answer 3 questions plss

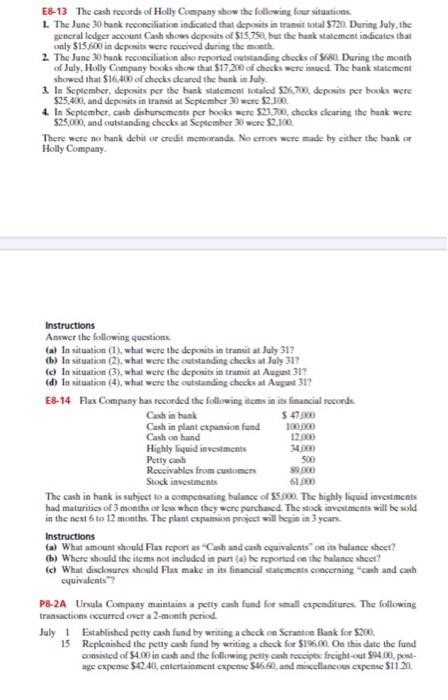

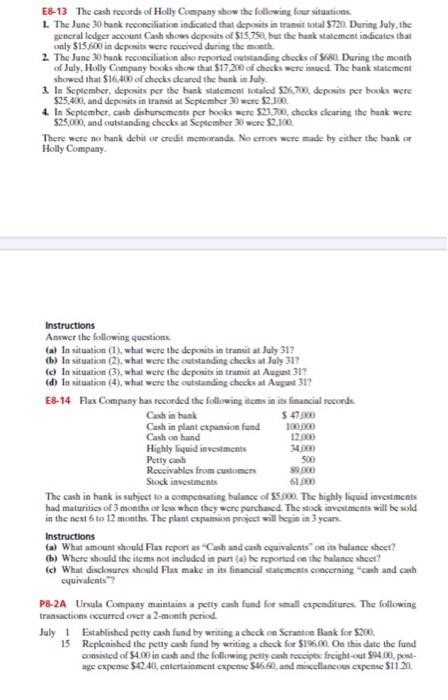

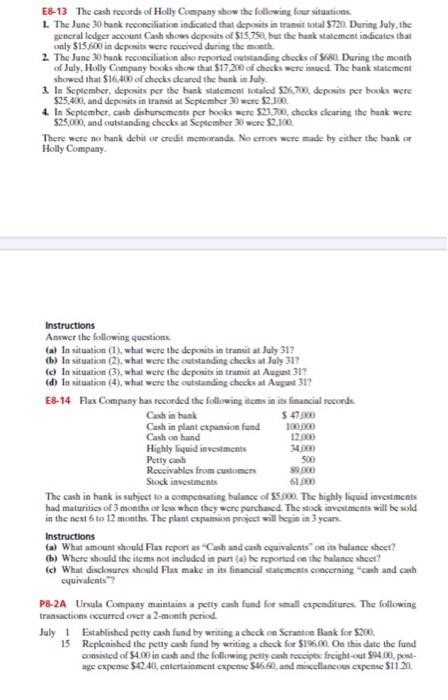

E8-13 The cash roceds of Holly Company show the following four situation 1. The June 30 bank reconciliation indicated that deposits in transit total $720. During July, the general ledger account Cash shows deposits of $15,750, but the hunk statement indicates that 2. The June 30 hunk reconciliation also reported outstanding chocks of $686. During the month of July, Holly Company books show that $17.200 of checks were med. The bank statement showed that $16,400 of checks cleared the bank in July 3. In September, deposits per the bank statement totaled $26,700, deposits per books were $25,400, and deposits in transit September 30 were $2.100 4. In September, cash disbursements per books were $23.700. checks clearing the hunk were 525.000, and outstanding checks at September 30 wrc $2,100. There were no bank debit or credit memoranda. No errons were made by cither the bank or Holly Company . Instructions Answer the following questions (a) In situation (1), what were the deposits in transit at July 31? (b) In situation (2), what were the outstanding checks at Jaly 317 (In situation (3), what were the deposits intrant at August 317 (d) In situation (4), what were the outstanding checks at August 312 E8-14 Flux Company has recorded the following items in its financial records Cash in hank $ 47.000 Cash in plant expansion fund 100.000 Cash on hand 12.000 Highly liquid investments Petty cash 500 Receivables from customers 89.000 Stock investments 61.00 The cash in bank is subject to a compensating balance of 5.000. The highly liquid investments had maturities of 3 months or low when they were purchased. The stock investments will be sold in the next 6 to 12 months. The plant expansion project will begin in 3 ycare Instructions (a) What amount should Flax report as Cash and cash quivalents on its hulunce sheet? (h) Where should the items not included in purt (@be reported on the balance sheet? ( What disclosures should Flux make in its financial statements concerning cash and cash equivalents P8-2A Ursula Company maintains a petty cash fund for small expenditure. The following transactions occurred over a 2-month period July 1 Established petty cash fund by writing a check on Scranton Bank for $200. 15 Replenished the petty cash fund by writing a check for $19.00. On this date the fund consisted of $4.00 in cash and the following petty cash recipe freight-out $94.00, post- uge expense 54241, entertainment expense S., and miscellaneous expense $11.20 E8-13 The cash roceds of Holly Company show the following four situation 1. The June 30 bank reconciliation indicated that deposits in transit total $720. During July, the general ledger account Cash shows deposits of $15,750, but the hunk statement indicates that 2. The June 30 hunk reconciliation also reported outstanding chocks of $686. During the month of July, Holly Company books show that $17.200 of checks were med. The bank statement showed that $16,400 of checks cleared the bank in July 3. In September, deposits per the bank statement totaled $26,700, deposits per books were $25,400, and deposits in transit September 30 were $2.100 4. In September, cash disbursements per books were $23.700. checks clearing the hunk were 525.000, and outstanding checks at September 30 wrc $2,100. There were no bank debit or credit memoranda. No errons were made by cither the bank or Holly Company . Instructions Answer the following questions (a) In situation (1), what were the deposits in transit at July 31? (b) In situation (2), what were the outstanding checks at Jaly 317 (In situation (3), what were the deposits intrant at August 317 (d) In situation (4), what were the outstanding checks at August 312 E8-14 Flux Company has recorded the following items in its financial records Cash in hank $ 47.000 Cash in plant expansion fund 100.000 Cash on hand 12.000 Highly liquid investments Petty cash 500 Receivables from customers 89.000 Stock investments 61.00 The cash in bank is subject to a compensating balance of 5.000. The highly liquid investments had maturities of 3 months or low when they were purchased. The stock investments will be sold in the next 6 to 12 months. The plant expansion project will begin in 3 ycare Instructions (a) What amount should Flax report as Cash and cash quivalents on its hulunce sheet? (h) Where should the items not included in purt (@be reported on the balance sheet? ( What disclosures should Flux make in its financial statements concerning cash and cash equivalents P8-2A Ursula Company maintains a petty cash fund for small expenditure. The following transactions occurred over a 2-month period July 1 Established petty cash fund by writing a check on Scranton Bank for $200. 15 Replenished the petty cash fund by writing a check for $19.00. On this date the fund consisted of $4.00 in cash and the following petty cash recipe freight-out $94.00, post- uge expense 54241, entertainment expense S., and miscellaneous expense $11.20