Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer 12 please its after 11 and 10 that I already asked answer for separately:) 10. 11. Calculating Project OCF Bush Boomerang, Inc., is considering

Answer 12 please its after 11 and 10 that I already asked answer for separately:)

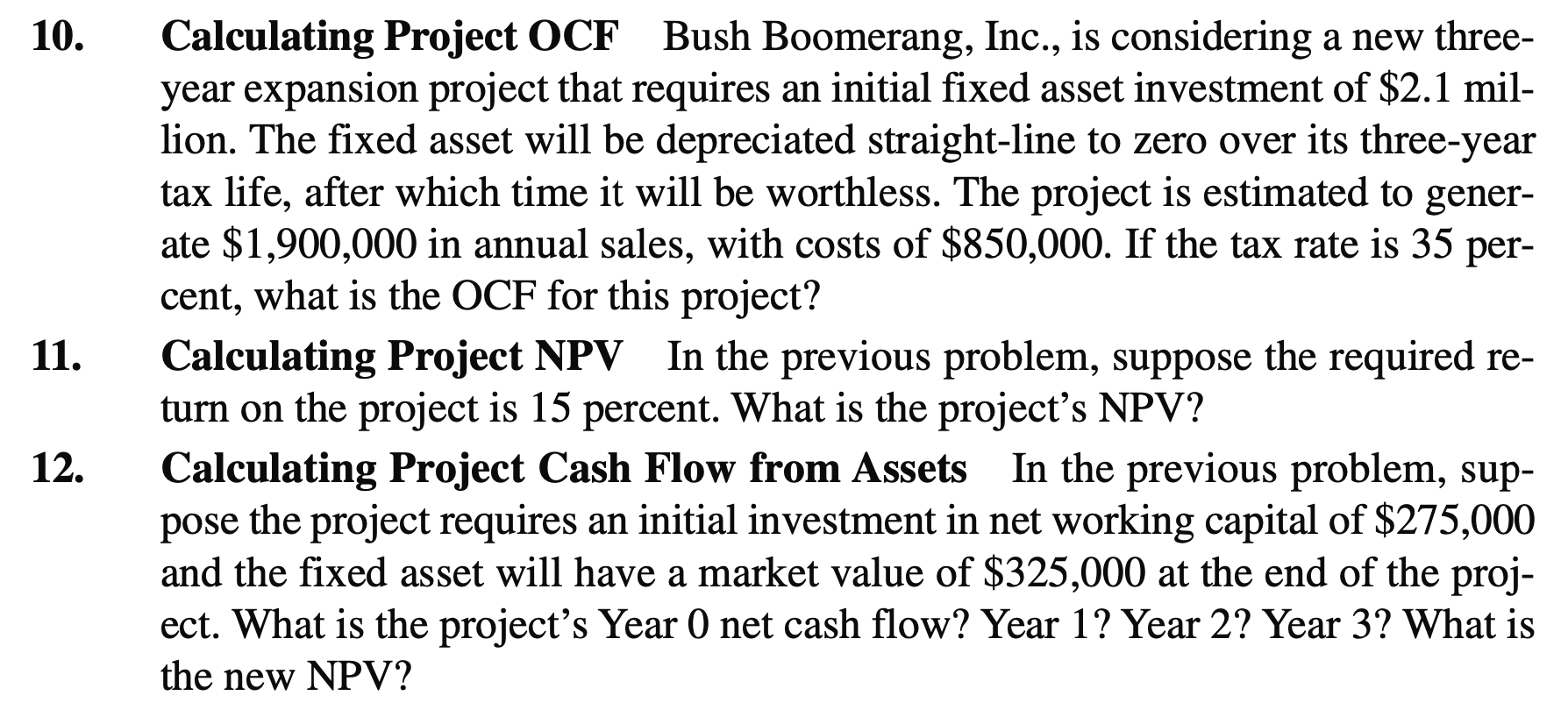

10. 11. Calculating Project OCF Bush Boomerang, Inc., is considering a new three- year expansion project that requires an initial fixed asset investment of $2.1 mil- lion. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to gener- ate $1,900,000 in annual sales, with costs of $850,000. If the tax rate is 35 per- cent, what is the OCF for this project? Calculating Project NPV In the previous problem, suppose the required re- turn on the project is 15 percent. What is the project's NPV? Calculating Project Cash Flow from Assets In the previous problem, sup- pose the project requires an initial investment in net working capital of $275,000 and the fixed asset will have a market value of $325,000 at the end of the proj- ect. What is the project's Year 0 net cash flow? Year 1? Year 2? Year 3? What is the new NPV? 12Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started