Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Anne & Henry are thinking of buying a retirement cottage in Cornwall, and renting it out until they retire. They have found one they

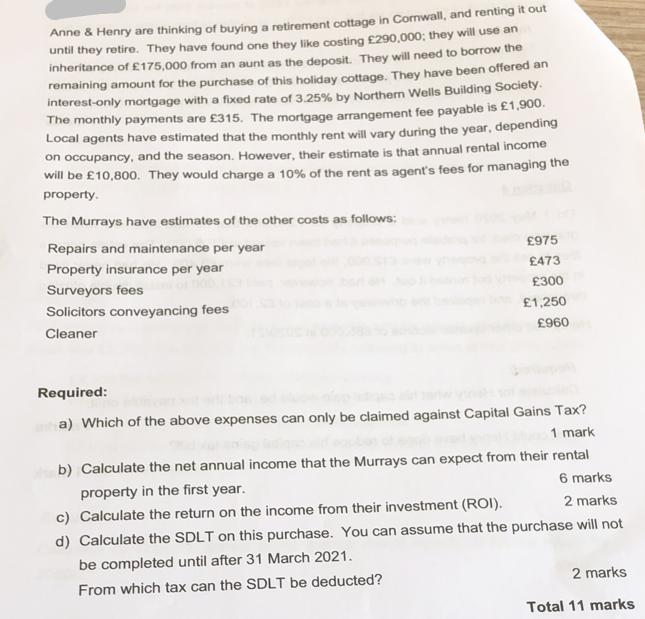

Anne & Henry are thinking of buying a retirement cottage in Cornwall, and renting it out until they retire. They have found one they like costing 290,000; they will use an inheritance of 175,000 from an aunt as the deposit. They will need to borrow the remaining amount for the purchase of this holiday cottage. They have been offered an interest-only mortgage with a fixed rate of 3.25% by Northern Wells Building Society. The monthly payments are 315. The mortgage arrangement fee payable is 1,900. Local agents have estimated that the monthly rent will vary during the year, depending on occupancy, and the season. However, their estimate is that annual rental income will be 10,800. They would charge a 10% of the rent as agent's fees for managing the property. The Murrays have estimates of the other costs as follows: Repairs and maintenance per year Property insurance per year Surveyors fees Solicitors conveyancing fees Cleaner 975 473 300 1,250 960 Required: a) Which of the above expenses can only be claimed against Capital Gains Tax? 1 mark b) Calculate the net annual income that the Murrays can expect from their rental property in the first year. 6 marks c) Calculate the return on the income from their investment (ROI). 2 marks d) Calculate the SDLT on this purchase. You can assume that the purchase will not be completed until after 31 March 2021. From which tax can the SDLT be deducted? 2 marks Total 11 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Expenses that can only be claimed against Capital Gains Tax are typically expenses related to the acquisition or improvement of a property rather than ongoing operational expenses From the list prov...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started