Question

Anna Smith, a self - employed, calendar - year taxpayer, sold several assets during Year 3 . ?For each of the Year 3 ?asset dispositions

Anna Smith, a selfemployed, calendaryear taxpayer, sold several assets during Year ?For each of the Year ?asset dispositions provided in column ?of the table below, identify the tax basis and holding period of the assets ?for gain or loss purposes. In column ?enter the amount of the tax basis of the disposed assets ?Enter all amounts as positive, whole values.

If the answer is zero, enter a zero ?In column ?select from the option list the appropriate holding period for the disposed assetsshortterm or longtermAnna Smith, a selfemployed, calendaryear taxpayer, sold several assets during Year ?For each of the Year ?asset dispositions provided in column A of the table below, identify the tax basis and holding period of the assets ?for gain or loss purposes. In column B ?enter the amount of the tax basis of the disposed assets ?Enter all amounts as positive, whole values. If the answer is zero, enter a zero ?In column C ?select from the option list the appropriate holding period for the disposed assetsshortterm or longterm

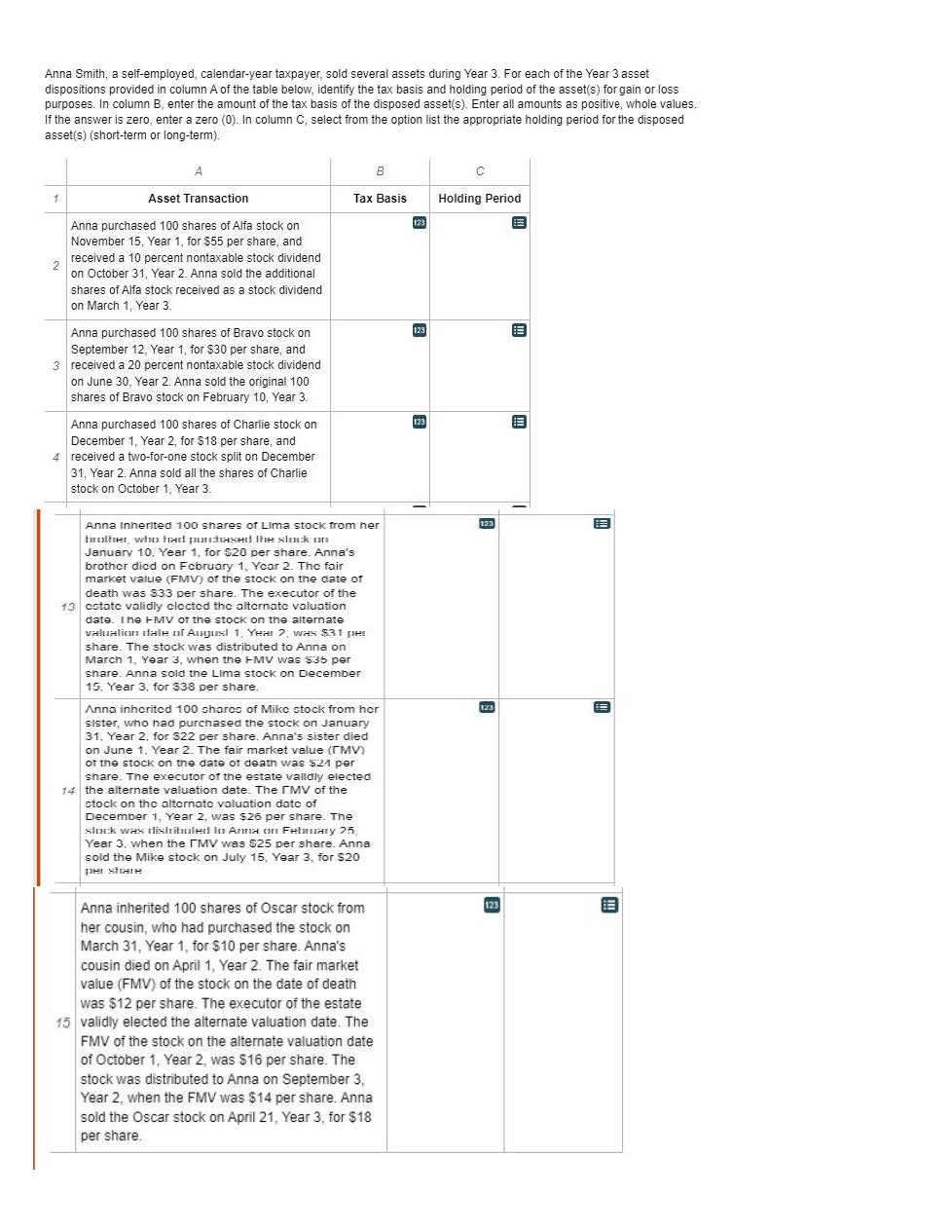

Anna Smith, a self-employed, calendar-year taxpayer, sold several assets during Year 3. For each of the Year 3 asset dispositions provided in column A of the table below, identify the tax basis and holding period of the asset(s) for gain or loss purposes. In column B, enter the amount of the tax basis of the disposed asset(s). Enter all amounts as positive, whole values. If the answer is zero, enter a zero (0). In column C, select from the option list the appropriate holding period for the disposed asset(s) (short-term or long-term). 1 2 Asset Transaction Anna purchased 100 shares of Alfa stock on November 15, Year 1, for $55 per share, and received a 10 percent nontaxable stock dividend on October 31, Year 2. Anna sold the additional shares of Alfa stock received as a stock dividend on March 1, Year 3. Anna purchased 100 shares of Bravo stock on September 12, Year 1, for $30 per share, and 3 received a 20 percent nontaxable stock dividend on June 30, Year 2. Anna sold the original 100 shares of Bravo stock on February 10, Year 3. Anna purchased 100 shares of Charlie stock on December 1, Year 2, for $18 per share, and 4 received a two-for-one stock split on December 31, Year 2. Anna sold all the shares of Charlie stock on October 1, Year 3. B Tax Basis Anna Inherited 100 shares of Lima stock from her brother, who had purchased the stock on January 10, Year 1, for $20 per share. Anna's brother died on February 1, Year 2. The fair market value (FMV) of the stock on the date of death was $33 per share. The executor of the 13 cotate validly elected the alternate valuation date. The HMV of the stock on the alternate valuation date of August 1, Year 2, was $31 per share. The stock was distributed to Anna on March 1, Year 3, when the HMV was $35 per share. Anna sold the Lima stock on December 15. Year 3, for $38 per share. Anna inherited 100 shares of Mike stock from her sister, who had purchased the stock on January 31, Year 2, for $22 per share. Anna's sister died on June 1, Year 2. The fair market value (TMV) of the stock on the date of death was $21 per share. The executor of the estate validly elected 14 the alternate valuation date. The MV of the stock on the alternate valuation date of December 1, Year 2, was $26 per share. The slock was distributed to Anna on February 25 Year 3. when the TMV was $25 per share. Anna sold the Mike stock on July 15, Year 3, for $20 per share Anna inherited 100 shares of Oscar stock from her cousin, who had purchased the stock on March 31, Year 1, for $10 per share. Anna's cousin died on April 1, Year 2. The fair market value (FMV) of the stock on the date of death was $12 per share. The executor of the estate 15 validly elected the alternate valuation date. The FMV of the stock on the alternate valuation date of October 1, Year 2, was $16 per share. The stock was distributed to Anna on September 3, Year 2, when the FMV was $14 per share. Anna sold the Oscar stock on April 21, Year 3, for $18 per share. Holding Period 123 123 123 123 123 123

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started