Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer 12 + 13 12. Which of the following is a problem of historical risk premium? I. It is highly sensitive to sample period. II.

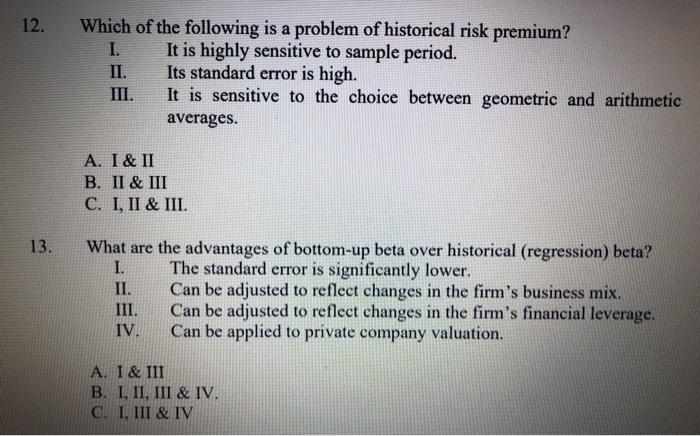

answer 12 + 13  12. Which of the following is a problem of historical risk premium? I. It is highly sensitive to sample period. II. Its standard error is high. III. It is sensitive to the choice between geometric and arithmetic averages. A. I & II B. II & III C. I, II & III. 13. What are the advantages of bottom-up beta over historical (regression) beta? 1. The standard error is significantly lower. II. Can be adjusted to reflect changes in the firm's business mix. III. Can be adjusted to reflect changes in the firm's financial leverage. Can be applied to private company valuation. IV. A. I & III B. I, II, III & IV. C. 1, III & IV

12. Which of the following is a problem of historical risk premium? I. It is highly sensitive to sample period. II. Its standard error is high. III. It is sensitive to the choice between geometric and arithmetic averages. A. I & II B. II & III C. I, II & III. 13. What are the advantages of bottom-up beta over historical (regression) beta? 1. The standard error is significantly lower. II. Can be adjusted to reflect changes in the firm's business mix. III. Can be adjusted to reflect changes in the firm's financial leverage. Can be applied to private company valuation. IV. A. I & III B. I, II, III & IV. C. 1, III & IV

answer 12 + 13

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started