Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer 14-19 16. $ During the first two years, MOM, Inc., drove the truck 57,200 and 52,400 miles, respectively, to deliver merchandise to its customers.

answer 14-19

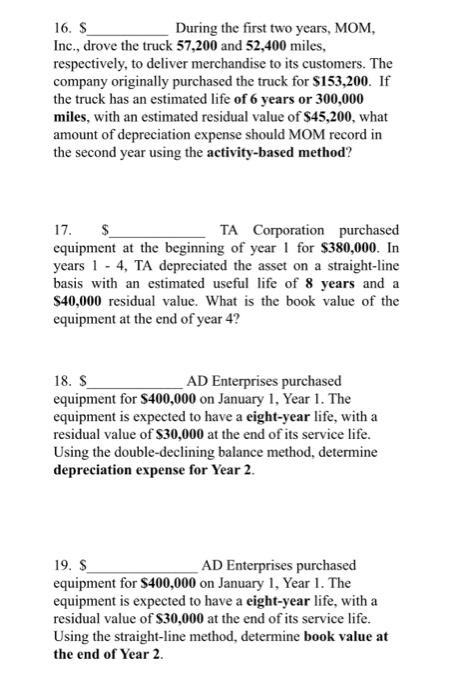

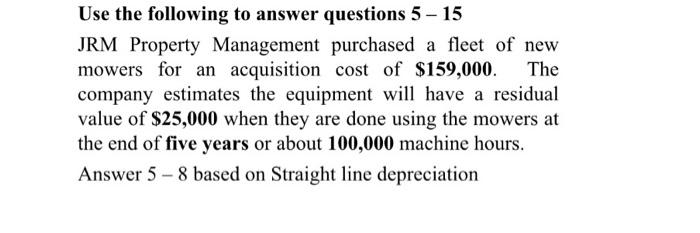

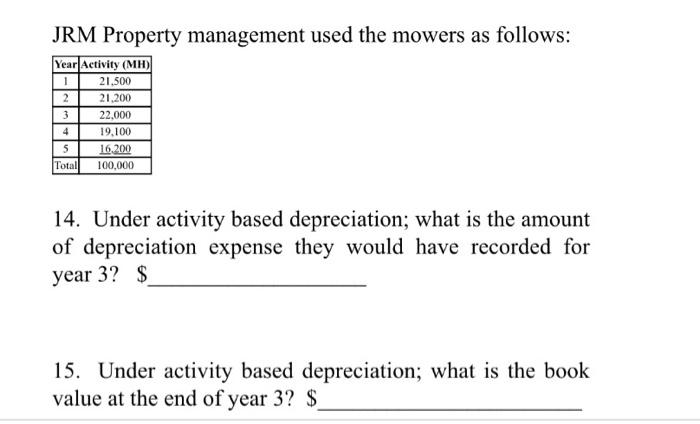

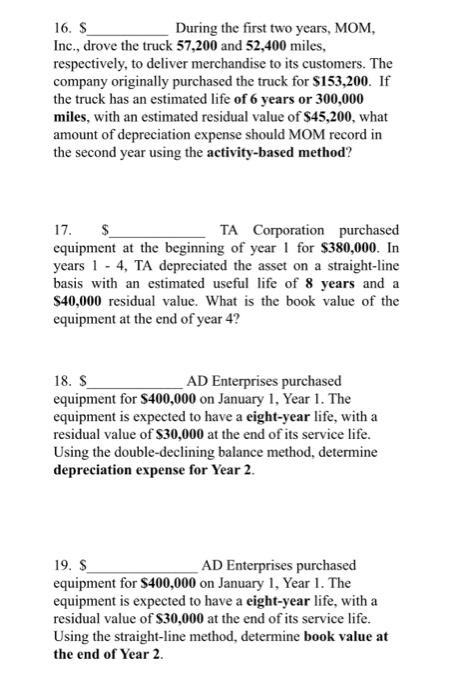

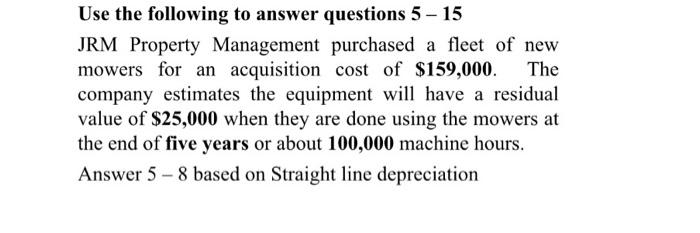

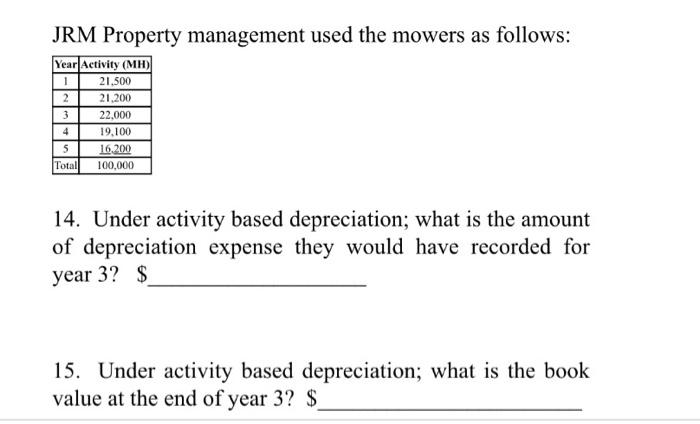

16. $ During the first two years, MOM, Inc., drove the truck 57,200 and 52,400 miles, respectively, to deliver merchandise to its customers. The company originally purchased the truck for $153,200. If the truck has an estimated life of 6 years or 300,000 miles, with an estimated residual value of $45,200, what amount of depreciation expense should MOM record in the second year using the activity-based method? 17. $ TA Corporation purchased equipment at the beginning of year 1 for $380,000. In years 1 - 4, TA depreciated the asset on a straight-line basis with an estimated useful life of 8 years and a $40,000 residual value. What is the book value of the equipment at the end of year 4? 18. $ AD Enterprises purchased equipment for $400,000 on January 1, Year 1. The equipment is expected to have a eight-year life, with a residual value of $30,000 at the end of its service life. Using the double-declining balance method, determine depreciation expense for Year 2. 19. S AD Enterprises purchased equipment for $400,000 on January 1, Year 1. The equipment is expected to have a eight-year life, with a residual value of $30,000 at the end of its service life. Using the straight-line method, determine book value at the end of Year 2. Use the following to answer questions 5 - 15 JRM Property Management purchased a fleet of new mowers for an acquisition cost of $159,000. The company estimates the equipment will have a residual value of $25,000 when they are done using the mowers at the end of five years or about 100,000 machine hours. Answer 5 - 8 based on Straight line depreciation JRM Property management used the mowers as follows: Year Activity (MH) 1 2 3 21.500 21,200 22.000 19.100 16.200 100,000 4 5 Total 14. Under activity based depreciation; what is the amount of depreciation expense they would have recorded for year 3? $ 15. Under activity based depreciation; what is the book value at the end of year 3? $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started