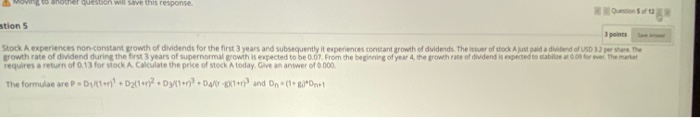

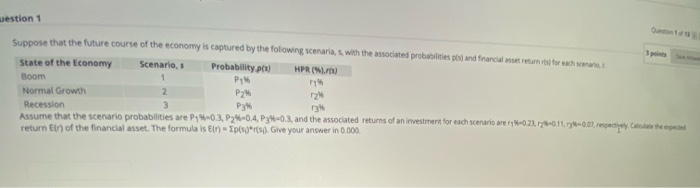

another question will save this response. stion 5 1 points Stock A experiences non constant growth of dividends for the first 3 years and subsequently it experiences constant growth of dividends. The issuer of stock A just paid a dividend of USD 1.7 per are the growth rate of dividend during the first 3 years of supernormal growth is expected to be 0.07. From the beginning of year 4, the growth rate of dividend is expected to stabios forever. The met requires a return of 0.13 for stock A Calculate the price of stock A today. Give an answer of 0.000 The formulae are PDuter.D211*12+D3/(1+r) Delf-8XTer and D (+8) On+1 uestion 1 Suppose that the future course of the economy is captured by the following scenaria, with the associated probabilite pestand francial asset retam toy for each scenario State of the Economy Scenario, s Probability.pl) HPR () Boom P: 77% Normal Growth P296 2M Recession P3 Assume that the scenario probabilities are P1%-0.3.24-0.4. P3-0.3, and the associated returns of an investment for each scenario are 1-0 22.120.11.94-0.07, respectedly Calehe return of the financial asset. The formula is Ein-Ips) Give your answer in 0.000 another question will save this response. stion 5 1 points Stock A experiences non constant growth of dividends for the first 3 years and subsequently it experiences constant growth of dividends. The issuer of stock A just paid a dividend of USD 1.7 per are the growth rate of dividend during the first 3 years of supernormal growth is expected to be 0.07. From the beginning of year 4, the growth rate of dividend is expected to stabios forever. The met requires a return of 0.13 for stock A Calculate the price of stock A today. Give an answer of 0.000 The formulae are PDuter.D211*12+D3/(1+r) Delf-8XTer and D (+8) On+1 uestion 1 Suppose that the future course of the economy is captured by the following scenaria, with the associated probabilite pestand francial asset retam toy for each scenario State of the Economy Scenario, s Probability.pl) HPR () Boom P: 77% Normal Growth P296 2M Recession P3 Assume that the scenario probabilities are P1%-0.3.24-0.4. P3-0.3, and the associated returns of an investment for each scenario are 1-0 22.120.11.94-0.07, respectedly Calehe return of the financial asset. The formula is Ein-Ips) Give your answer in 0.000