ANSWER 1 ONLY

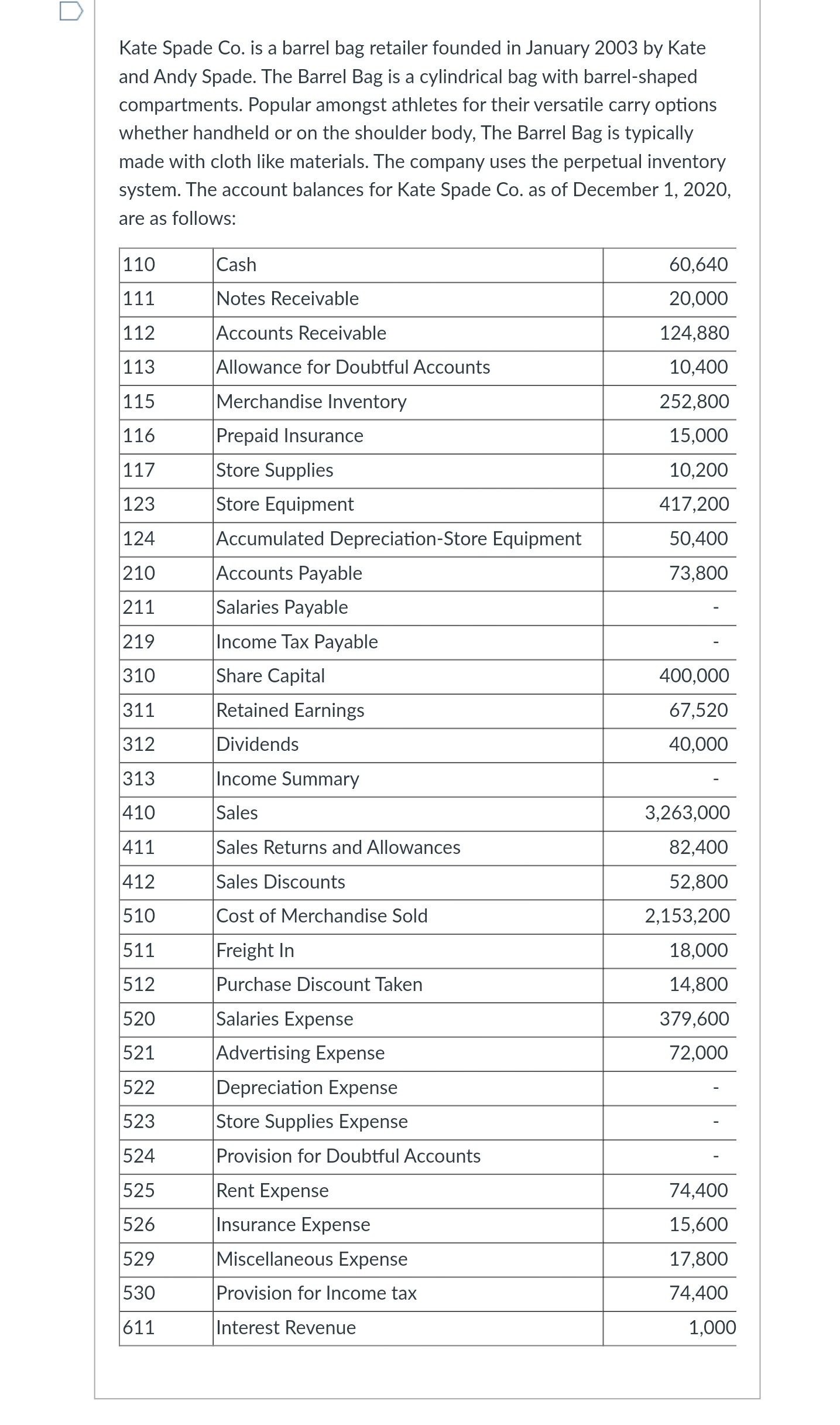

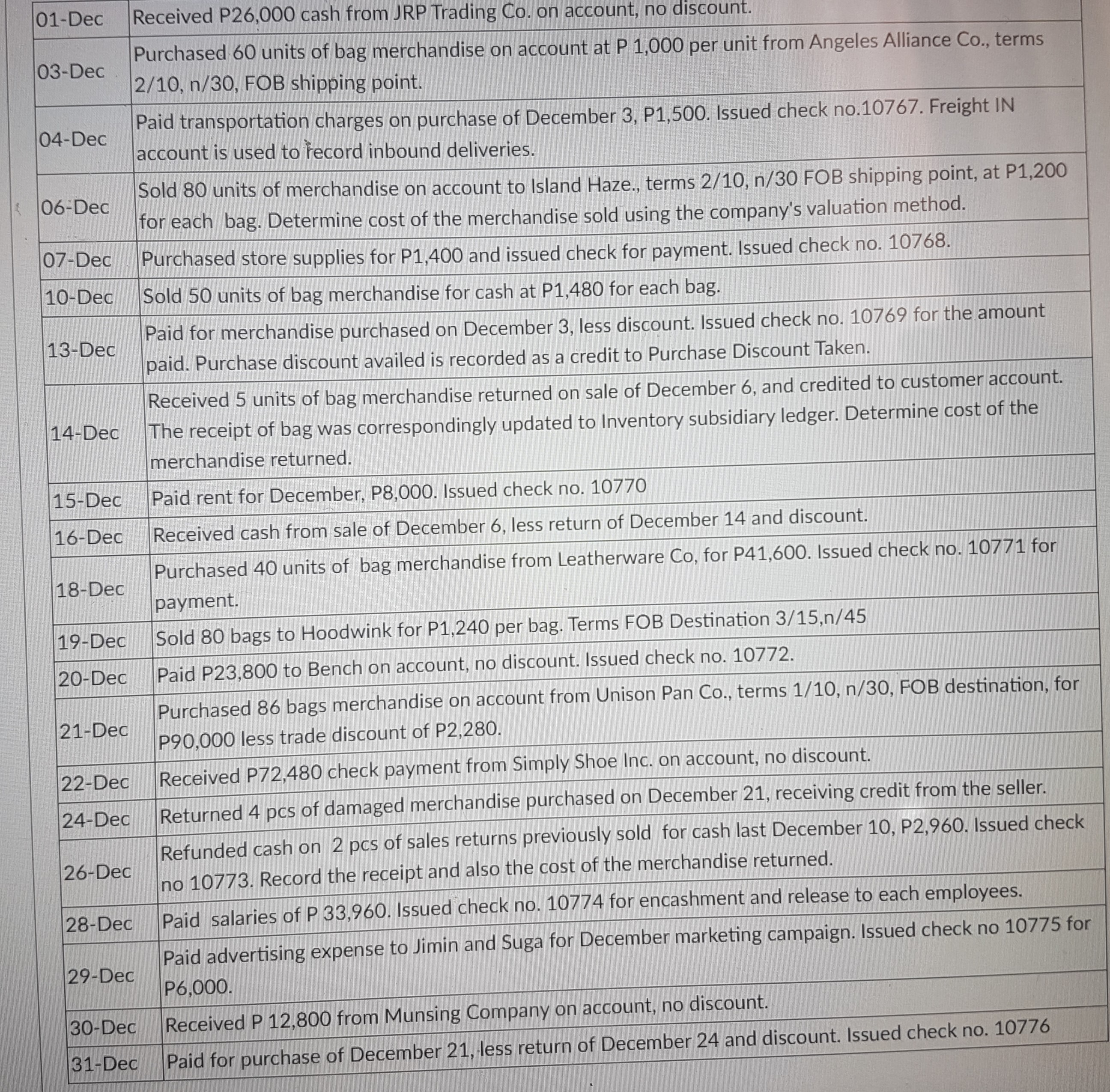

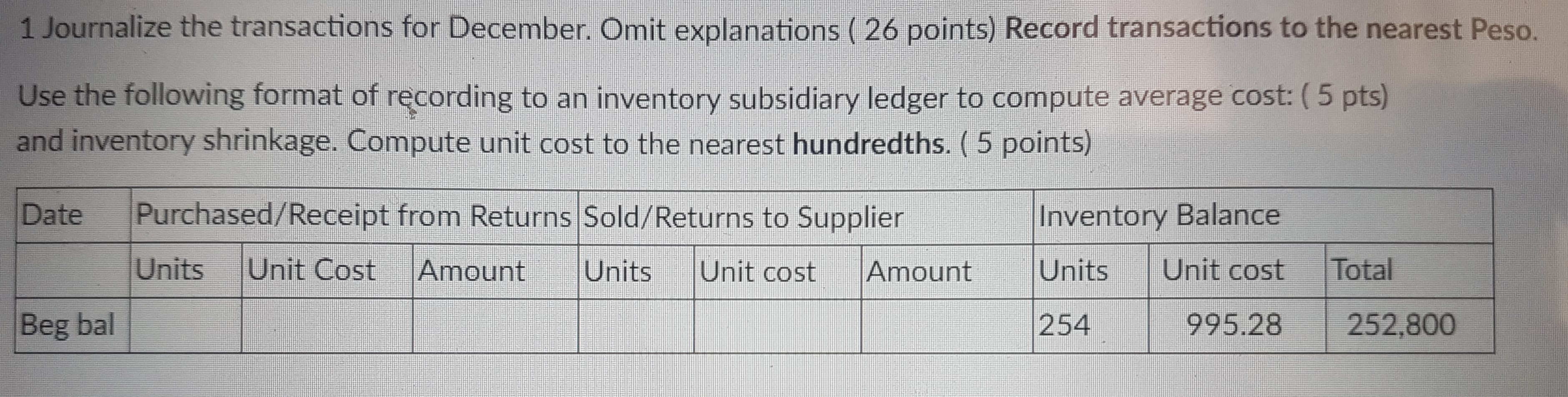

Kate Spade Co. is a barrel bag retailer founded in January 2003 by Kate and Andy Spade. The Barrel Bag is a cylindrical bag with barrel-shaped compartments. Popular amongst athletes for their versatile carry options whether handheld or on the shoulder body, The Barrel Bag is typically made with cloth like materials. The company uses the perpetual inventory system. The account balances for Kate Spade Co. as of December 1, 2020, are as follows: 110 Cash 60,640 111 Notes Receivable 20,000 112 Accounts Receivable 124,880 113 Allowance for Doubtful Accounts 10,400 115 Merchandise Inventory 252,800 116 Prepaid Insurance 15,000 117 Store Supplies 10,200 123 Store Equipment 417,200 124 Accumulated Depreciation-Store Equipment 50,400 210 Accounts Payable 73,800 211 Salaries Payable 219 Income Tax Payable 310 Share Capital 400,000 311 Retained Earnings 67,520 312 Dividends 40,000 313 Income Summary 410 Sales 3,263,000 411 Sales Returns and Allowances 82,400 412 Sales Discounts 52,800 510 Cost of Merchandise Sold 2,153,200 511 Freight In 18,000 512 Purchase Discount Taken 14,800 520 Salaries Expense 379,600 521 Advertising Expense 72,000 522 Depreciation Expense 523 Store Supplies Expense 524 Provision for Doubtful Accounts 525 Rent Expense 74,400 526 Insurance Expense 15,600 529 Miscellaneous Expense 17,800 530 Provision for Income tax 74,400 611 Interest Revenue 1,00001-Dec Received P26,000 cash from JRP Trading Co. on account, no discount. 