answar me this question plese

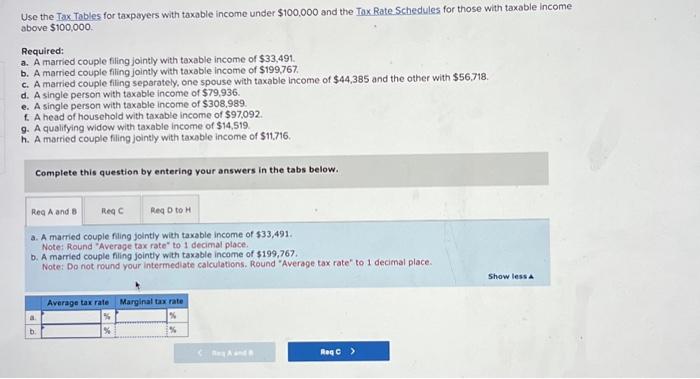

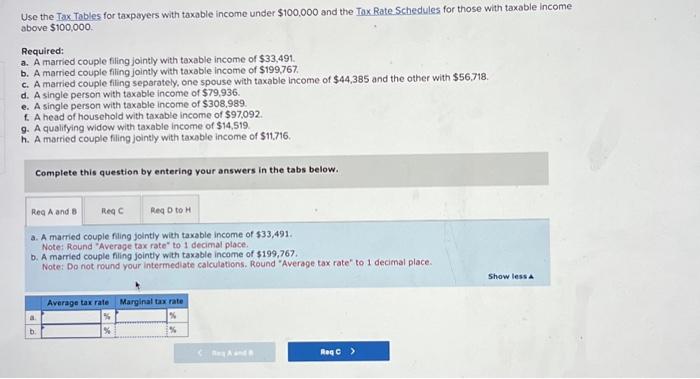

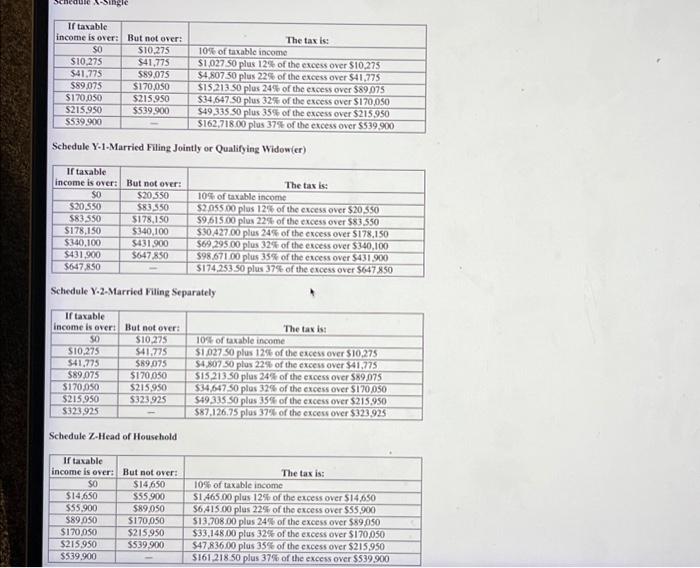

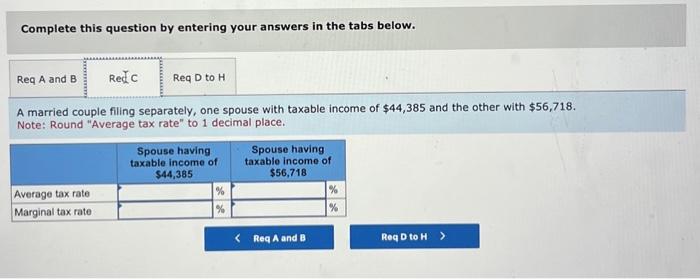

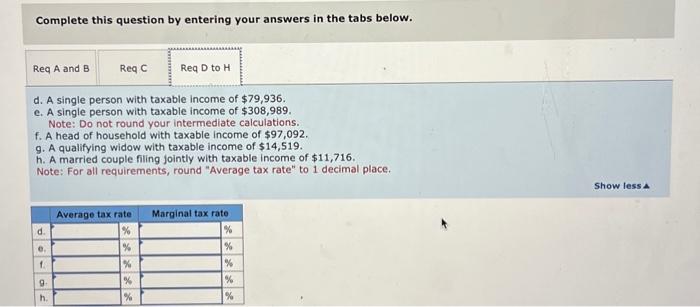

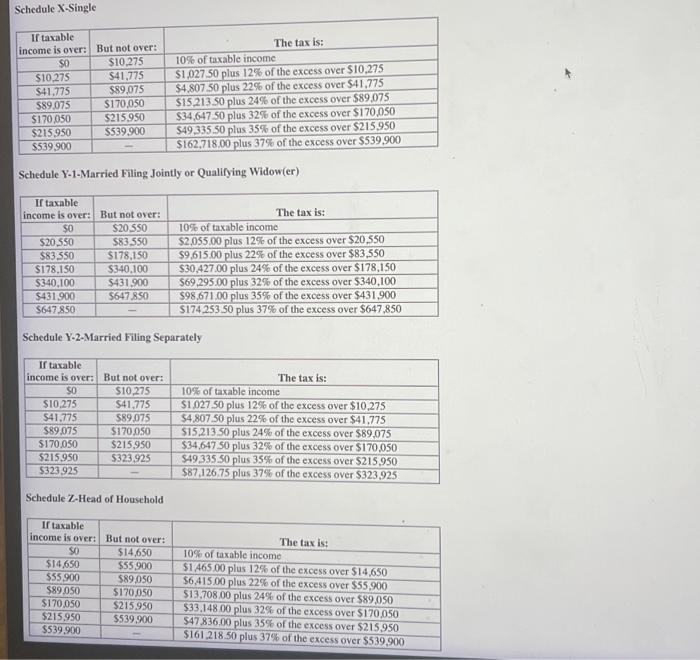

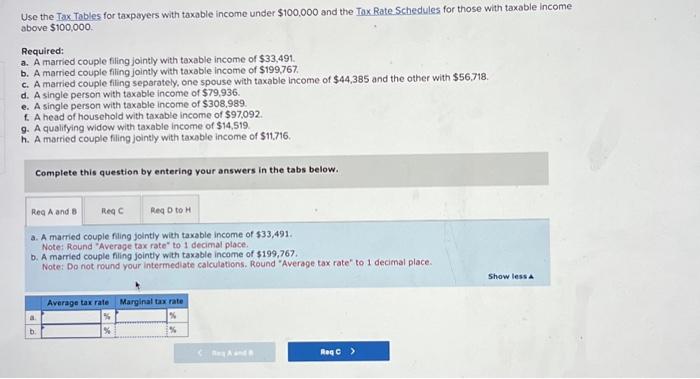

Use the Tax Tobles for taxpayers with taxable income under $100,000 and the Tox Rate Schedules for those with taxable income above $100,000. Required: a. A married couple filing jointly with taxable income of $33,491. b. A married couple filing jointly with taxable income of $199,767. c. A married couple filing separately, one spouse with taxable income of $44,385 and the other with $56,718. d. A single person with taxable income of $79,936. e. A single person with taxable income of $308,989 f. A head of household with taxable income of $97,092. 9. A qualifying widow with taxable income of $14,519 h. A married couple filing jointly with taxable income of $11,716 Complete this question by entering your answers in the tabs below. a. A married couple fling jointly with taxable income of $33,491. Note: Round "Average tax rate" to 1 decimal place. b. A married couple filing jointly with taxable income of $199,767. Note: Do not round your intermediate calculations. Round "Average tax rate' to 1 decimal place. Complete this question by entering your answers in the tabs below. A married couple filing separately, one spouse with taxable income of $44,385 and the other with $56,718. Note: Round "Average tax rate" to 1 decimal place. Complete this question by entering your answers in the tabs below. d. A single person with taxable income of $79,936. e. A single person with taxable income of $308,989. Note: Do not round your intermediate calculations. f. A head of household with taxable income of $97,092. 9. A qualifying widow with taxable income of $14,519. h. A married couple filing jointly with taxable income of $11,716. Note: For all requirements, round "Average tax rate" to 1 decimal place. Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) Schedule Y.2-Married Fing Separately Schedule Z-Head of Household Schedule X-Single Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) Schedule Y-2-Married Filing Separately Schedule Z-Head of Household Use the Tax Tobles for taxpayers with taxable income under $100,000 and the Tox Rate Schedules for those with taxable income above $100,000. Required: a. A married couple filing jointly with taxable income of $33,491. b. A married couple filing jointly with taxable income of $199,767. c. A married couple filing separately, one spouse with taxable income of $44,385 and the other with $56,718. d. A single person with taxable income of $79,936. e. A single person with taxable income of $308,989 f. A head of household with taxable income of $97,092. 9. A qualifying widow with taxable income of $14,519 h. A married couple filing jointly with taxable income of $11,716 Complete this question by entering your answers in the tabs below. a. A married couple fling jointly with taxable income of $33,491. Note: Round "Average tax rate" to 1 decimal place. b. A married couple filing jointly with taxable income of $199,767. Note: Do not round your intermediate calculations. Round "Average tax rate' to 1 decimal place. Complete this question by entering your answers in the tabs below. A married couple filing separately, one spouse with taxable income of $44,385 and the other with $56,718. Note: Round "Average tax rate" to 1 decimal place. Complete this question by entering your answers in the tabs below. d. A single person with taxable income of $79,936. e. A single person with taxable income of $308,989. Note: Do not round your intermediate calculations. f. A head of household with taxable income of $97,092. 9. A qualifying widow with taxable income of $14,519. h. A married couple filing jointly with taxable income of $11,716. Note: For all requirements, round "Average tax rate" to 1 decimal place. Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) Schedule Y.2-Married Fing Separately Schedule Z-Head of Household Schedule X-Single Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) Schedule Y-2-Married Filing Separately Schedule Z-Head of Household