Answered step by step

Verified Expert Solution

Question

1 Approved Answer

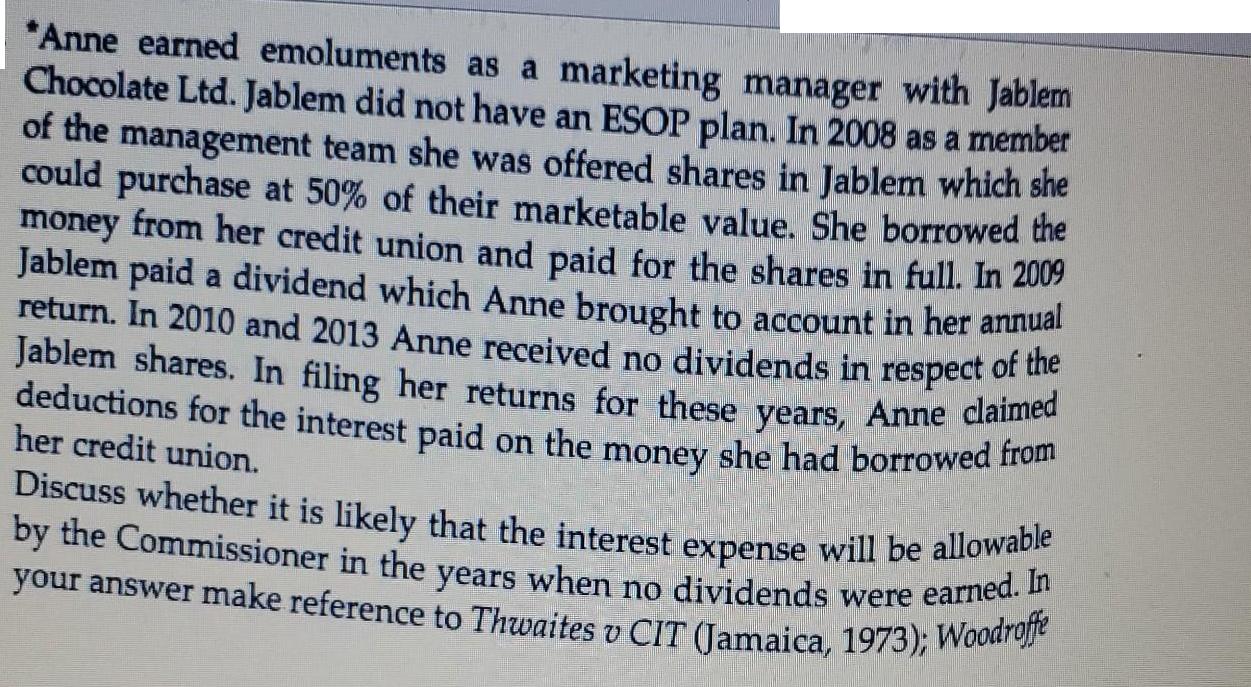

*Anne earned emoluments as a marketing manager with Jablem Chocolate Ltd. Jablem did not have an ESOP plan. In 2008 as a member of

*Anne earned emoluments as a marketing manager with Jablem Chocolate Ltd. Jablem did not have an ESOP plan. In 2008 as a member of the management team she was offered shares in Jablem which she could purchase at 50% of their marketable value. She borrowed the money from her credit union and paid for the shares in full. In 2009 Jablem paid a dividend which Anne brought to account in her annual return. In 2010 and 2013 Anne received no dividends in respect of the Jablem shares. In filing her returns for these years, Anne claimed deductions for the interest paid on the money she had borrowed from her credit union. Discuss whether it is likely that the interest expense will be allowable by the Commissioner in the years when no dividends were earned. In your answer make reference to Thwaites v CIT (Jamaica, 1973); Woodroffe

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

As marketing manager at Janlem Chocolate Ltd Anne received compensation There was no employee stock ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started