03-Dec Purchased 60 units of bag merchandise on account at P 1,000 per unit from Angeles Alliance Co., terms 2/10, n/30, FOB shipping point. 04-Dec Paid transportation charges on purchase of December 3, P1,500. Issued check no.10767. Freight IN account is used to record inbound deliveries. 06-Dec Sold 80 units of merchandise on account to Island Haze., terms 2/10, n/30 FOB shipping point, at P1,200 or each bag. Determine cost of the merchandise sold using the company's valuation method. 07-Dec Purchased store supplies for P1,400 and issued check for payment. Issued check no. 10768. 10-Dec Sold 50 units of bag merchandise for cash at P1,480 for each bag. 13-Dec Paid for merchandise purchased on December 3, less discount. Issued check no. 10769 for the amount paid. Purchase discount availed is recorded as a credit to Purchase Discount Taken. Received 5 units of bag merchandise returned on sale of December 6, and credited to customer account. 14-Dec The receipt of bag was correspondingly updated to Inventory subsidiary ledger. Determine cost of the merchandise returned. 15-Dec Paid rent for December, P8,000. Issued check no. 10770 16-Dec Received cash from sale of December 6, less return of December 14 and discount. Purchased 40 units of bag merchandise from Leatherware Co, for P41,600. Issued check no. 10771 for 18-Dec payment. 