Answered step by step

Verified Expert Solution

Question

1 Approved Answer

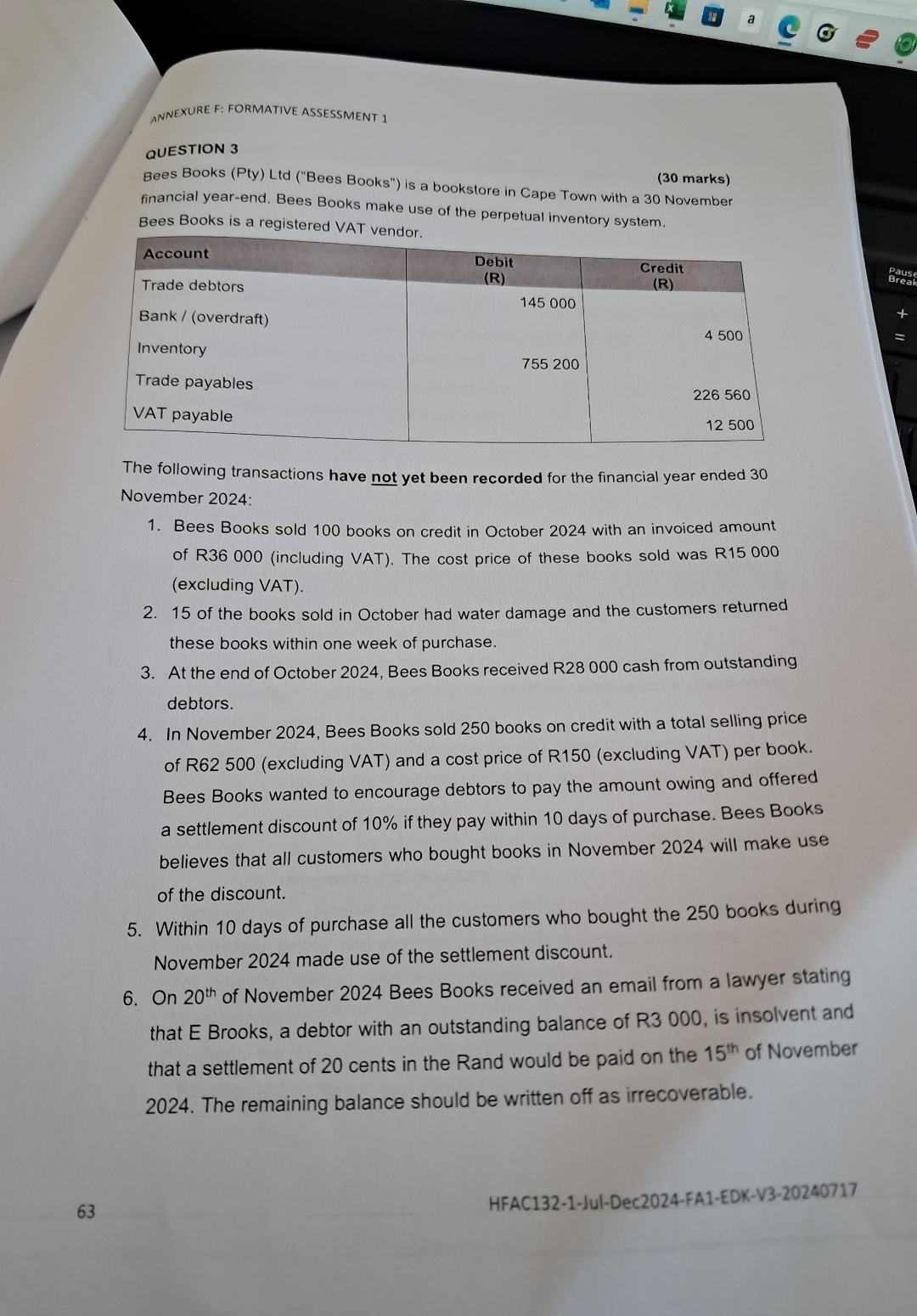

ANNEXURE F: FORMATIVE ASSESSMENT 1 QUESTION 3 ( 3 0 marks ) Bees Books ( Pty ) Ltd ( Bees Books ) is a

ANNEXURE F: FORMATIVE ASSESSMENT

QUESTION

marks

Bees Books Pty Ltd Bees Books" is a bookstore in Cape Town with a November financial yearend. Bees Books make use of the perpetual inventory system.

Bees Books is a registered VAT vendor.

tableAccounttableDebitRtableCreditRTrade debtors,Bank overdraftInventoryTrade payables,,

The following transactions have not yet been recorded for the financial year ended November :

Bees Books sold books on credit in October with an invoiced amount of Rincluding VAT The cost price of these books sold was Rexcluding VAT

of the books sold in October had water damage and the customers returned these books within one week of purchase.

At the end of October Bees Books received R cash from outstanding debtors.

In November Bees Books sold books on credit with a total selling price of Rexcluding VAT and a cost price of Rexcluding VAT per book. Bees Books wanted to encourage debtors to pay the amount owing and offered a settlement discount of if they pay within days of purchase. Bees Books believes that all customers who bought books in November will make use of the discount.

Within days of purchase all the customers who bought the books during November made use of the settlement discount.

On of November Bees Books received an email from a lawyer stating that E Brooks, a debtor with an outstanding balance of R is insolvent and that a settlement of cents in the Rand would be paid on the of November The remaining balance should be written off as irrecoverable.

HFACJulDeCFAEDKV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started