Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Another question Explain in a way I can easily understand QUESTION NINE Chikumbuso Ltd manufactures a range of products and the data below refer to

Another question

Explain in a way I can easily understand

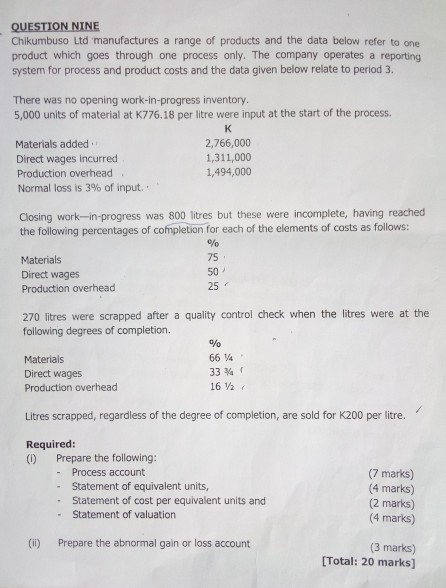

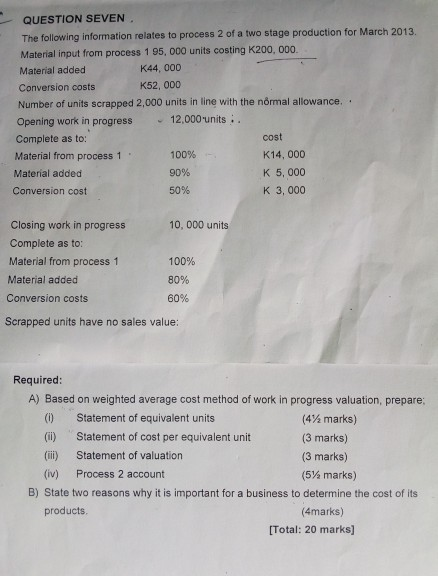

QUESTION NINE Chikumbuso Ltd manufactures a range of products and the data below refer to one product which goes through one process only. The company operates a reporting system for process and product costs and the data given below relate to period 3. There was no opening work-in-progress inventory. 5,000 units of material at K776.18 per litre were input at the start of the process. Materials added Direct wages incurred Production overhead Normal loss is 3% of input. 2,766,000 1,311,000 1,494,000 Closing work-in-progress was 800 litres but these were incomplete, having reached the following percentages of completion for each of the elements of costs as follows: % Materials 75 Direct wages Production overhead 25 50 270 litres were scrapped after a quality control check when the litres were at the following degrees of completion. % Materials 66 14 Direct wages 33 Var Production overhead 16 12 Litres scrapped, regardless of the degree of completion, are sold for K200 per litre." Required: (1) Prepare the following: - Process account - Statement of equivalent units, - Statement of cost per equivalent units and - Statement of valuation (7 marks) (4 marks) (2 marks) (4 marks) () Prepare the abnormal gain or loss account (3 marks) [Total: 20 marks] QUESTION SEVEN The following information relates to process 2 of a two stage production for March 2013 Material input from process 1 95,000 units costing K200,000 Material added K44,000 Conversion costs K52,000 Number of units scrapped 2,000 units in line with the normal allowance. Opening work in progress 12,000 units .. Complete as to: cost Material from process 1 100%- K14,000 Material added 90% K 5,000 Conversion cost 50% K 3,000 Closing work in progress 10,000 units Complete as to: Material from process 1 100% Material added 80% Conversion costs 60% Scrapped units have no sales value: Required: A) Based on weighted average cost method of work in progress valuation, prepare (0) Statement of equivalent units (4% marks) (1) Statement of cost per equivalent unit (3 marks) (ii) Statement of valuation (3 marks) (iv) Process 2 account (5% marks) B) State two reasons why it is important for a business to determine the cost of its products (4marks) [Total: 20 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started