Answered step by step

Verified Expert Solution

Question

1 Approved Answer

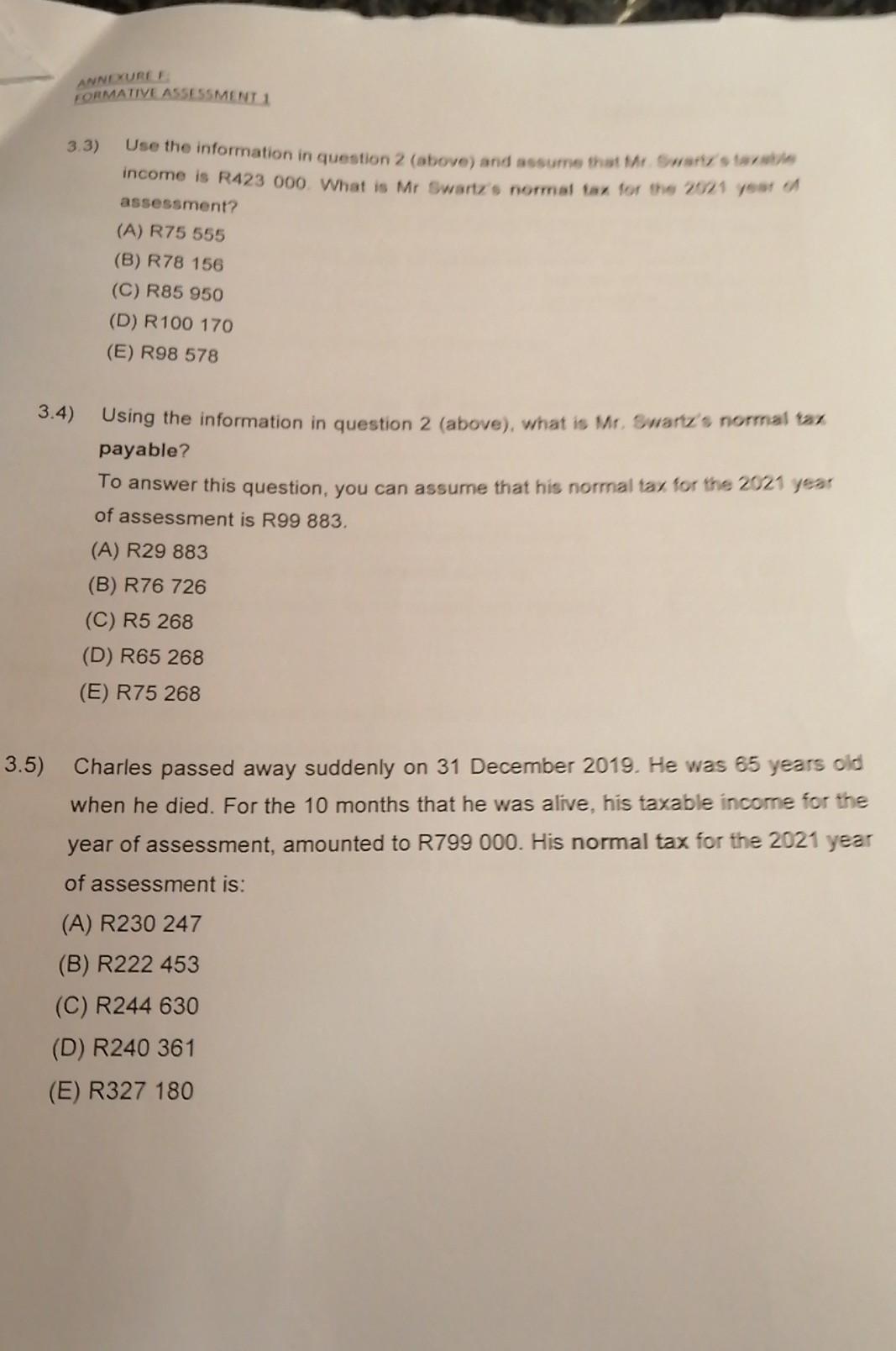

ANNEXUREE FORMATIVE ASSESSMENT 1 3.3) Use the information in question 2 (above) and assume that the Sward startta income is R423 000. What is Mr

ANNEXUREE FORMATIVE ASSESSMENT 1 3.3) Use the information in question 2 (above) and assume that the Sward startta income is R423 000. What is Mr Swartz's normal tar for the 2021 year assessment? (A) R75 555 (B) R78 156 (C) R85 950 (D) R100 170 (E) R98 578 3.4) Using the information in question 2 (above), what is Mr. Smart's normal t payable? To answer this question, you can assume that his normal tax for the 2021 year of assessment is R99 883 (A) R29 883 (B) R76 726 (C) R5 268 (D) R65 268 (E) R75 268 3.5) Charles passed away suddenly on 31 December 2019. He was 65 years old when he died. For the 10 months that he was alive, his taxable income for the year of assessment, amounted to R799 000. His normal tax for the 2021 year of assessment is: (A) R230 247 (B) R222 453 (C) R244 630 (D) R240 361 (E) R327 180 ANNEXUREE FORMATIVE ASSESSMENT 1 3.3) Use the information in question 2 (above) and assume that the Sward startta income is R423 000. What is Mr Swartz's normal tar for the 2021 year assessment? (A) R75 555 (B) R78 156 (C) R85 950 (D) R100 170 (E) R98 578 3.4) Using the information in question 2 (above), what is Mr. Smart's normal t payable? To answer this question, you can assume that his normal tax for the 2021 year of assessment is R99 883 (A) R29 883 (B) R76 726 (C) R5 268 (D) R65 268 (E) R75 268 3.5) Charles passed away suddenly on 31 December 2019. He was 65 years old when he died. For the 10 months that he was alive, his taxable income for the year of assessment, amounted to R799 000. His normal tax for the 2021 year of assessment is: (A) R230 247 (B) R222 453 (C) R244 630 (D) R240 361 (E) R327 180

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started