19-Dec Sold 80 bags to Hoodwink for P1,240 per bag. Terms FOB Destination 3/15,n/45 20-Dec Paid P23,800 to Bench on account, no discount. Issued check no. 10772. Purchased 86 bags merchandise on account from Unison Pan Co., terms 1/10, n/30, FOB destination, for 21-Dec P90,000 less trade discount of P2,280. 22-Dec Received P72,480 check payment from Simply Shoe Inc. on account, no discount. 24-Dec Returned 4 pcs of damaged merchandise purchased on December 21, receiving credit from the seller. Refunded cash on 2 pcs of sales returns previously sold for cash last December 10, P2,960. Issued check 26-Dec no 10773. Record the receipt and also the cost of the merchandise returned. 28-Dec Paid salaries of P 33,960. Issued check no. 10774 for encashment and release to each employees. Paid advertising expense to Jimin and Suga for December marketing campaign. Issued check no 10775 for 29-Dec P6,000. 30-Dec Received P 12,800 from Munsing Company on account, no discount. 31-Dec Paid for purchase of December 21, less return of December 24 and discount. Issued check no. 107761 Journalize the transactions for December. Omit explanations ( 26 points) Record transactions to the nearest Peso. Use the following format of recording to an inventory subsidiary ledger to compute average cost: ( 5 pts) and inventory shrinkage. Compute unit cost to the nearest hundredths. ( 5 points) Date Purchased/Receipt from Returns Sold/Returns to Supplier Inventory Balance Units Unit Cost Amount Units Unit cost Amount Units Unit cost Total Beg bal 254 995.28 252,800