Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ans a and c three alternatives are given in the table below: Alternative A Invest Large $1,200,000 $300,000 Alternative B Invest Medium $800,000 Alternative C

Ans a and c

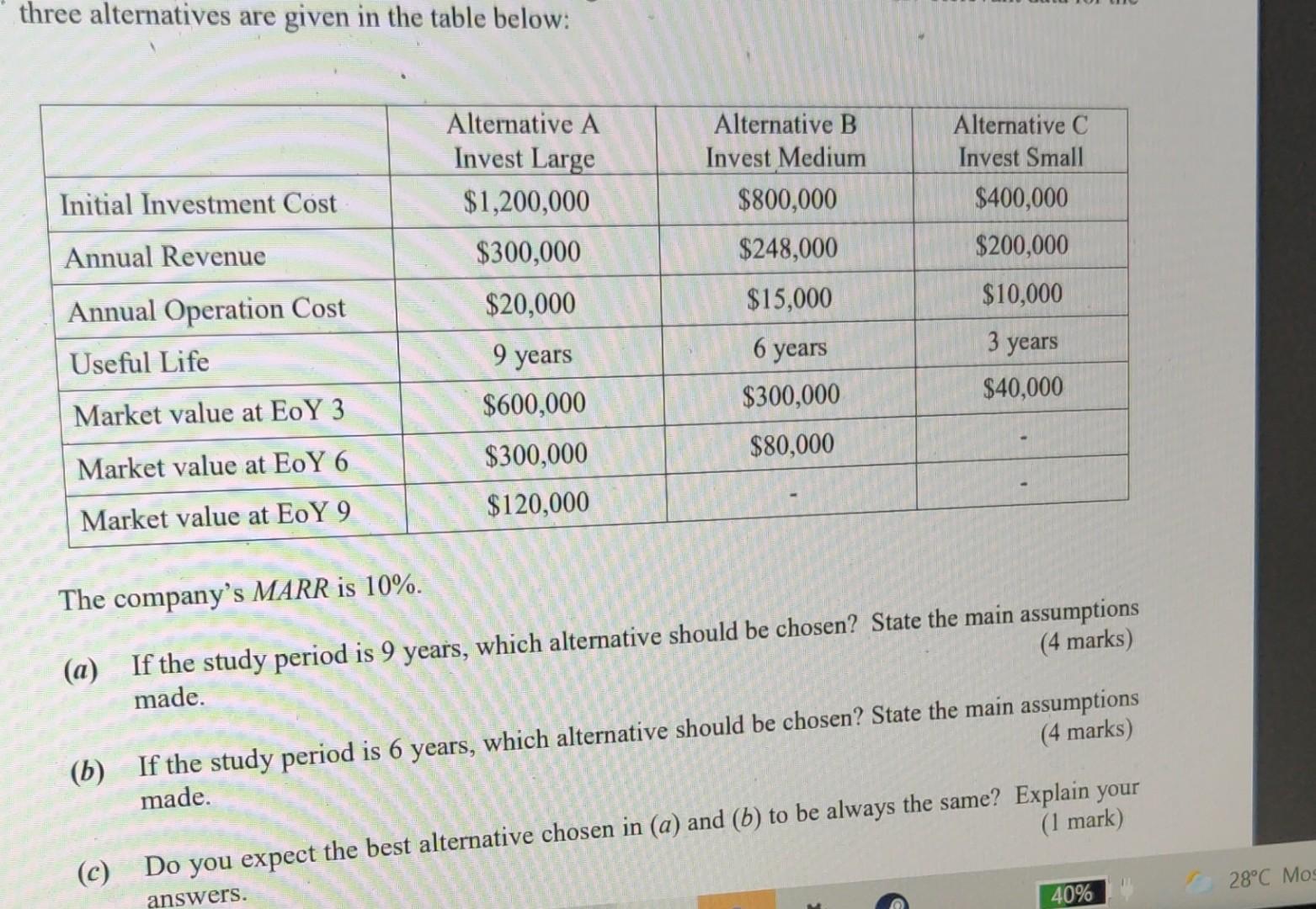

three alternatives are given in the table below: Alternative A Invest Large $1,200,000 $300,000 Alternative B Invest Medium $800,000 Alternative C Invest Small $400,000 Initial Investment Cost Annual Revenue $248,000 $200,000 Annual Operation Cost $20,000 $15,000 $10,000 3 years Useful Life 9 years 6 years $300,000 $40,000 Market value at EoY 3 $600,000 $80,000 Market value at EoY 6 $300,000 $120,000 Market value at EoY 9 The company's MARR is 10%. (a) If the study period is 9 years, which alternative should be chosen? State the main assumptions made. (4 marks) (b) If the study period is 6 years, which alternative should be chosen? State the main assumptions (4 marks) made. (C) Do you expect the best alternative chosen in (a) and (b) to be always the same? Explain your (1 mark) 28C Mos answers. 40%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started