Question: Feb. 6 Declared the required annual cash dividend on preferred shares and a $0.23 per share cash dividend on the common shares. 26 Paid

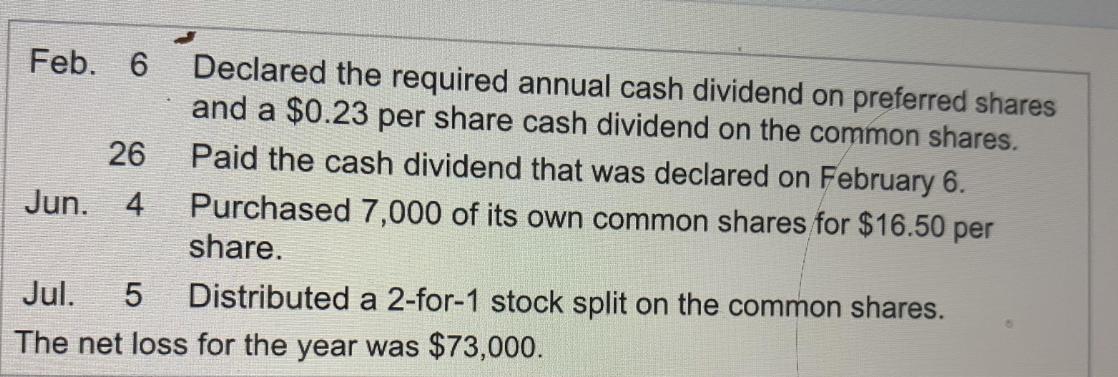

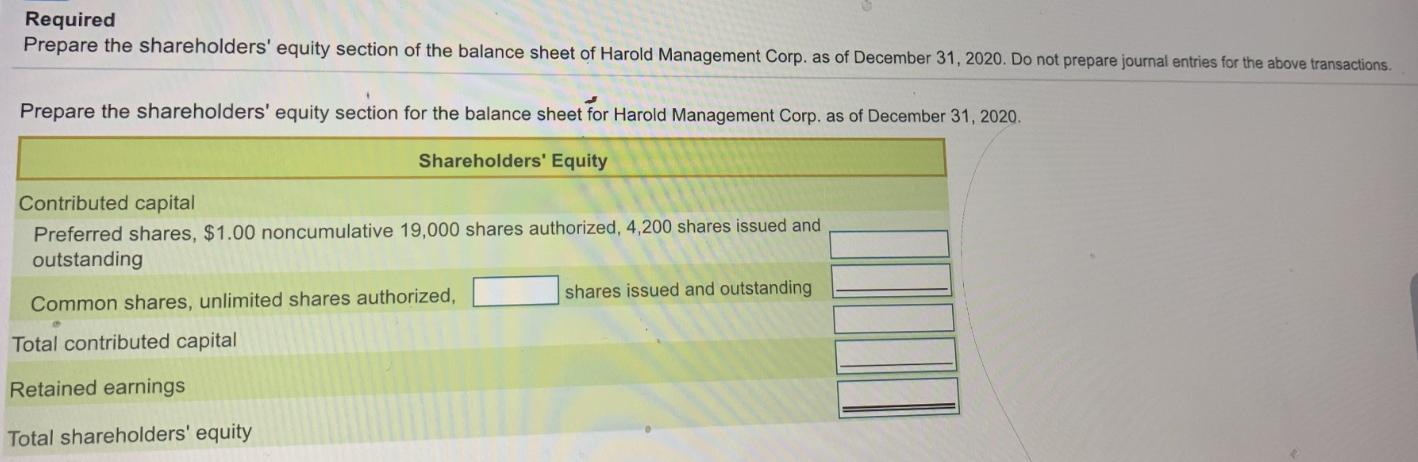

Feb. 6 Declared the required annual cash dividend on preferred shares and a $0.23 per share cash dividend on the common shares. 26 Paid the cash dividend that was declared on February 6. Jun. 4 Purchased 7,000 of its own common shares for $16.50 per share. Jul. Distributed a 2-for-1 stock split on the common shares. The net loss for the year was $73,000. Shareholders' Equity Contributed capital Preferred shares, $1.00, noncumulative 19,000 shares authorized, 4,200 shares issued and outstanding 84,000 Common shares, unlimited shares authorized, 196,000 shares issued and outstanding 2,548,000 Total contributed capital 2,632,000 Retained earnings 627,300 3,259,300 Total shareholders' equity Required Prepare the shareholders' equity section of the balance sheet of Harold Management Corp. as of December 31, 2020. Do not prepare journal entries for the above transactions. Prepare the shareholders' equity section for the balance sheet for Harold Management Corp. as of December 31, 2020. Shareholders' Equity Contributed capital Preferred shares, $1.00 noncumulative 19,000 shares authorized, 4,200 shares issued and outstanding shares issued and outstanding Common shares, unlimited shares authorized, Total contributed capital Retained earnings Total shareholders' equity

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Harold Management Corp Stockholders Equity section of Balance sheet as at Decem... View full answer

Get step-by-step solutions from verified subject matter experts