Answered step by step

Verified Expert Solution

Question

1 Approved Answer

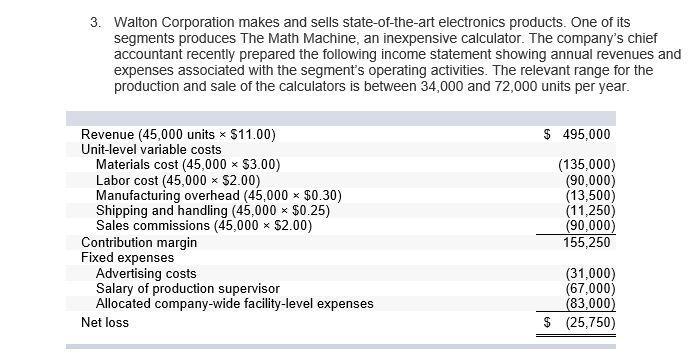

3. Walton Corporation makes and sells state-of-the-art electronics products. One of its segments produces The Math Machine, an inexpensive calculator. The company's chief accountant

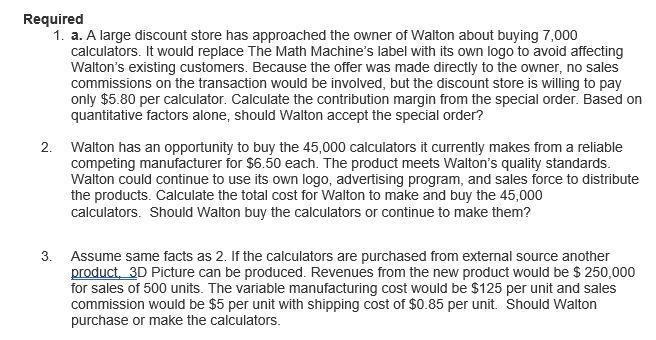

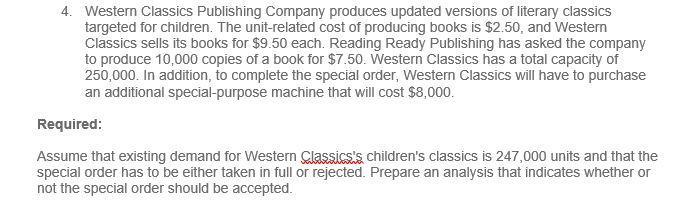

3. Walton Corporation makes and sells state-of-the-art electronics products. One of its segments produces The Math Machine, an inexpensive calculator. The company's chief accountant recently prepared the following income statement showing annual revenues and expenses associated with the segment's operating activities. The relevant range for the production and sale of the calculators is between 34,000 and 72,000 units per year. Revenue (45,000 units $11.00) Unit-level variable costs Materials cost (45,000 $3.00) Labor cost (45,000 $2.00) Manufacturing overhead (45,000 x $0.30) Shipping and handling (45,000 $0.25) Sales commissions (45,000 $2.00) Contribution margin Fixed expenses Advertising costs Salary of production supervisor Allocated company-wide facility-level expenses Net loss $ 495,000 (135,000) (90,000) (13,500) (11,250) (90,000) 155,250 (31,000) (67,000) (83,000) $ (25,750) Required 1. a. A large discount store has approached the owner of Walton about buying 7,000 calculators. It would replace The Math Machine's label with its own logo to avoid affecting Walton's existing customers. Because the offer was made directly to the owner, no sales commissions on the transaction would be involved, but the discount store is willing to pay only $5.80 per calculator. Calculate the contribution margin from the special order. Based on quantitative factors alone, should Walton accept the special order? 2. Walton has an opportunity to buy the 45,000 calculators it currently makes from a reliable competing manufacturer for $6.50 each. The product meets Walton's quality standards. Walton could continue to use its own logo, advertising program, and sales force to distribute the products. Calculate the total cost for Walton to make and buy the 45,000 calculators. Should Walton buy the calculators or continue to make them? 3. Assume same facts as 2. If the calculators are purchased from external source another product, 3D Picture can be produced. Revenues from the new product would be $ 250,000 for sales of 500 units. The variable manufacturing cost would be $125 per unit and sales commission would be $5 per unit with shipping cost of $0.85 per unit. Should Walton purchase or make the calculators. 4. Western Classics Publishing Company produces updated versions of literary classics targeted for children. The unit-related cost of producing books is $2.50, and Western Classics sells its books for $9.50 each. Reading Ready Publishing has asked the company to produce 10,000 copies of a book for $7.50. Western Classics has a total capacity of 250,000. In addition, to complete the special order, Western Classics will have to purchase an additional special-purpose machine that will cost $8,000. Required: Assume that existing demand for Western Classics's children's classics is 247,000 units and that the special order has to be either taken in full or rejected. Prepare an analysis that indicates whether or not the special order should be accepted.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Walton Corporation Answer 1 a Amount Sell price 580 Less Relevant costs Remarks Remarks Direct materials 300 Relevant It is a unit level cost so relev...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started