Annuity payments are assumed to come at the end of each payment period (termed an ordinary annuity). However, an exception occurs when the annuity payments come at the beginning of each period (termed an annuity due).

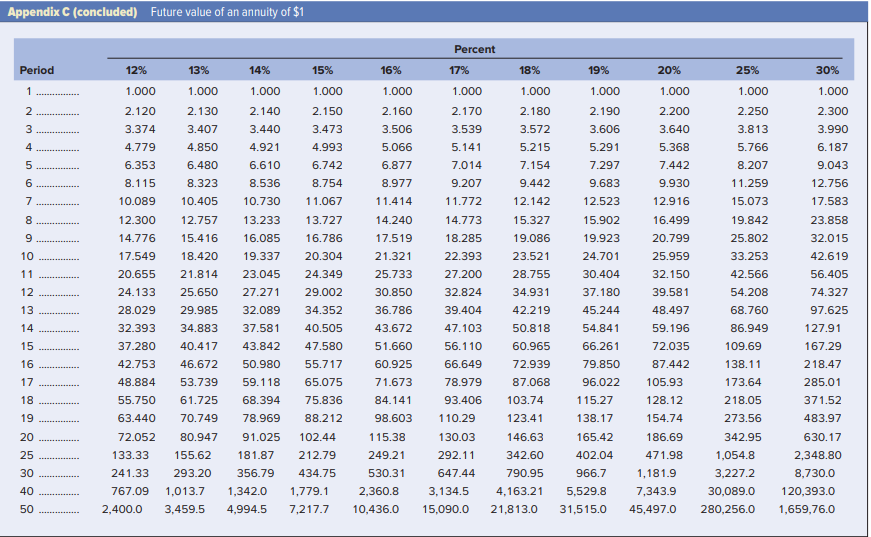

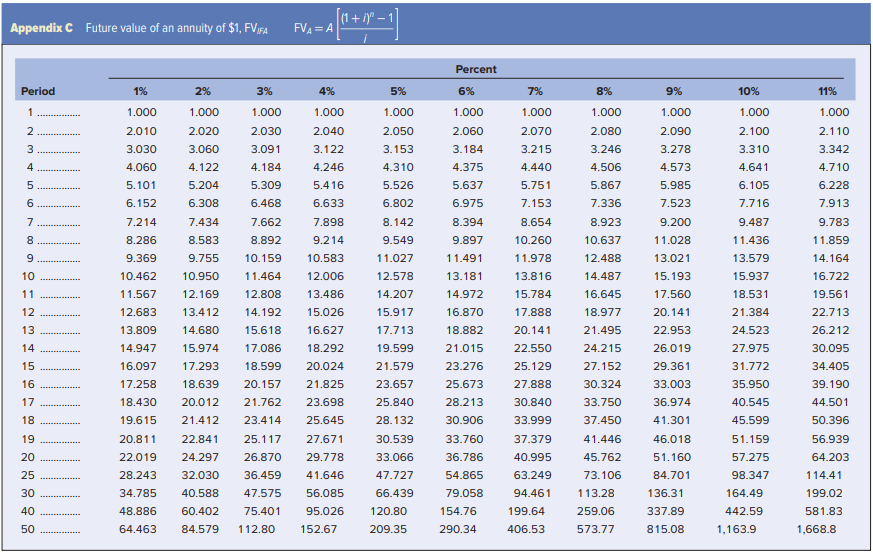

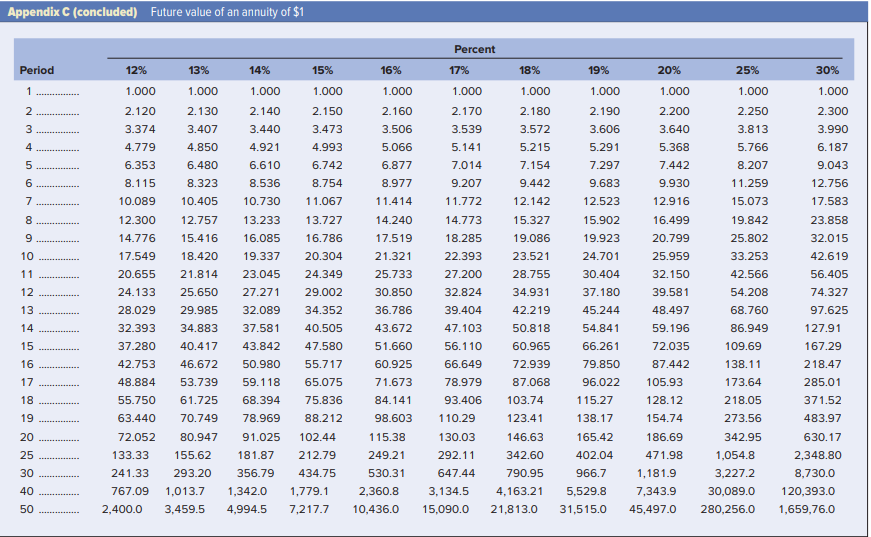

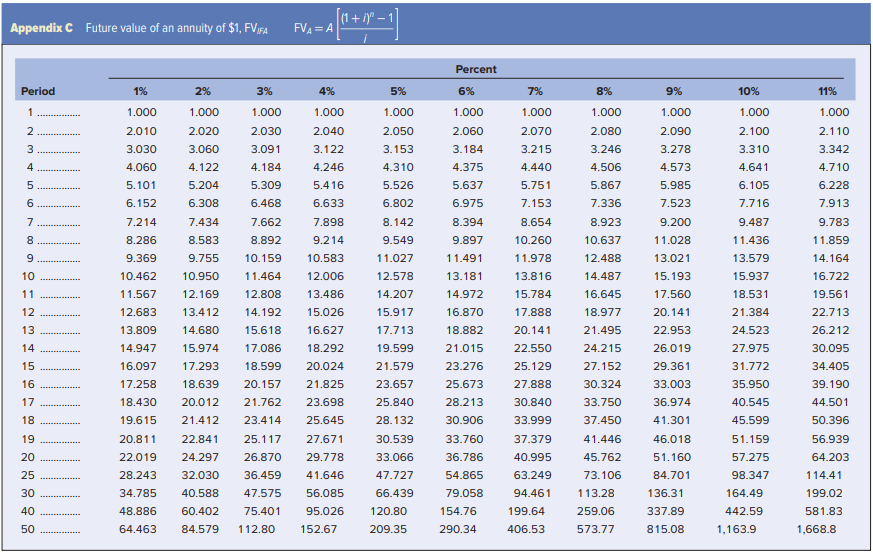

What is the future value of a 18-year annuity of $2,000 per period where payments come at the beginning of each period? The interest rate is 5 percent. Use Appendix C for an approximate answer, but calculate your final answer using the formula and financial calculator methods. To find the future value of an annuity due when using the Appendix tables, add 1 to n and subtract 1 from the tabular value. For example, to find the future value of a $100 payment at the beginning of each period for five periods at 10 percent, go to Appendix C for n = 6 and i = 10 percent. Look up the value of 7.716 and subtract 1 from it for an answer of 6.716 or $671.60 ($100 6.716). (Do not round intermediate calculations. Round your final answer to 2 decimal places.)

