Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer 2-4 excel sheet attached if needed 2. Change all of the numbers in the data area of your worksheet so that it looks like

answer 2-4

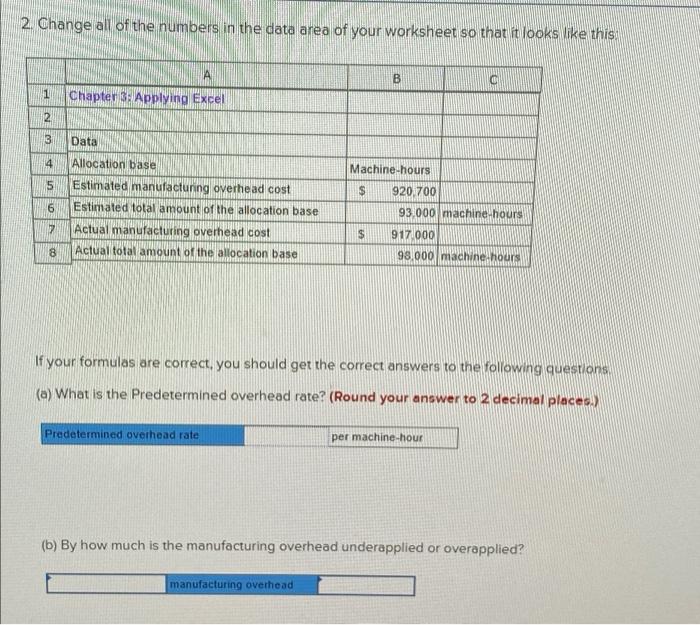

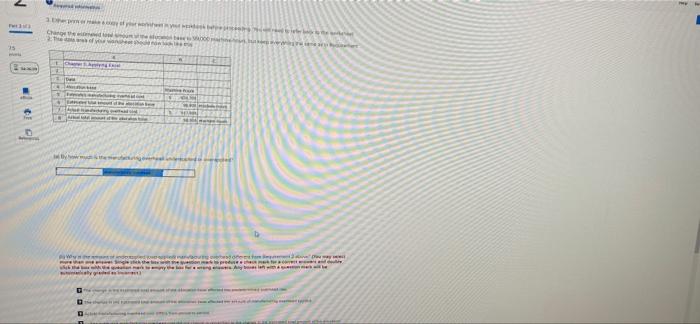

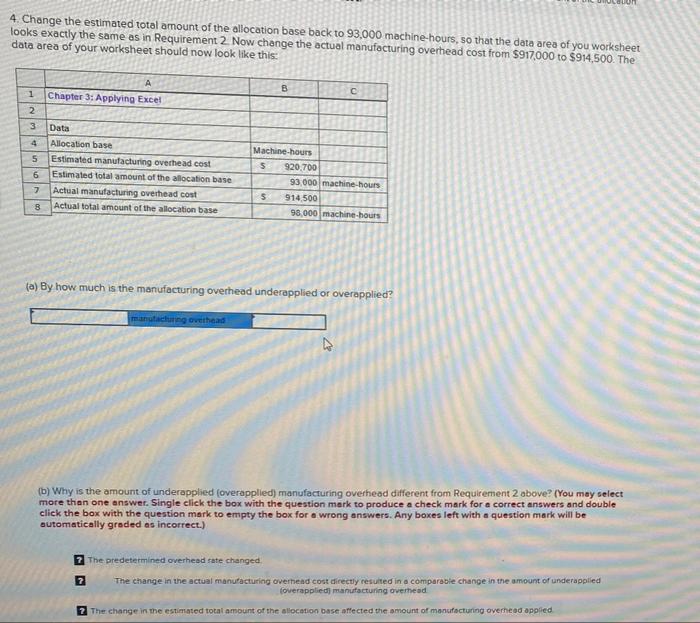

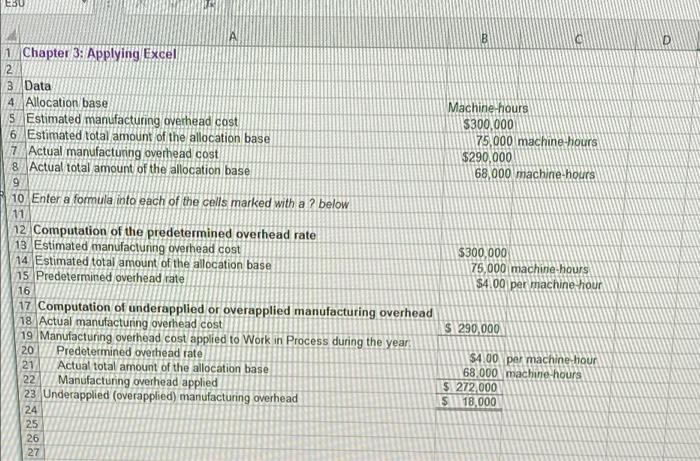

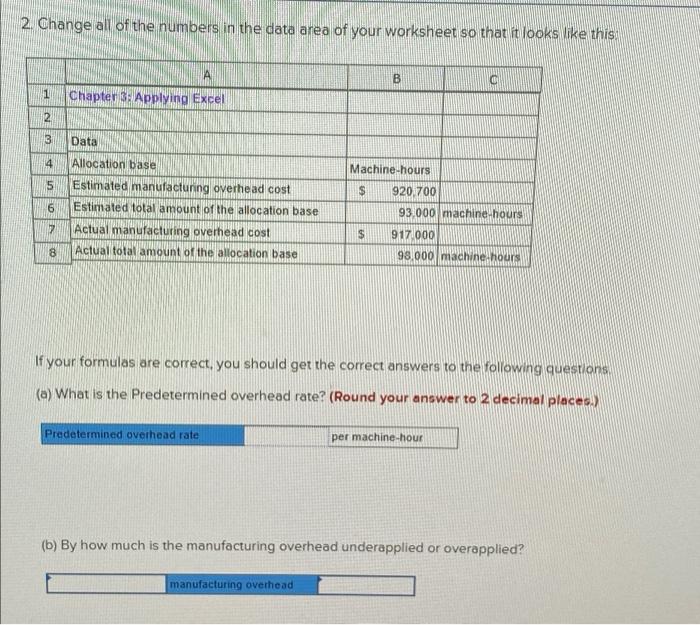

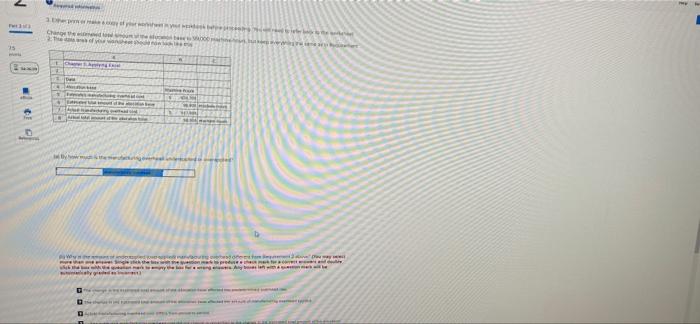

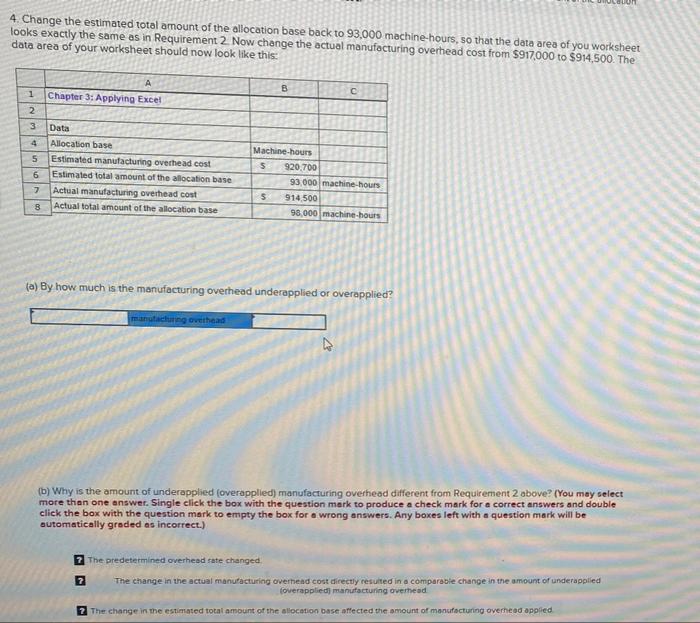

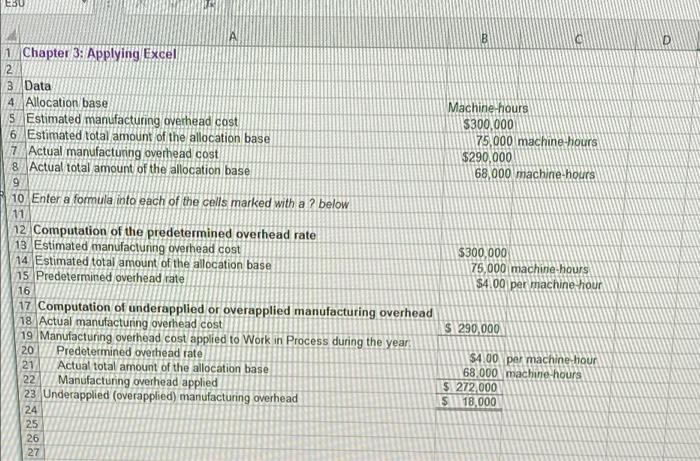

2. Change all of the numbers in the data area of your worksheet so that it looks like this: A B c 1 Chapter Applying Excel 2 2 3 4 Data 5 Allocation base Estimated manufacturing overhead cost Estimated total amount of the allocation base Actual manufacturing overhead cost Actual total amount of the allocation base Machine-hours $ 920,700 93,000 machine-hours 6 7 $ 917 000 8 98,000 machine hours If your formulas are correct, you should get the correct answers to the following questions, (a) What is the Predetermined overhead rate? (Round your answer to 2 decimal places.) Predetermined overhead rate per machine-hour (b) By how much is the manufacturing overhead underapplied or overapplied? manufacturing overhead Cha . d BO 4. Change the estimated total amount of the allocation base back to 93,000 machine-hours, so that the data area of you worksheet looks exactly the same as in Requirement 2 Now change the actual manufacturing overhead cost from $917,000 to $914,500. The data area of your worksheet should now look like this: c A 1 Chapter 3: Applying Excel 2 3 Data 4 Allocation base 5 Estimated manufacturing overhead cost 6 Estimated total amount of the allocation base 7 Actual manufacturing overhead cost 8 Actual total amount of the allocation base Machine-hours 5 920.700 93.000 machine-hours 5 914.500 98,000 machine-hours (a) By how much is the manufacturing overhead underapplied or overapplied? manutachting ovethead A (b) Why is the amount of underapplied (overapplied) manufacturing overhead different from Requirement 2 above? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answers and double click the box with the question mark to empty the box for a wrong answers. Any boxes left with e question mark will be automatically graded as incorrect.) The predetermined overhead rate changed The change in the actual manufacturing overhead cost directly resulted in a comparable change in the amount of underapplied Coverapplied manufacturing overhead 2 The change in the estimated total amount of the allocation base affected the amount of manufacturing overhead applied 50 B 1 Chapter 3: Applying Excel 2 3 Data 4 Allocation base Machine hours 5 Estimated manufacturing overhead cost $300,000 6 Estimated total amount of the allocation base 75,000 machine hours 7 Actual manufacturing overhead cost $290,000 8 Actual total amount of the allocation base 68,000 machine-hours 9 10 Enter a formula into each of the cells marked with a below 11 12 Computation of the predetermined overhead rate 13 Estimated manufacturing overhead cost $300,000 14 Estimated total amount of the allocation base 75,000 machine-hours 15 Predetermined overhead rate $4.00 per machine hour 16 17 Computation of underapplied or overapplied manufacturing overhead 18 Actual manufacturing overhead cost SI 290.000 19 Manufacturing overhead cost applied to Work in Process during the year 20 Predetermined overhead rate $4.00 per machine hour 21 Actual total amount of the allocation base 68,000 machine-hours 22 Manufacturing overhead applied $ 272 000 23 Underapplied (overapplied) manufacturing overhead $118.000 24 25 26 27 excel sheet attached if needed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started