Answered step by step

Verified Expert Solution

Question

1 Approved Answer

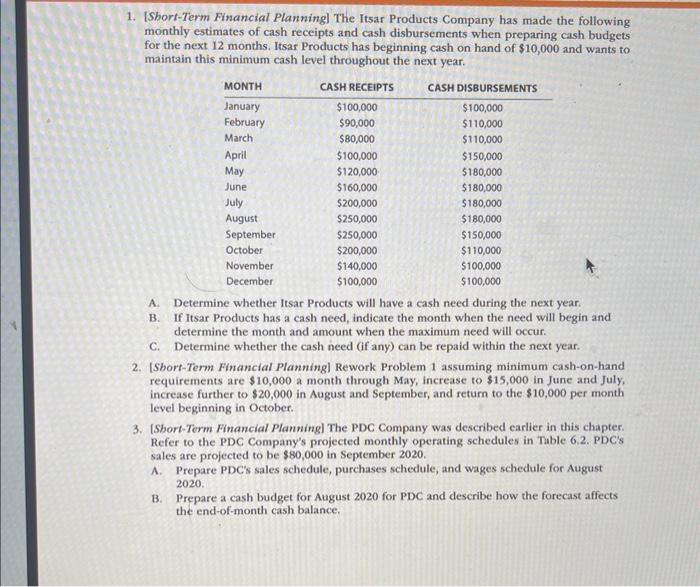

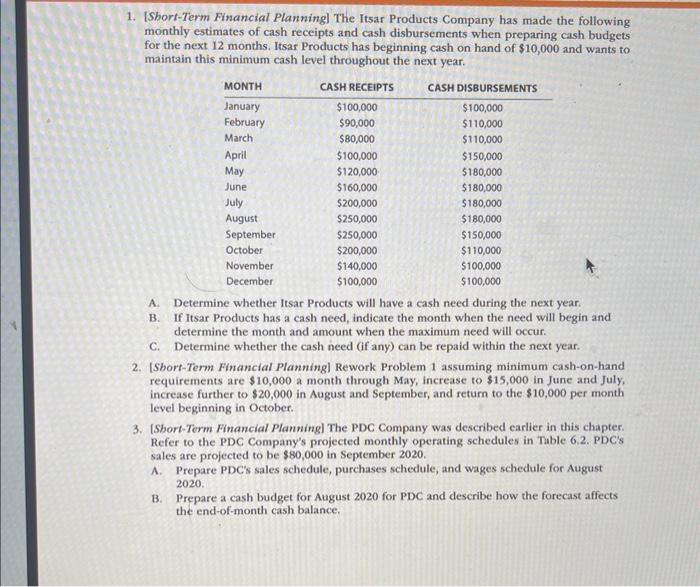

answer 1,3, and 5 1. [Short-Term Financial Planning] The Itsar Products Company has made the following monthly estimates of cash receipts and cash disbursements when

answer 1,3, and 5

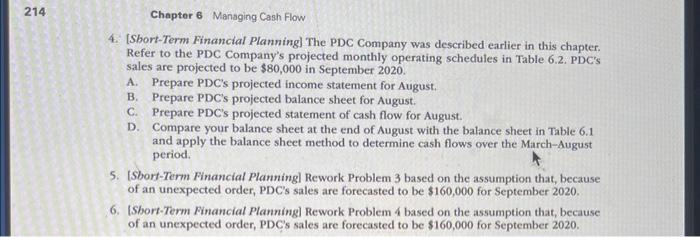

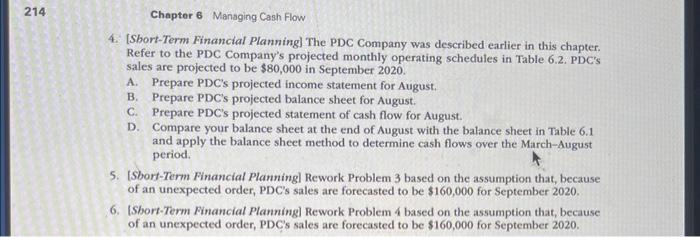

1. [Short-Term Financial Planning] The Itsar Products Company has made the following monthly estimates of cash receipts and cash disbursements when preparing cash budgets for the next 12 months. Itsar Products has beginning cash on hand of $10,000 and wants to maintain this minimum cash level throughout the next year. A. Determine whether Itsar Products will have a cash need during the next year. B. If Itsar Products has a cash need, indicate the month when the need will begin and determine the month and amount when the maximum need will occur. C. Determine whether the cash need (if any) can be repaid within the next year. 2. [Sbort-Term Financial Planning] Rework Problem 1 assuming minimum cash-on-hand requirements are $10,000 a month through May, increase to $15,000 in June and July, increase further to $20,000 in August and September, and return to the $10,000 per month level beginning in October. 3. [Short-Term Financial Planning] The PDC Company was described earlier in this chapter. Refer to the PDC Company's projected monthly operating schedules in Table 6.2. PDC's sales are projected to be $80,000 in September 2020. A. Prepare PDC's sales schedule, purchases schedule, and wages schedule for August 2020. B. Prepare a cash budget for August 2020 for PDC and describe how the forecast affects the end-of-month cash balance. 4. [Sbort-Term Financial Planning] The PDC Company was described earlier in this chapter. Refer to the PDC Company's projected monthly operating schedules in Table 6.2. PDC's sales are projected to be $80,000 in September 2020 . A. Prepare PDC's projected income statement for August. B. Prepare PDC's projected balance sheet for August. C. Prepare PDC's projected statement of cash flow for August. D. Compare your balance sheet at the end of August with the balance sheet in Table 6.1 and apply the balance sheet method to determine cash flows over the March-August period. 5. [Sbort-Term Financial Planning] Rework Problem 3 based on the assumption that, because of an unexpected order, PDC's sales are forecasted to be $160,000 for September 2020. 6. [Sbort-Term Financial Planning] Rework Problem 4 based on the assumption that, because of an unexpected order, PDC's sales are forecasted to be $160,000 for September 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started