Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Another way to work out the ratio is to divide the total value of inventory by the value of the materials issued during the delivery

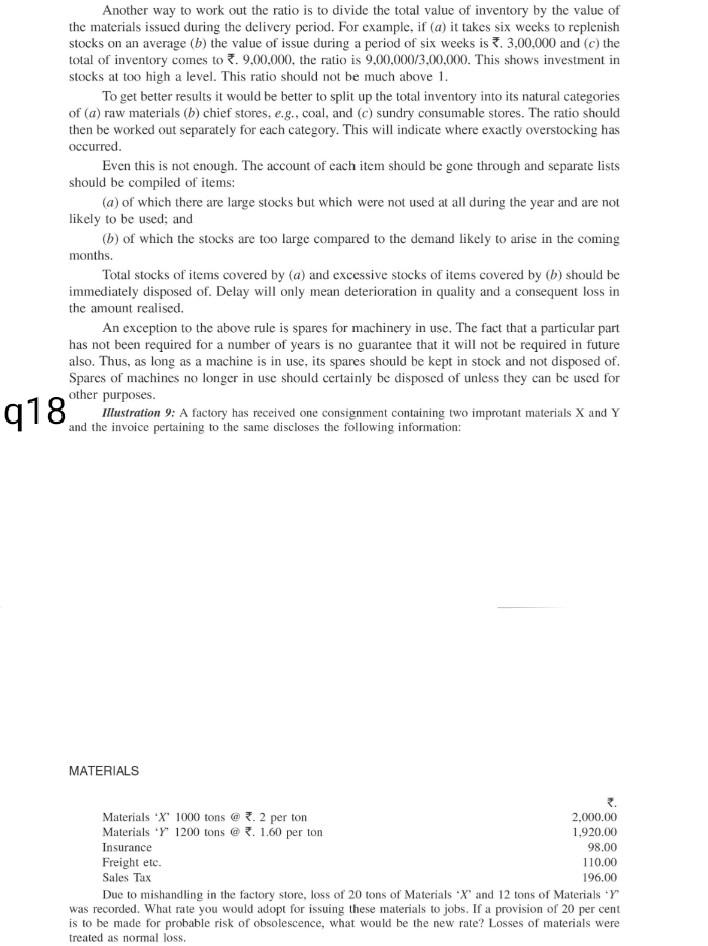

Another way to work out the ratio is to divide the total value of inventory by the value of the materials issued during the delivery period. For example, if (a) it takes six weeks to replenish stocks on an average (b) the value of issue during a period of six weeks is 23,00,000 and (c) the total of inventory comes to 3. 9.00.000, the ratio is 9,00,000/3,00,000. This shows investment in stocks at too high a level. This ratio should not be much above 1. To get better results it would be better to split up the total inventory into its natural categories of (a) raw materials (b) chief stores. e.g.. coal, and (c) sundry consumable stores. The ratio should then be worked out separately for each category. This will indicate where exactly overstocking has occurred. Even this is not enough. The account of each item should be gone through and separate lists should be compiled of items: (a) of which there are large stocks but which were not used at all during the year and are not likely to be used; and (b) of which the stocks are too large compared to the demand likely to arise in the coming months. Total stocks of items covered by (a) and excessive stocks of items covered by (b) should be immediately disposed of. Delay will only mean deterioration in quality and a consequent loss in the amount realised An exception to the above rule is spares for machinery in use. The fact that a particular part has not been required for a number of years is no guarantee that it will not be required in future also. Thus, as long as a machine is in use, its spares should be kept in stock and not disposed of. Spares of machines no longer in use should certainly be disposed of unless they can be used for other purposes. Illustration 9: A factory has received one consignment containing two improtant materials X and Y and the invoice pertaining to the same discloses the following information: 918 MATERIALS Materials X 1000 tons @7.2 per ton 2.000.00 Materials 'Y' 1200 tons @*. 1.60 per ton 1.920.00 Insurance 98.00 Freight etc. 110.00 Sales Tax 196.00 Due to mishandling in the factory store, loss of 20 tons of Materials "X" and 12 tons of Materials +Y" was recorded. What rate you would adopt for issuing these materials to jobs. If a provision of 20 per cent is to be made for probable risk of obsolescence, what would be the new rate? Losses of materials were treated as normal loss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started