Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Another expert got it wrong and ignored me asking if they could retry the question. The answer is not 2820. I know that the value

Another expert got it wrong and ignored me asking if they could retry the question. The answer is not 2820. I know that the value will be a 3 digit number, but I don't know how to calculate it.

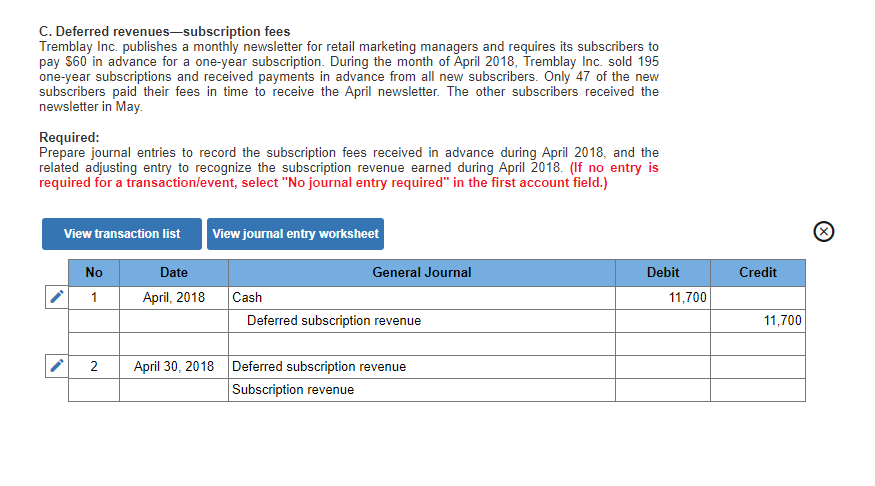

C. Deferred revenues-subscription fees Tremblay Inc. publishes a monthly newsletter for retail marketing managers and requires its subscribers to pay $60 in advance for a one-year subscription. During the month of April 2018, Tremblay Inc. sold 195 one-year subscriptions and received payments in advance from all new subscribers. Only 47 of the new subscribers paid their fees in time to receive the April newsletter. The other subscribers received the newsletter in May. Required: Prepare journal entries to record the subscription fees received in advance during April 2018, and the related adjusting entry to recognize the subscription revenue earned during April 2018. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet No Date Credit Debit 11,700 1 General Journal Cash Deferred subscription revenue April, 2018 11,700 2 April 30, 2018 Deferred subscription revenue Subscription revenueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started