Answer a, b and e.

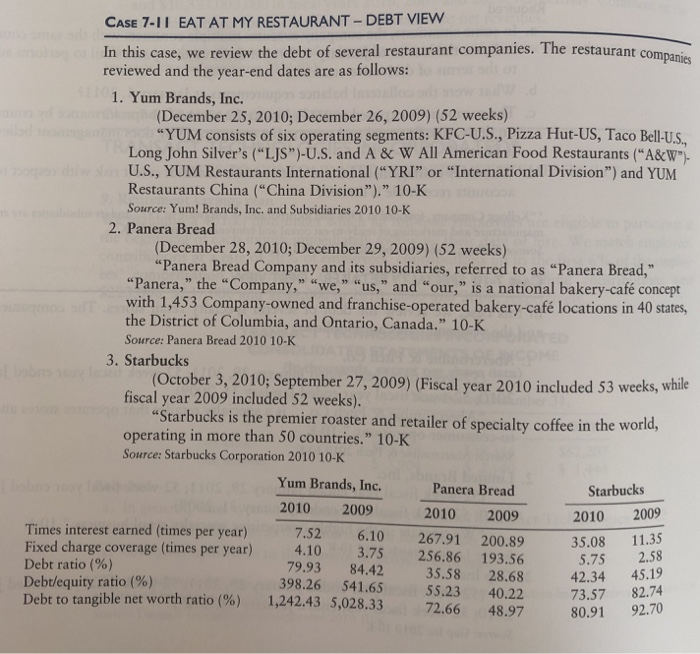

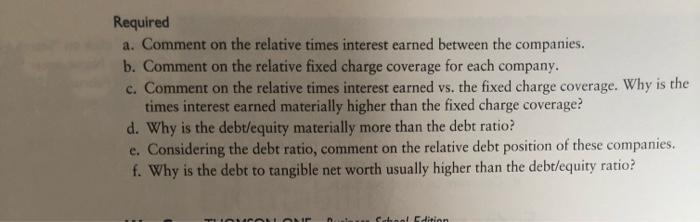

Review Case 7-11 "Eat at my Restaurant - Debt View" on pp. 320- 321 from Ch. 7 of Financial Reporting & Analysis. Answer the following Required problems. When commenting on each ratio, provide evidence to support your rationale. Include an illustration, figure, or table. Look at the Figure Example document for how these illustrations may appear. b e CASE 7-11 EAT AT MY RESTAURANT - DEBT VIEW In this case, we review the debt of several restaurant companies. The restaurant companies reviewed and the year-end dates are as follows: 1. Yum Brands, Inc. (December 25, 2010; December 26, 2009) (52 weeks) "YUM consists of six operating segments: KFC-U.S., Pizza Hut-US, Taco Bell-U.S., Long John Silver's (LJS")-U.S. and A & W All American Food Restaurants (A&W")- U.S., YUM Restaurants International ("YRI" or "International Division") and YUM Restaurants China ("China Division")." 10-K Source: Yum! Brands, Inc. and Subsidiaries 2010 10-K 2. Panera Bread (December 28, 2010; December 29, 2009) (52 weeks) "Panera Bread Company and its subsidiaries, referred to as "Panera Bread," "Panera," the "Company," "we," "us," and "our," is a national bakery-caf concept with 1,453 Company-owned and franchise-operated bakery-caf locations in 40 states, the District of Columbia, and Ontario, Canada." 10-K Source: Panera Bread 2010 10-K 3. Starbucks (October 3, 2010; September 27, 2009) (Fiscal year 2010 included 53 weeks, while fiscal year 2009 included 52 weeks). "Starbucks is the premier roaster and retailer of specialty coffee in the world, operating in more than 50 countries." 10-K Source: Starbucks Corporation 2010 10-K Yum Brands, Inc. Panera Bread Starbucks 2010 2009 2010 2009 2010 Times interest earned (times per year) 7.52 267.91 200.89 35.08 Fixed charge coverage (times per year) 4.10 256.86 193.56 5.75 Debt ratio (%) 79.93 84.42 35.58 28.68 42.34 Debt/equity ratio (%) 398.26 541.65 55.23 40.22 73.57 Debt to tangible net worth ratio (%) 1,242.43 5,028.33 72.66 48.97 80.91 6.10 3.75 2009 11.35 2.58 45.19 82.74 92.70 Required a. Comment on the relative times interest earned between the companies. b. Comment on the relative fixed charge coverage for each company. c. Comment on the relative times interest earned vs. the fixed charge coverage. Why is the times interest earned materially higher than the fixed charge coverage? d. Why is the debt/equity materially more than the debt ratio? e. Considering the debt ratio, comment on the relative debt position of these companies. f. Why is the debt to tangible net worth usually higher than the debt/equity ratio? color Geberian