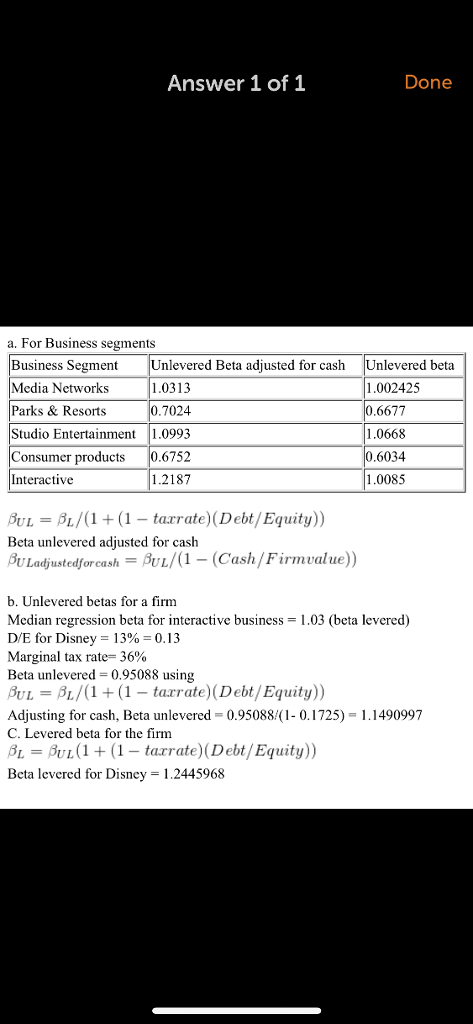

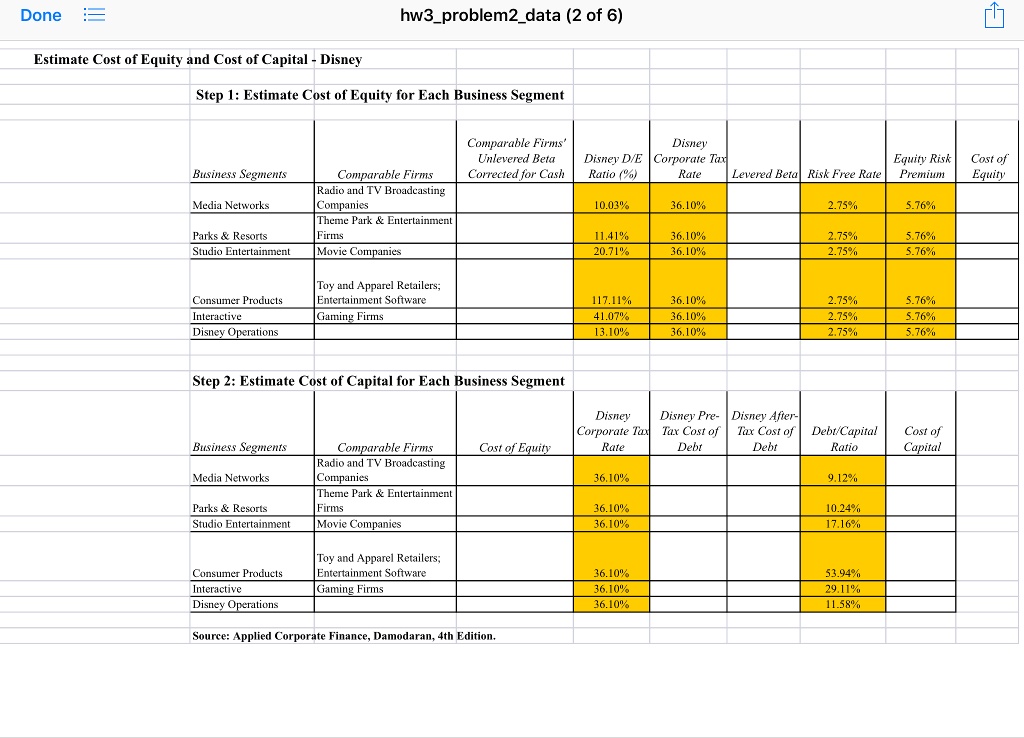

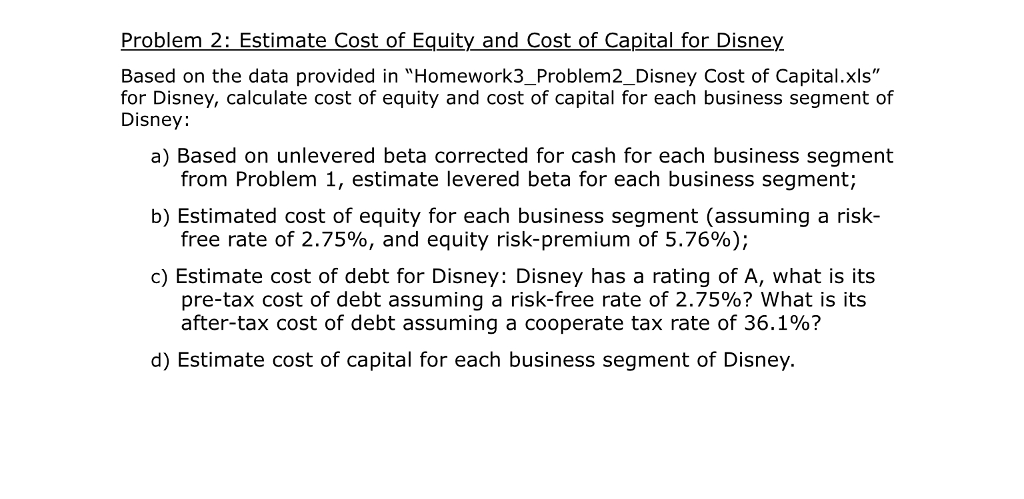

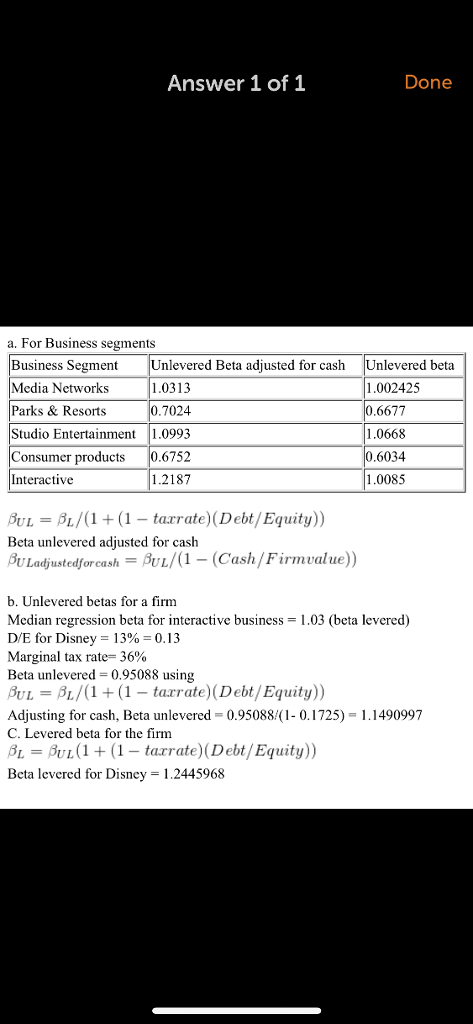

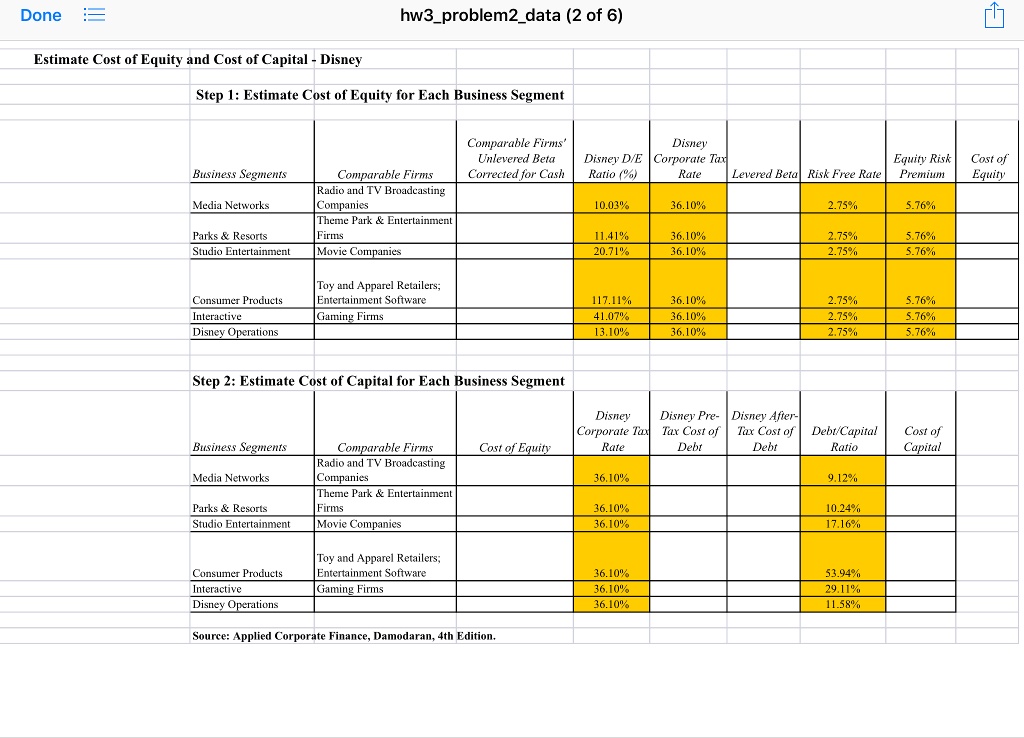

Answer 1 of 1 a. For Business segments Business Segment Unlevered Beta adjusted for cash Media Networks Parks & Resorts Studio Entertainment 1.0993 Consumer products 0.6752 Interactive Unlevered beta 1.002425 1.0313 6677 .0668 6034 1.0085 0.7024 1.2187 BUL = L/ (1 + (1-tarrate)( Debt/ Equity)) Beta unlevered adjusted for cash Ladjustedforcash BUL/(1- (Cash/Firmvalue) b. Unlevered betas for a firm Median regression beta for interactive business 1.03 (beta levered) DE for Disney 13% 0, 13 Marginal tax rate-36% Beta unlevered 0.95088 using BuL = L/ (1 + (1-tan-rate)(Debt/ Equity)) Adjusting for cash, Beta unlevered - 0.95088/(1- 0.1725) 1.1490997 C. Levered beta for the firm B1-BUL 1 (1- tarrate) (Debt/Equity)) Beta levered for Disney = 1.2445968 Done_ hw3 problem2_data (2 of 6) Estimate