Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer a b c d plss You have been appointed as the Finance Manager of Diamond Sdn Bhd recently. Your immediate task as the Finance

answer a b c d plss

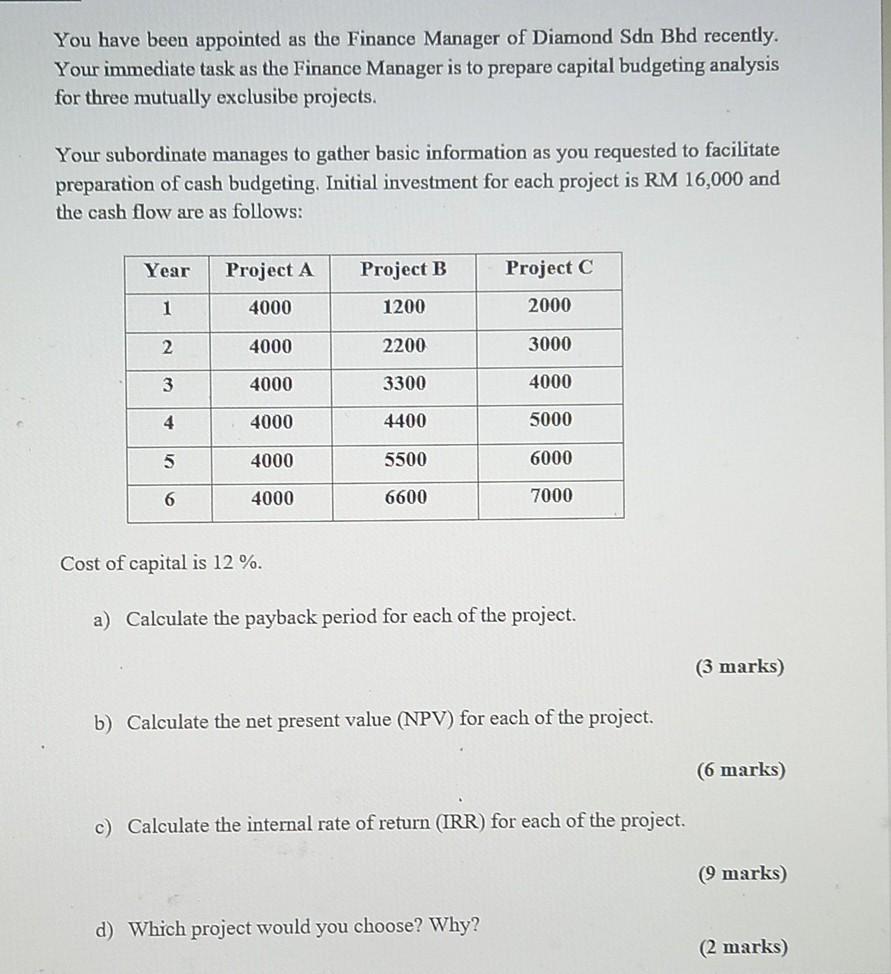

You have been appointed as the Finance Manager of Diamond Sdn Bhd recently. Your immediate task as the Finance Manager is to prepare capital budgeting analysis for three mutually exclusibe projects. Your subordinate manages to gather basic information as you requested to facilitate preparation of cash budgeting. Initial investment for each project is RM 16,000 and the cash flow are as follows: Year Project A Project B Project C 1 4000 1200 2000 2 4000 2200 3000 3 4000 3300 4000 4 4000 4400 5000 5 4000 5500 6000 6 4000 6600 7000 Cost of capital is 12 %. a) Calculate the payback period for each of the project. b) Calculate the net present value (NPV) for each of the project. c) Calculate the internal rate of return (IRR) for each of the project. d) Which project would you choose? Why? (3 marks) (6 marks) (9 marks) (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started