Question

Annabelle Invests in the Market Annabelle Sizemore has cashed in some treasury bonds and a life insurance policy that her parents had accumulated over the

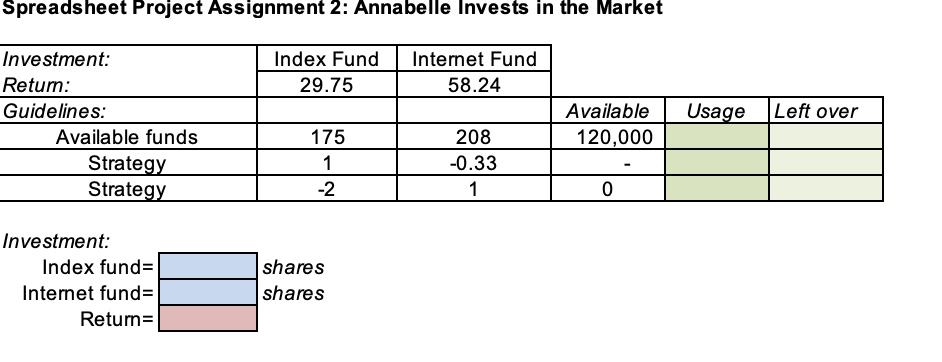

Annabelle Invests in the Market Annabelle Sizemore has cashed in some treasury bonds and a life insurance policy that her parents had accumulated over the years for her. She has also saved some money in certificates of deposit and savings bonds during the 10 years since she graduated from college. As a result, she has $120,000 available to invest. Given the recent rise in the stock market, she feels that she should invest all of this amount there. She has researched the market and has decided that she wants to invest in an index fund tied to S&P stocks and in an Internet stock fund. However, she is very concerned about the volatility of Internet stocks. Therefore, she wants to balance her risk to some degree. She has decided to select an index fund from Shield Securities and an Internet stock fund from Madison Funds, Inc. She has also decided that the proportion of the dollar amount she invests in the index fund relative to the Internet fund should be at least one-third but that she should not invest more than twice the amount in the Internet fund that she invests in the index fund. The price per share of the index fund is $175, whereas the price per share of the Internet fund is $208. The average annual return during the last 3 years for the index fund has been 17%, and for the Internet stock fund it has been 28%. She anticipates that both mutual funds will realize the same average returns for the coming year that they have in the recent past; however, at the end of the year she is likely to reevaluate her investment strategy anyway. Thus, she wants to develop an investment strategy that will maximize her return for the coming year.

1. Formulate a linear programming model for Annabelle that will indicate how much money she should invest in each fund and solve this model.

2. Suppose Annabelle decides to change her risk balancing formula by eliminating the restriction that the proportion of the amount she invests in the index fund to the amount that she invests in the Internet fund must be at least one-third. What will the effect be on her solution? Suppose instead that she eliminates the restriction that the proportion of money she invests in the Internet fund relative to the stock fund not to exceed a ratio of 2 to 1. How will this affect her solution?

3. If Annabelle can get $1 more to invest, how will that affect her solution? $2 more? $3 more? What can you say about her return on her investment strategy, given these successive changes?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started