Cost of Equity and Cost of Capital - Disney Step 1: Estimate Cost of Equity for Each Business Segment Comparable Firms Disney Unlevered BetaDisney Corrected for Cash Ratio (%) DE Corporate 7 Equity RiskCost of PremiumEquit Business Segments Comparable HS Rate Levered Beta Risk Free Rate Radio and TV Broadcasting Companies Theme Park & Entertainment Firms Movie Companies Media Networks 10.03% 36.10% 2.75% 5.76% Parks & Resorts Studio Entertainment 11.41% 20.71 % 36.10% 36.10% 2.75% 2.75% 5.76% 5.76% Consumer Products Interactive Dis Toy and Apparel Retailers; Entertainment Software Gaming Firms 117.11% 4 1.07% 13.10% 36.10% 36.10% 36, 1090 2.75% 2.75% 2.75% 5.76% 5.76% 5.76% Step 2: Estimate Cost of Capital for Each Business Segment Disney Disney Pre- Disney Afier- Corporate Ta Tax Cost of Tax Cost ofDebt CapitaCost of Capital Cost of Equity Rate Debt Debt Ratio 9.12% 10.24% Busimess segmentS Comparable HS Radio and TV Broadcasting Companies Theme Park & Entertainment Firms Movie Companies Media Networks 36, 10% Parks & Resorts 36. I 0% 36, 10% Studio Entertainment 17.16% Consumer Products Interactive Disney Toy and Apparel Retailers; Entertainment Software Gaming Firms 36. I 0% 36, 10% 36. 10% 53.94% 29. I 1% 1 1.58% ations Source: Applied Corporate Finance, Damodaran, 4th Edition. Problem 2: Estimate Cost of Equity_and Cost of Capital for Disney. Based on the data provided in "Homework3_Problem2_Disney Cost of Capital.xls" for Disney, calculate cost of equity and cost of capital for each business segment of Disney: a) Based on unlevered beta corrected for cash for each business segment from Problem 1, estimate levered beta for each business segment; free rate of 2.75%, and equity risk-premium of 5.76%); pre-tax cost of debt assuming a risk-free rate of 2.75%? What is its b) Estimated cost of equity for each business segment (assuming a risk- c) Estimate after-tax cost of debt assuming a cooperate tax rate of 36.1%? d) Estimate cost of capital for each business segment of Disney