Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information is for ABC Ltd. for the last financial year Current Ratio: 5 Quick Ratio: 1.8 Inventory Turnover: 7 Total Current Assets: $340,000

- The following information is for ABC Ltd. for the last financial year

Current Ratio: 5

Quick Ratio: 1.8

Inventory Turnover: 7

Total Current Assets: $340,000

Cash: $43,000

COGS = 80% of Sales

Required:

- What were the total sales for the year?

- How many day’s sales were outstanding in Accounts Receivable?

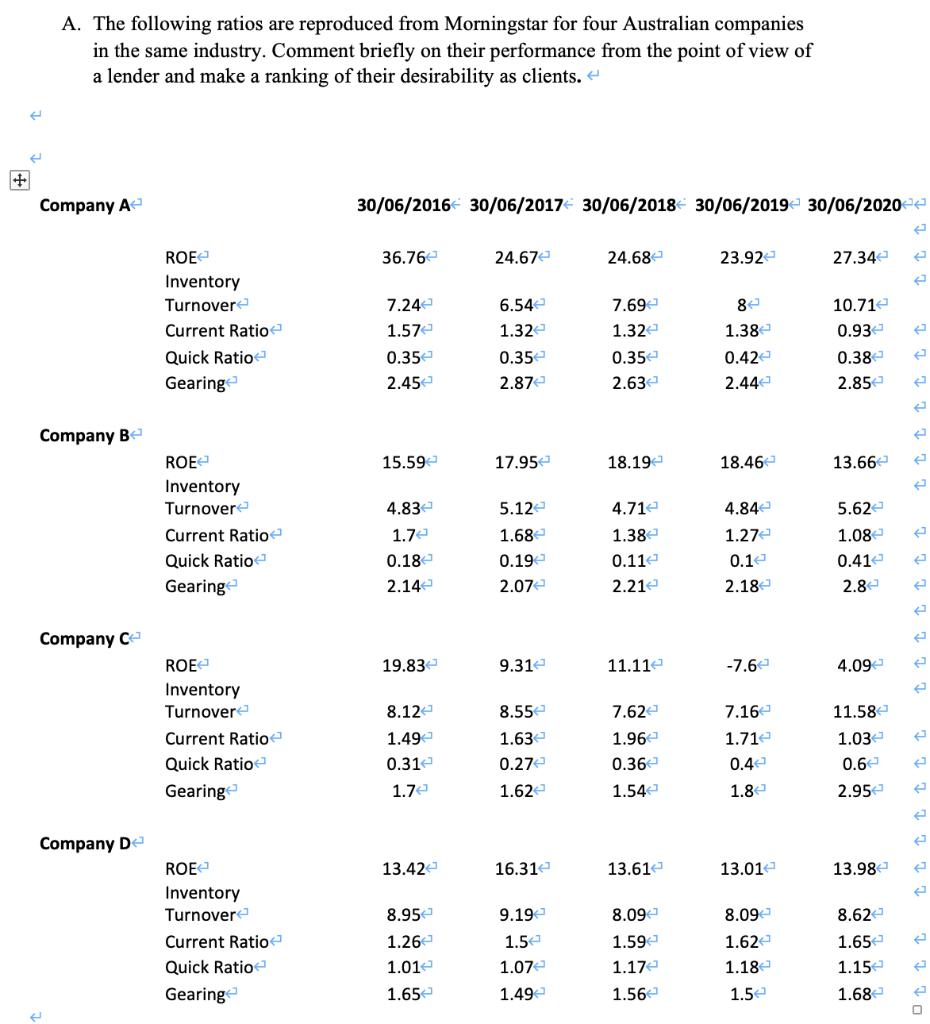

A. The following ratios are reproduced from Morningstar for four Australian companies in the same industry. Comment briefly on their performance from the point of view of a lender and make a ranking of their desirability as clients. Company A 30/06/2016 30/06/2017 30/06/2018 30/06/2019e 30/06/2020a ROE 36.76e 24.67e 24.68 23.92 27.34 Inventory Turnover Current Ratio 7.24 6.54 7.69 8e 10.71e 1.57e 1.32e 1.32e 1.38e 0.93 Quick Ratio 0.35 2.87 0.35e 0.35 2.63 0.42e 0.38 Gearing 2.45 2.44 2.85e Company Be ROE 15.59 17.95 18.19 18.46 13.66 Inventory Turnovere 4.83e 5.12e 4.71e 4.84e 1.27e 5.62e Current Ratio Quick Ratio 1.7e 1.68e 1.38e 1.08 0.18 0.11 2.21 0.19 0.41e 2.8 0.1e Gearing 2.14 2.07e 2.18 Company C ROE 19.83e 9.31e 11.11e -7.6 4.09 Inventory Turnover Current Ratioe Quick Ratio Gearing 8.12e 8.55e 7.62e 7.16 11.58 1.49 1.63e 1.96e 1.71e 1.03 0.31e 0.27e 0.36 0.4 0.6 1.7e 1.62 1.54 1.8 2.95e Company De ROE 13.42 16.31 13.61 13.01 13.98 Inventory Turnovere 8.95 9.19 8.09 8.09 8.62 Current Ratio Quick Ratio 1.5 1.07 1.26e 1.59 1.62 1.65 1.01e 1.17e 1.18e 1.15e Gearinge 1.65e 1.49 1.56e 1.5e 1.68e

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started