Appendix C (concluded) Future value of an annuity of $1 Percent Period 12% 13% 14% 15% 16% 17% 18% 19% 20% 25% 30% 1 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2.300 2 2.130 2.140 2.170 2.200 2.120 3.374 2.190 3.606 3 3.407 4.850 3.990 3.440 4.921 2.150 3.473 4.993 6.742 2.180 3.572 5.215 4 5 3.539 5.141 7.014 4.779 6.353 8.115 3.640 5.368 7.442 6.480 7.154 6.187 9.043 12.756 17.583 09 8.323 6 7 8 9 10 11 12 6.610 8.536 10.730 13.233 16.085 19.337 23.045 27.271 32.089 37.581 43.842 50.980 59.118 68.394 78.969 91.025 10.089 12.300 14.776 17.549 20.655 24.133 28.029 32.393 37.280 42.753 48.884 55.750 63.440 72.052 133.33 241.33 767.09 2,400.0 10.405 12.757 15.416 18.420 21.814 25.650 29.985 34.883 40.417 46.672 53.739 61.725 70.749 80.947 155.62 293.20 1,013.7 3,459.5 1.000 2.160 3.506 5.066 6.877 8.977 11.414 14.240 17.519 21.321 25.733 30.850 36.786 43.672 51.660 60.925 71.673 84.141 98.603 115.38 249.21 530.31 2,360.8 10,436.0 13 14 8.754 11.067 13.727 16.786 20.304 24.349 29.002 34.352 40.505 47.580 55.717 65.075 75.836 88.212 102.44 212.79 434.75 1,779.1 7,217.7 9.207 11.772 14.773 18.285 22.393 27.200 32.824 39.404 47.103 56.110 66.649 78.979 93.406 110.29 130.03 9.442 12.142 15.327 19.086 23.521 28.755 34.931 42.219 50.818 60.965 72.939 87.068 103.74 123.41 5.291 7.297 9.683 12.523 15.902 19.923 24.701 30.404 37.180 45.244 54.841 66.261 79.850 96.022 115.27 138.17 15 16 2.250 3.813 5.766 8.207 11.259 15.073 19.842 25.802 33.253 42.566 54.208 68.760 86.949 109.69 138.11 173.64 218.05 273.56 342.95 1,054.8 3,227.2 30,089.0 280,256.0 9.930 12.916 16.499 20.799 25.959 32.150 39.581 48.497 59.196 72.035 87.442 105.93 128.12 154.74 186.69 471.98 1,181.9 7,343.9 45,497.0 23.858 32.015 42.619 56.405 74.327 97.625 127.91 167.29 218.47 285.01 371.52 483.97 17 18 19 630.17 20 25 165.42 402.04 292.11 30 181.87 356.79 1,342.0 4,994.5 146.63 342.60 790.95 4,163.21 21,813.0 647.44 3,134.5 15.090.0 40 2,348.80 8,730.0 120,393.0 1,659,76.0 966.7 5,529.8 31,515.0 50 Appendix C Future value of an annuity of $1, FVFA (1 + i)" - FVA= A Percent Period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 1.000 1.000 1.000 1 2 1.000 2.020 3.060 1.000 2.090 w N 2.060 3.184 3 1.000 2.010 3.030 4.060 5.101 6.152 2.030 3.091 4.184 1.000 2.050 3.153 4.310 5.526 6.802 1.000 2.070 3.215 4.440 5.751 2.100 3.310 4.641 6.105 4 1.000 2.080 3.246 4.506 5.867 7.336 8.923 1.000 2.110 3.342 4.710 6.228 3.278 4.573 5.985 7.523 4.122 5.204 6.308 5 4.375 5.637 6.975 8.394 5.309 0 6.468 7.153 7.716 9.487 7 7.214 7.434 7.662 8.892 8 00002 9.200 11.028 13.021 15.193 10 1.000 2.040 3.122 4.246 5.416 6.633 7.898 9.214 10.583 12.006 13.486 15.026 16.627 18.292 20.024 21.825 23.698 25.645 8.142 9.549 11.027 12.578 14.207 15.917 17.713 8.286 9.369 10.462 11.567 12.683 13.809 14.947 16.097 17.258 18.430 19.615 11 12 8.583 9.755 10.950 12.169 13.412 14.680 15.974 17.293 18.639 20.012 21.412 10.159 11.464 12.808 14.192 15.618 17.086 18.599 20.157 21.762 23.414 13 14 15 8.654 10.260 11.978 13.816 15.784 17.888 20.141 22.550 25.129 27.888 30.840 33.999 9.897 11.491 13.181 14.972 16.870 18.882 21.015 23.276 25.673 28.213 30.906 17.560 20.141 22.953 26.019 29.361 33.003 36.974 7.913 9.783 11.859 14.164 16.722 19.561 22.713 26.212 30.095 34.405 39.190 44.501 50.396 10.637 12.488 14.487 16.645 18.977 21.495 24.215 27.152 30.324 33.750 37.450 41.446 45.762 73.106 113.28 259.06 573.77 11.436 13.579 15.937 18.531 21.384 24.523 27.975 31.772 35.950 40.545 45.599 16 17 18 19.599 21.579 23.657 25.840 28.132 30.539 33.066 47.727 66.439 120.80 41.301 19 37.379 25.117 26.870 27.671 29.778 33.760 36.786 20 20.811 22.019 28.243 34.785 46.018 51.160 84.701 25 22.841 24.297 32.030 40.588 60.402 84.579 36.459 47.575 75.401 40.995 63.249 94.461 41.646 56.085 95.026 54.865 79.058 51.159 57.275 98.347 164.49 442.59 1,163.9 30 40 50 56.939 64.203 114.41 199.02 581.83 48.886 154.76 290.34 199.64 406.53 136.31 337.89 815.08 64.463 112.80 152.67 209.35 1,668.8