answer 4.2 and 4.3 on the tables below

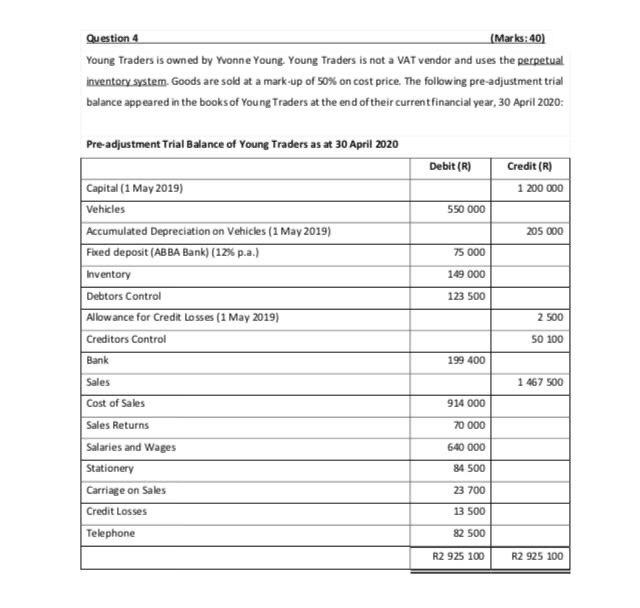

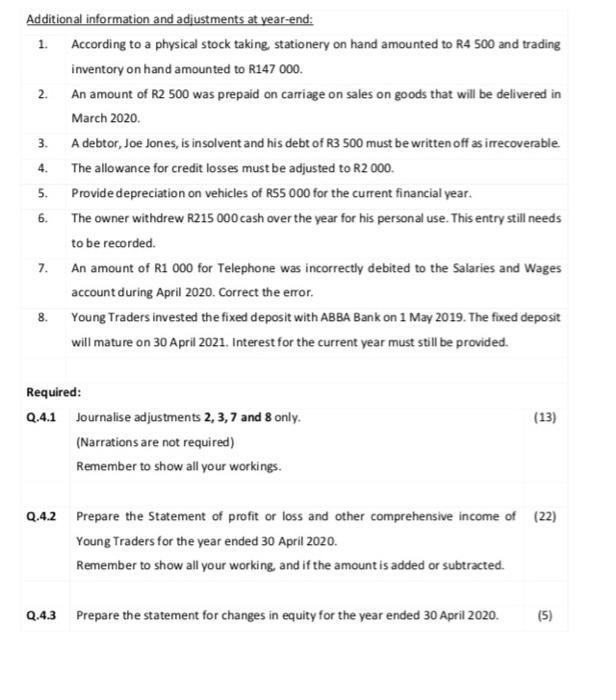

Question 4 (Marks:40) Young Traders is owned by Yvonne Young Young Traders is not a VAT vendor and uses the perpetual inventory system. Goods are sold at a mark-up of 50% on cost price. The following pre-adjustment trial balance appeared in the books of Young Traders at the end of their current financial year, 30 April 2020: Pre-adjustment Trial Balance of Young Traders as at 30 April 2020 Debit (R) Credit (R) 1 200 000 550 000 205 000 75 000 149 000 123 500 2 500 50 100 Capital (1 May 2019) Vehicles Accumulated Depreciation on Vehicles (1 May 2019) Fixed deposit (AB BA Bank) (12% p.a.) Inventory Debtors Control Allowance for Credit losses (1 May 2019) Creditors Control Bank Sales Cost of Sales Sales Returns Salaries and Wages Stationery Carriage on Sales Credit Losses Telephone 199 400 1 467 500 914 000 70 000 640 000 84 500 23 700 13 500 82 500 R2 925 100 R2 925 100 2. 4. Additional information and adjustments at year-end: 1. According to a physical stock taking stationery on hand amounted to R4 500 and trading inventory on hand amounted to R147 000. An amount of R2 500 was prepaid on carriage on sales on goods that will be delivered in March 2020 3. A debtor, Joe Jones, is insolvent and his debt of R3 500 must be written off as irrecoverable The allowance for credit losses must be adjusted to R2 000. Provide depreciation on vehicles of R55 000 for the current financial year. 6. The owner withdrew R215 000 cash over the year for his personal use. This entry still needs to be recorded. 7. An amount of R1 000 for Telephone was incorrectly debited to the Salaries and Wages account during April 2020. Correct the error. Young Traders invested the fixed deposit with ABBA Bank on 1 May 2019. The fixed deposit will mature on 30 April 2021. Interest for the current year must still be provided 5. 8 (13) Required: Q.4.1 Journalise adjustments 2, 3, 7 and 8 only. (Narrations are not required) Remember to show all your workings. Q.4.2 Prepare the Statement of profit or loss and other comprehensive income of (22) Young Traders for the year ended 30 April 2020. Remember to show all your working, and if the amount is added or subtracted. Q.4.3 Prepare the statement for changes in equity for the year ended 30 April 2020. (5) Q42 (22) Young Traders Statement of Profit or loss and other Comprehensive Income for the year ended 30 April 2020 R R (5) 2.4.3 Young Traders Statement of changes in equity for the year ended 30 April 2020 R