Question

Anne Hathaway Inc. bought an equipment for $3,550,000 for a project that lasts for 3 years. The asset will be depreciated using a 3-year

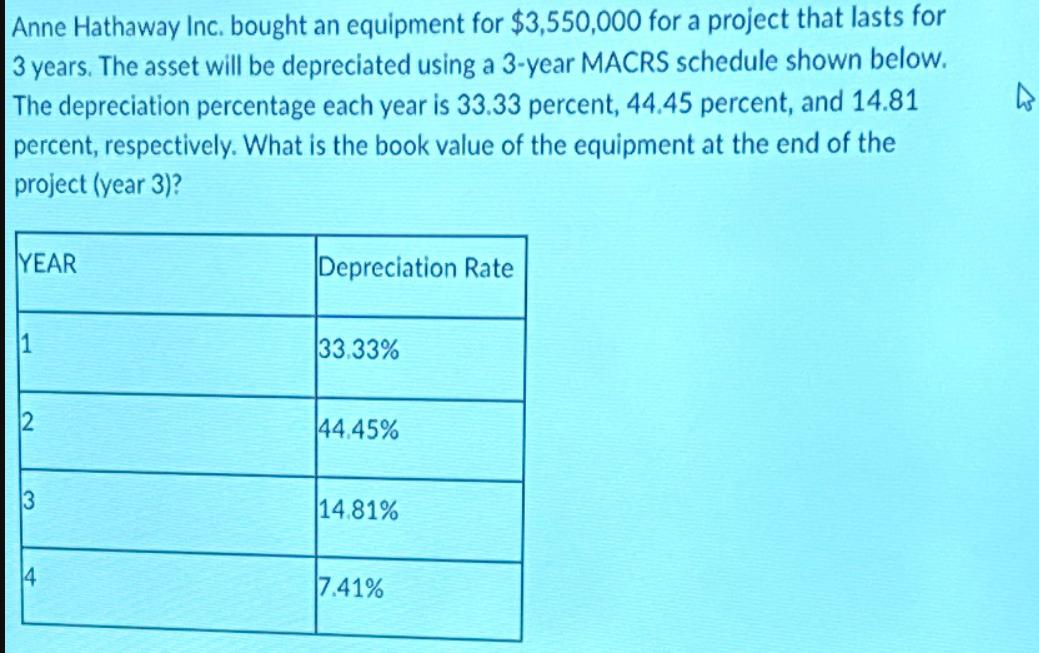

Anne Hathaway Inc. bought an equipment for $3,550,000 for a project that lasts for 3 years. The asset will be depreciated using a 3-year MACRS schedule shown below. The depreciation percentage each year is 33.33 percent, 44.45 percent, and 14.81 percent, respectively. What is the book value of the equipment at the end of the project (year 3)? YEAR 1 Depreciation Rate 33.33% 2 44.45% 3 14.81% 4 7.41%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the book value of the equipment at the end of t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations Of Financial Management

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen

17th Edition

126001391X, 978-1260013917

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App