Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer 1-5 Please show your work clearly and circle your answer Answer the following multiple-choice questions by darkening your Scantron for the best answer. If

Answer 1-5

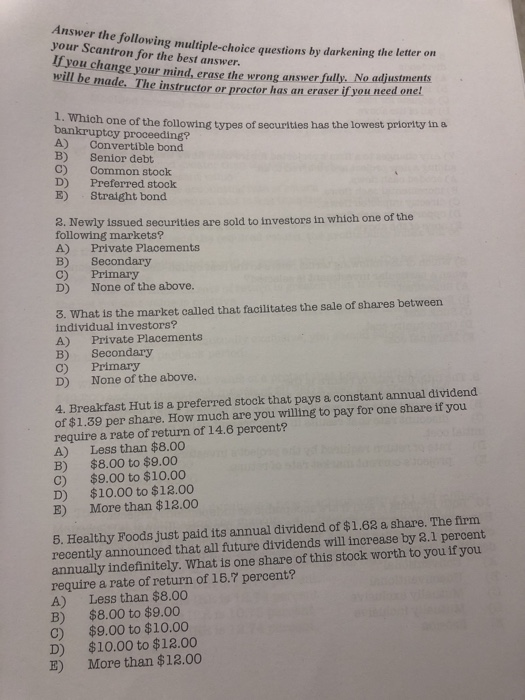

Answer the following multiple-choice questions by darkening your Scantron for the best answer. If you change your mind, erase the wrot antserser if you need one! will be made. The instructor or proctor has an the letter on 1. Which one eig? bankruptcy proceeding? A) Convertible bond B) Senior debt C) Common stock D) Preferred stock E) Straight bond one of the following types of securities has the lowest priority in a 2. Newly issued securities are sold to investors in which one of the following markets? A) Private Placements B) Secondary C) Primary D) None of the above. 3. What is the market called that facilitates the sale of shares between individual investors? A) Private Placements B) Secondary C) Primary D) None of the above. 4. Breakfast Hut is a preferred stock that pays a constant annual dividend of $1.89 per share. How much are you willing to pay for one share if you require a rate of return of 14.6 percent? A) Less than $8.00 B) $8.00 to $9.00 C) $9.00 to $10.00 D) $10.00 to $12.00 E) More than $12.00 5. Healthy Foods just paid its annual dividend of $1.62 a share. The firm recently announced that all future dividends will increase by 3.1 percent annually indefinitely. What is one share of this stock worth to you if you require a rate of return of 15.7 percent? A) Less than $8.00 B) $8.00 to $9.00 C) $9.00 to $10.00 D) $10.00 to $12.00 E) More than $12.00 Please show your work clearly and circle your answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started