Select one: a. A criminal act b. An unintentional tort c. A breach of contract d. An intentional tort What type of insurance specifically pays for the financial consequences of the insured giving bad advice? Select one: a. Advisement insurance b. Personnel coverage c. Umbrella liability d. Professional liability Which of the following is NOT a purpose of the principle of indemnity? Select one: a. To reduce moral hazard b. To make insureds financially whole after a loss c. To settle property insurance losses on a replacement cost basis d. To pay the insured what they lost, theoretically no more or no less Which of the following is NOT true about insurance? Select one: a. Insurance is the exchange of a small certain sum for a large uncertain sum b. Insurance only works if the pool is larger enough to make losses more predictable for the pool c. Having insurance makes whether or not a loss will occur more predictable d. Insurance is the transfer of financial risk from the insured to the insurance company 17 Dr. Walter is a surgeon at Metropolis General. During a surgery on Zoe, where he was supposed to remove Zoe's appendix, Dr. Walter removes her gall bladder instead. Zoe sues Dr. Walter fo: medical and pain and suffering. Res ipsa loquitor applies in this case. Who has the burden of proof regarding whether there was or was not negligence? Select one: a. Dr. Walter because he is the defendant and res ipsa loquitor applies b. Zoe because she is the plantiff and the plantiff ALWAYS has the burden of proof c. Zoe, because she is the plantiff and res ipsa loquitor applies d. The courts because they have to decide the case Contributory negligence Select one: a. Is the most common example of defenses against negligence b. Increases the loss for the defendant c. Is the same as assumption of risk d. Is rarely used anymore because it is too extreme One of the requirements of an insurable risk is that it should be fortuitous. Which of the following is not directly related to a risk being fortuitous? Select one: a. The loss should be accidental b. The probability of loss should be calculable c. The loss should be out of the insured's control d. The risk should not be assumed voluntarily by the insured Which of the following is NOT a good reason for subrogation in insurance policies? Select one: a. It requires the person responsible for the loss to ultimately pay for the loss b. It can result in lower premiums for property insurance c. It allows the insured to collect twice for the same loss d. The insured can get reimbursed more quickly for the majority of the loss (by their property insurer) and does not have to directly sue the liable party