Answered step by step

Verified Expert Solution

Question

1 Approved Answer

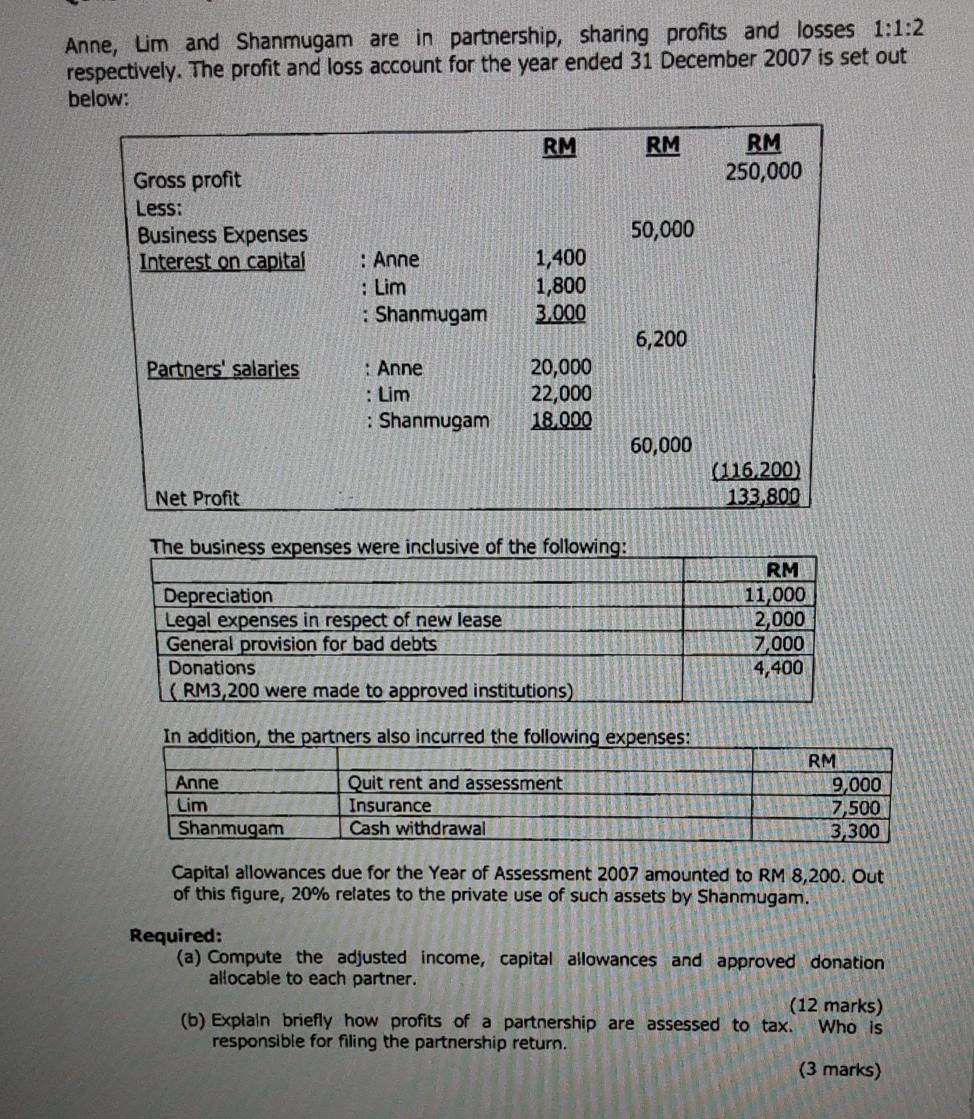

Anne, Lim and Shanmugam are in partnership, sharing profits and losses 1:1:2 respectively. The profit and loss account for the year ended 31 December 2007

Anne, Lim and Shanmugam are in partnership, sharing profits and losses 1:1:2 respectively. The profit and loss account for the year ended 31 December 2007 is set out below: RM RM RM 250,000 Gross profit Less: Business Expenses Interest on capital 50,000 : Anne : Lim 1,400 1,800 3,000 : Shanmugam 6,200 Partners' salaries : Anne : Lim : Shanmugam 20,000 22,000 18.000 60,000 (116 200) 133.800 Net Profit The business expenses were inclusive of the following: Depreciation Legal expenses in respect of new lease General provision for bad debts Donations (RM3,200 were made to approved institutions) RM 11,000 2,000 7,000 4,400 In addition, the partners also incurred the following expenses: Anne Lim Shanmugam Quit rent and assessment Insurance Cash withdrawal RM 9,000 7,500 3,300 Capital allowances due for the Year of Assessment 2007 amounted to RM 8,200. Out of this figure, 20% relates to the private use of such assets by Shanmugam. Required: (a) Compute the adjusted income, capital allowances and approved donation allocable to each partner. (12 marks) (b) Explain briefly how profits of a partnership are assessed to tax. Who is responsible for filing the partnership return. (3 marks) Anne, Lim and Shanmugam are in partnership, sharing profits and losses 1:1:2 respectively. The profit and loss account for the year ended 31 December 2007 is set out below: RM RM RM 250,000 Gross profit Less: Business Expenses Interest on capital 50,000 : Anne : Lim 1,400 1,800 3,000 : Shanmugam 6,200 Partners' salaries : Anne : Lim : Shanmugam 20,000 22,000 18.000 60,000 (116 200) 133.800 Net Profit The business expenses were inclusive of the following: Depreciation Legal expenses in respect of new lease General provision for bad debts Donations (RM3,200 were made to approved institutions) RM 11,000 2,000 7,000 4,400 In addition, the partners also incurred the following expenses: Anne Lim Shanmugam Quit rent and assessment Insurance Cash withdrawal RM 9,000 7,500 3,300 Capital allowances due for the Year of Assessment 2007 amounted to RM 8,200. Out of this figure, 20% relates to the private use of such assets by Shanmugam. Required: (a) Compute the adjusted income, capital allowances and approved donation allocable to each partner. (12 marks) (b) Explain briefly how profits of a partnership are assessed to tax. Who is responsible for filing the partnership return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started