Answered step by step

Verified Expert Solution

Question

1 Approved Answer

another option for f.) is not changed Question 1 [15 points] Vision Consulting Inc. had the following balances: Account 2014 Cash $66,000 Accounts receivable 56,500

another option for f.) is "not changed"

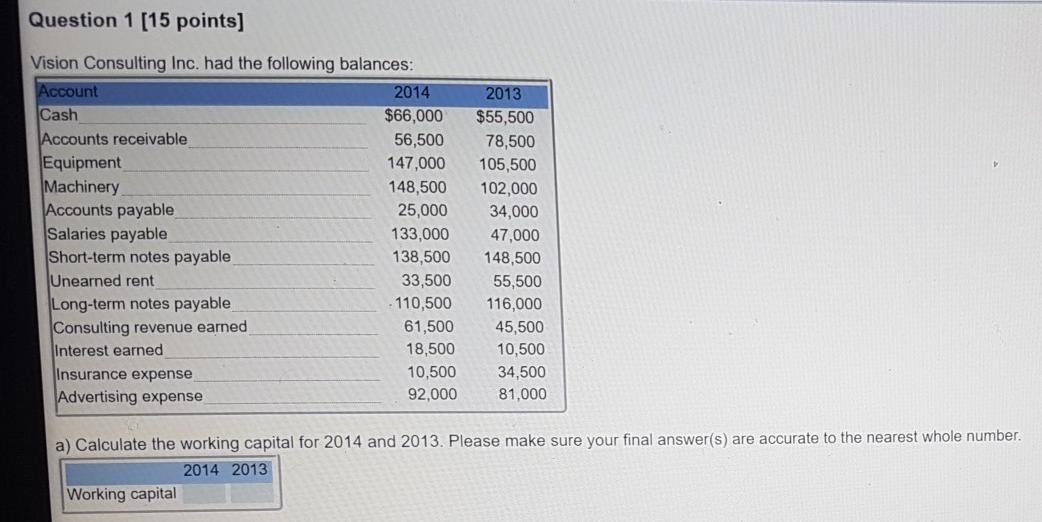

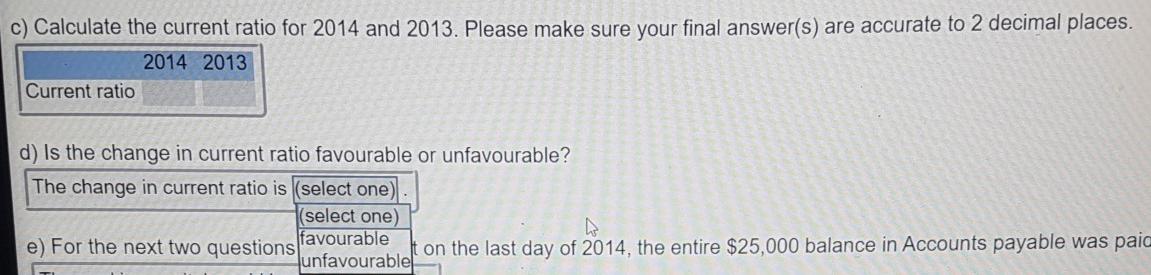

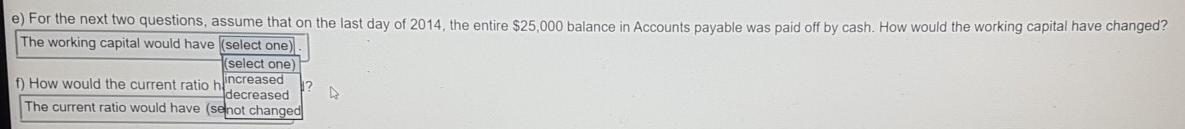

Question 1 [15 points] Vision Consulting Inc. had the following balances: Account 2014 Cash $66,000 Accounts receivable 56,500 Equipment 147,000 Machinery 148,500 Accounts payable 25,000 Salaries payable 133,000 Short-term notes payable 138,500 Unearned rent 33,500 Long-term notes payable 110,500 Consulting revenue earned 61,500 Interest earned 18,500 Insurance expense 10,500 Advertising expense 92,000 2013 $55,500 78,500 105,500 102,000 34,000 47,000 148,500 55,500 116,000 45,500 10,500 34,500 81.000 a) Calculate the working capital for 2014 and 2013. Please make sure your final answer(s) are accurate to the nearest whole number 2014 2013 Working capital b) Is the change in working capital favourable or unfavourable? The change in working capital is (select one) (select one c) Calculate the current ratio for favourable 113. Please make su unfavourable c) Calculate the current ratio for 2014 and 2013. Please make sure your final answer(s) are accurate to 2 decimal places. 2014 2013 Current ratio d) Is the change in current ratio favourable or unfavourable? The change in current ratio is (select one) (select one) h e) For the next two questions favourable on the last day of 2014, the entire $25,000 balance in Accounts payable was paic unfavourable e) For the next two questions, assume that on the last day of 2014, the entire $25,000 balance in Accounts payable was paid off by cash. How would the working capital have changed? The working capital would have (select one) (select one f) How would the current ratio increased Adecreased D The current ratio would have (se not changed f) How would the current ratio have changed? The current ratio would have (select one) (select one) increased decreasedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started