Answered step by step

Verified Expert Solution

Question

1 Approved Answer

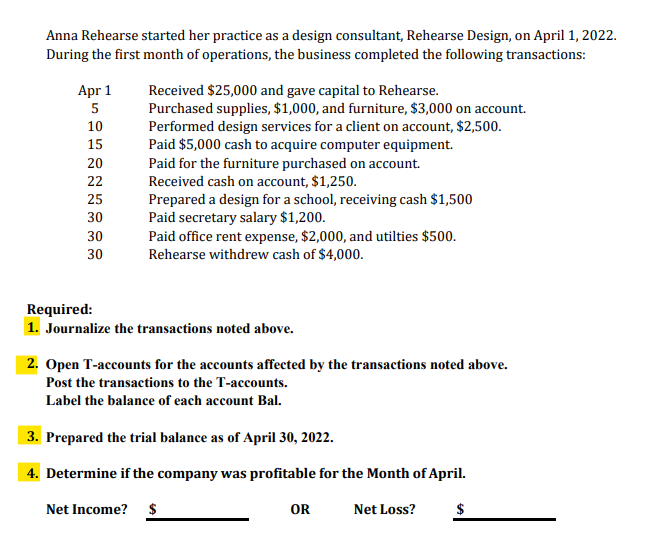

Anna Rehearse started her practice as a design consultant, Rehearse Design, on April 1, 2022. During the first month of operations, the business completed

Anna Rehearse started her practice as a design consultant, Rehearse Design, on April 1, 2022. During the first month of operations, the business completed the following transactions: Received $25,000 and gave capital to Rehearse. Purchased supplies, $1,000, and furniture, $3,000 on account. Performed design services for a client on account, $2,500. Paid $5,000 cash to acquire computer equipment. Apr 1 5 10 15 20 22 25 30 30 30 Paid office rent expense, $2,000, and utilties $500. Rehearse withdrew cash of $4,000. Paid for the furniture purchased on account. Received cash on account, $1,250. Prepared a design for a school, receiving cash $1,500 Paid secretary salary $1,200. Required: 1. Journalize the transactions noted above. 2. Open T-accounts for the accounts affected by the transactions noted above. Post the transactions to the T-accounts. Label the balance of each account Bal. 3. Prepared the trial balance as of April 30, 2022. 4. Determine if the company was profitable for the Month of April. Net Income? $ OR Net Loss?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started