Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ANNUITY (a) Mr. Rashid has the opportunity to invest in either of two annuities, each of which will cost RM38,000 today. Below here is

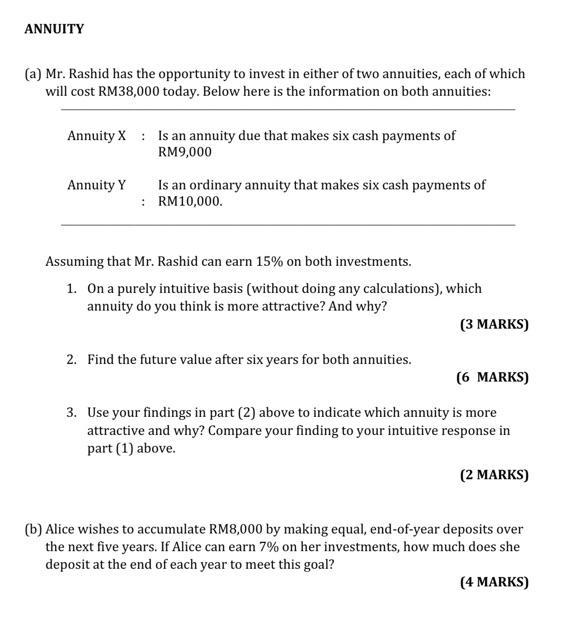

ANNUITY (a) Mr. Rashid has the opportunity to invest in either of two annuities, each of which will cost RM38,000 today. Below here is the information on both annuities: Annuity X Is an annuity due that makes six cash payments of RM9,000 Annuity Y Is an ordinary annuity that makes six cash payments of RM10,000. : Assuming that Mr. Rashid can earn 15% on both investments. 1. On a purely intuitive basis (without doing any calculations), which annuity do you think is more attractive? And why? 2. Find the future value after six years for both annuities. (3 MARKS) (6 MARKS) 3. Use your findings in part (2) above to indicate which annuity is more attractive and why? Compare your finding to your intuitive response in part (1) above. (2 MARKS) (b) Alice wishes to accumulate RM8,000 by making equal, end-of-year deposits over the next five years. If Alice can earn 7% on her investments, how much does she deposit at the end of each year to meet this goal? (4 MARKS)

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Each of the annuities cost the same a 1 Annuity Y is more attractive on a purely intuitive basis because the annual payment is higher RM 10000 compare...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started