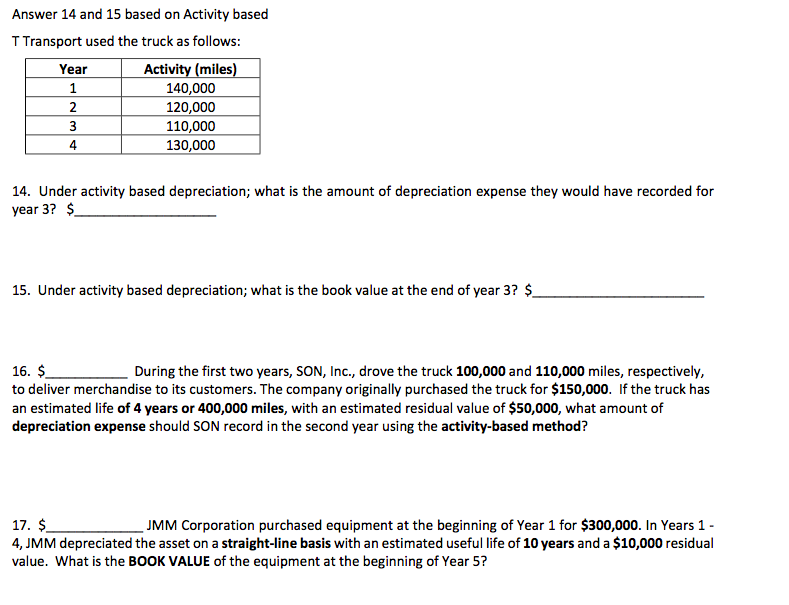

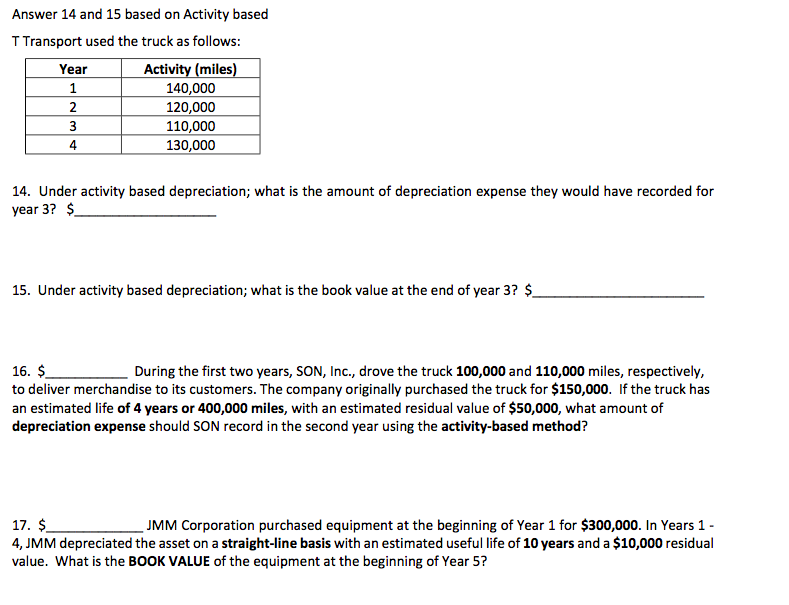

Answer 14 and 15 based on Activity based T Transport used the truck as follows: 1 2 3 4 Activity (miles) 140,000 120,000 110,000 130,000 T 14. Under activity based depreciation; what is the amount of depreciation expense they would have recorded for year 3? $. 15. Under activity based depreciation; what is the book value at the end of year 3? $_ 16. $ During the first two years, SON, Inc., drove the truck 100,000 and 110,000 miles, respectively, to deliver merchandise to its customers. The company originally purchased the truck for $150,000. If the truck has an estimated life of 4 years or 400,000 miles, with an estimated residual value of $50,000, what amount of depreciation expense should SON record in the second year using the activity-based method? 17. $ _JMM Corporation purchased equipment at the beginning of Year 1 for $300,000. In Years 1 - 4, JMM depreciated the asset on a straight-line basis with an estimated useful life of 10 years and a $10,000 residual value. What is the BOOK VALUE of the equipment at the beginning of Year 5? Answer 14 and 15 based on Activity based T Transport used the truck as follows: 1 2 3 4 Activity (miles) 140,000 120,000 110,000 130,000 T 14. Under activity based depreciation; what is the amount of depreciation expense they would have recorded for year 3? $. 15. Under activity based depreciation; what is the book value at the end of year 3? $_ 16. $ During the first two years, SON, Inc., drove the truck 100,000 and 110,000 miles, respectively, to deliver merchandise to its customers. The company originally purchased the truck for $150,000. If the truck has an estimated life of 4 years or 400,000 miles, with an estimated residual value of $50,000, what amount of depreciation expense should SON record in the second year using the activity-based method? 17. $ _JMM Corporation purchased equipment at the beginning of Year 1 for $300,000. In Years 1 - 4, JMM depreciated the asset on a straight-line basis with an estimated useful life of 10 years and a $10,000 residual value. What is the BOOK VALUE of the equipment at the beginning of Year 5