Question

Stephanie Barnes and Layla Taylor formed a partnership, Design Pros Imaging, last May. Each person contributed assets to the business and both partners work full-time

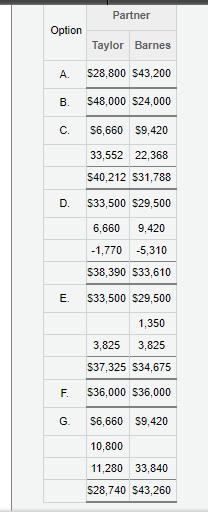

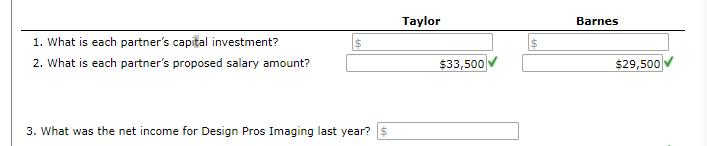

Stephanie Barnes and Layla Taylor formed a partnership, Design Pros Imaging, last May. Each person contributed assets to the business and both partners work full-time in the business. The business made a profit in the first year, which ended Dec. 31, but Layla and Stephanie are still discussing how to divide the net income equitably. Below is a table showing some options that their accountant worked up.

Unfortunately, the accountant's notes about each option have been lost. Stephanie remembers that the accountant proposed paying 4% interest yearly on each partner's capital investment at the beginning of the year. Layla asked the accountant to include at least one bonus option. The accountant used last year's results to show how the net income would have been divided under each option.

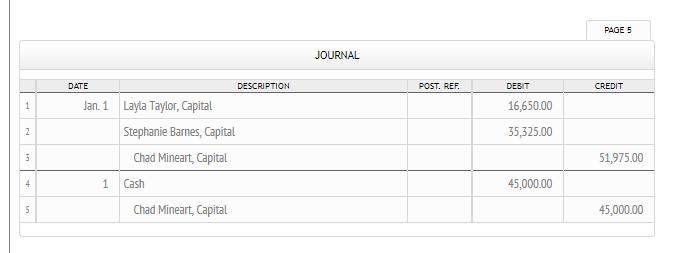

Another designer, Chad Mineart, joined the partnership on January 1, after all assets were adjusted to their market values. He is hoping to work in the business next year. The journal entries to record his admission are shown below.

Assume that Layla and Stephanie have decided to adopt Option D on the Design Pros Imaging panel. They are wondering how the division of net income under Option D will change with the new partner. Assume that income is the same as the prior year. Chad will not have a salary allowance the first year, but any remaining net income will be shared equally among the partners. Using last year’s data as an example, extend Option D to allow for Chad’s participation. What would Chad’s share of the net income be?

Partner Option Taylor Barnes A. $28,800 $43,200 . S48,000 S24,000 C. $6,660 $9,420 33,552 22,368 S40,212 S31,788 D. $33,500 $29,500 6,660 9,420 -1,770 -5,310 S38,390 S33,610 . S33,500 $29,500 1,350 3,825 3,825 S37,325 S34,675 F. S36,000 S36,000 G. $6,660 $9,420 10,800 11,280 33,840 $28,740 $43,260

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION If option D is used articulars Taylor ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started