Annie's Homemade has been invited to submit a bid to cater a Memorial Day picnic with 60 servings of four flavors for a total

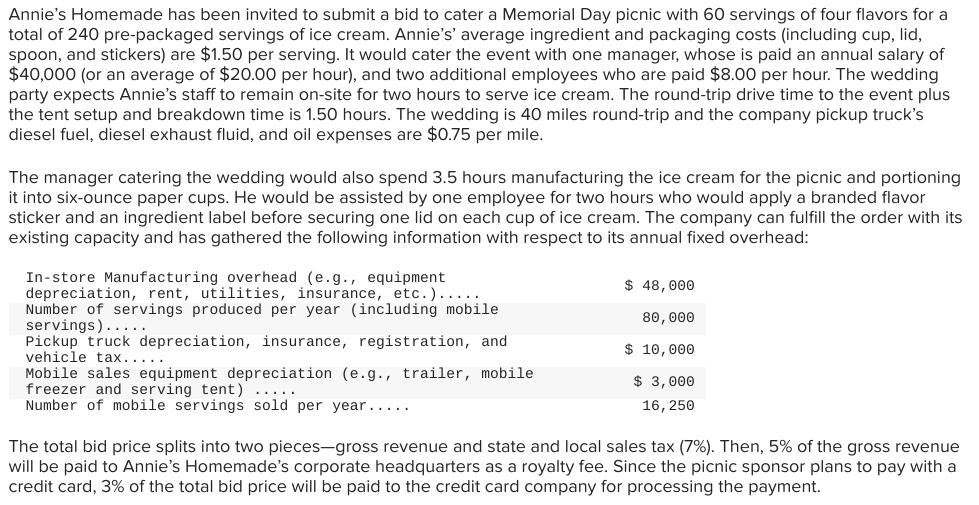

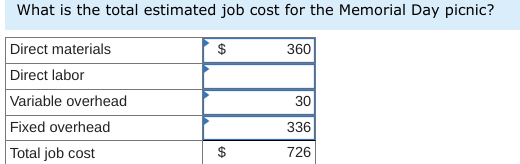

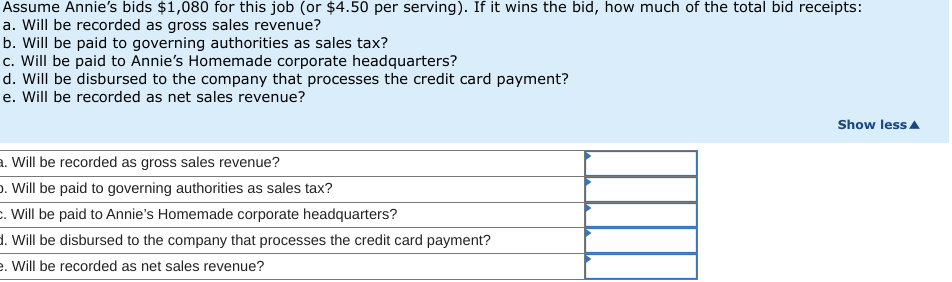

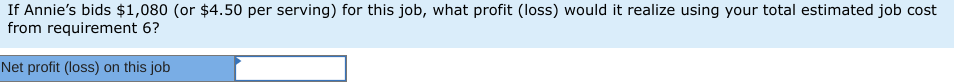

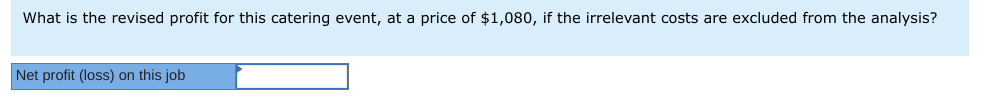

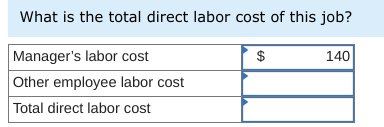

Annie's Homemade has been invited to submit a bid to cater a Memorial Day picnic with 60 servings of four flavors for a total of 240 pre-packaged servings of ice cream. Annie's' average ingredient and packaging costs (including cup, lid, spoon, and stickers) are $1.50 per serving. It would cater the event with one manager, whose is paid an annual salary of $40,000 (or an average of $20.00 per hour), and two additional employees who are paid $8.00 per hour. The wedding party expects Annie's staff to remain on-site for two hours to serve ice cream. The round-trip drive time to the event plus the tent setup and breakdown time is 1.50 hours. The wedding is 40 miles round-trip and the company pickup truck's diesel fuel, diesel exhaust fluid, and oil expenses are $0.75 per mile. The manager catering the wedding would also spend 3.5 hours manufacturing the ice cream for the picnic and portioning it into six-ounce paper cups. He would be assisted by one employee for two hours who would apply a branded flavor sticker and an ingredient label before securing one lid on each cup of ice cream. The company can fulfill the order with its existing capacity and has gathered the following information with respect to its annual fixed overhead: In-store Manufacturing overhead (e.g., equipment depreciation, rent, utilities, insurance, etc.)..... Number of servings produced per year (including mobile servings)..... Pickup truck depreciation, insurance, registration, and vehicle tax..... Mobile sales equipment depreciation (e.g., trailer, mobile freezer and serving tent) ..... Number of mobile servings sold per year..... $ 48,000 80,000 $ 10,000 $ 3,000 16,250 The total bid price splits into two pieces-gross revenue and state and local sales tax (7%). Then, 5% of the gross revenue will be paid to Annie's Homemade's corporate headquarters as a royalty fee. Since the picnic sponsor plans to pay with a credit card, 3% of the total bid price will be paid to the credit card company for processing the payment. What is the total estimated job cost for the Memorial Day picnic? Direct materials Direct labor Variable overhead Fixed overhead Total job cost $ 360 30 336 69 $ 726 Assume Annie's bids $1,080 for this job (or $4.50 per serving). If it wins the bid, how much of the total bid receipts: a. Will be recorded as gross sales revenue? b. Will be paid to governing authorities as sales tax? c. Will be paid to Annie's Homemade corporate headquarters? d. Will be disbursed to the company that processes the credit card payment? e. Will be recorded as net sales revenue? a. Will be recorded as gross sales revenue? . Will be paid to governing authorities as sales tax? c. Will be paid to Annie's Homemade corporate headquarters? d. Will be disbursed to the company that processes the credit card payment? e. Will be recorded as net sales revenue? Show less If Annie's bids $1,080 (or $4.50 per serving) for this job, what profit (loss) would it realize using your total estimated job cost from requirement 6? Net profit (loss) on this job What is the revised profit for this catering event, at a price of $1,080, if the irrelevant costs are excluded from the analysis? Net profit (loss) on this job What is the total direct labor cost of this job? Manager's labor cost $ Other employee labor cost Total direct labor cost 140

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Based on the information provided here are the calculations for the total estimated job cost profit loss and direct labor cost 1 Total estima...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started