answer all

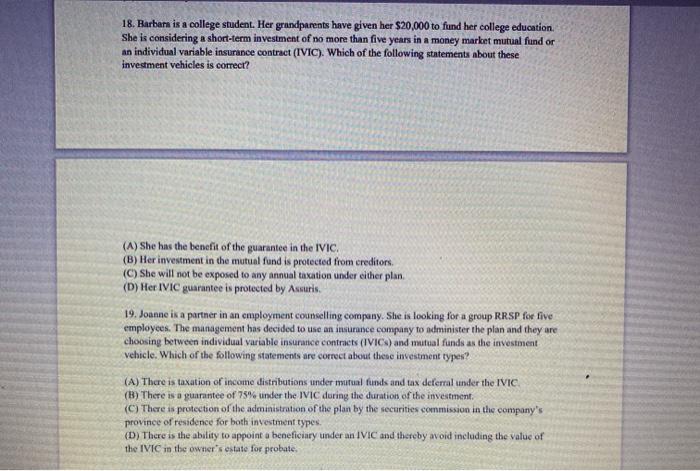

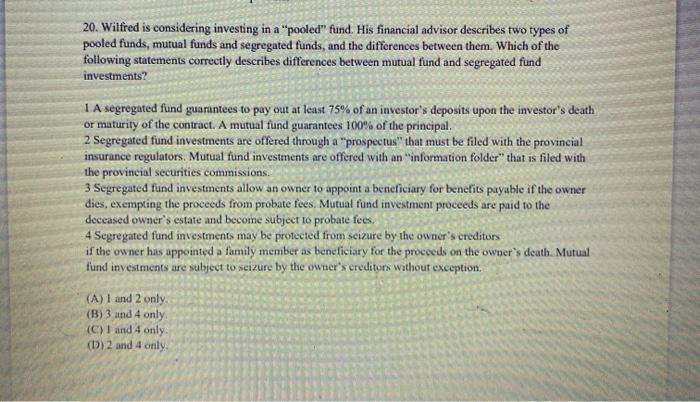

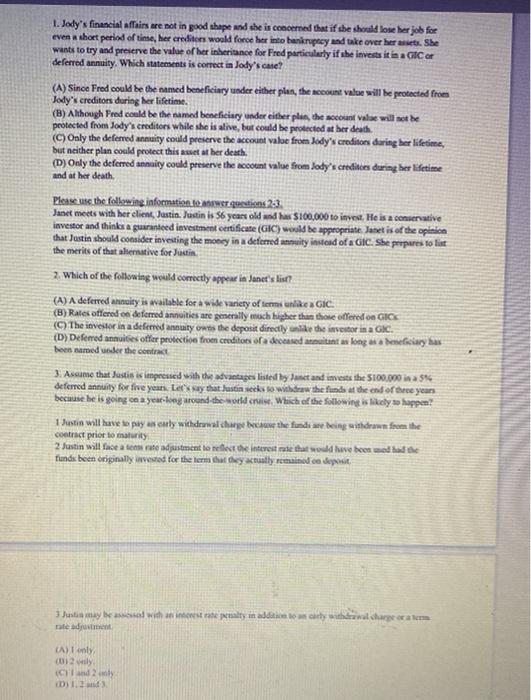

1. Jody's financial affairs are not in good shape and she is concerned that if she should lose her job for even a short period of tine, her creditors would force her into bankruptcy and take over her. She wants to try and preserve the value of her inheritance for Fred particularly if she invests it is a GTC deferred Annuity. Which statements is correct in Jody's cate? (A) Since Fred could be the named beneficiary under either plan, the count value will be protected from Jody's creditors during her lifetime. (B) Although Fred could be the named beneficiary under either plan, the account Valae will not be protected from Jody's creditors while she is alive, but could be protected at her death (C) Only the defened annuity could preserve the account value from Jody's creditors daring her lifetime, but neither plan could protect this asset at her death (D) Only the deferred annuity could preserve the account value from Jody's creditors during her lifetime and at her death Please use the following information tower gestions 2-3 Janet meets with her client, Justin. Justin is 56 years old and has $100,000 to invest. He is a conservative investor and thinks a guaranteed investment certificate (GIC) would be appropriate Janet is of the opinion that Justin should consider investing the money in a deferred annuity instead of a GIC. She prepares to list the merits of that alternative for Justin 2. Which of the following would comectly appear in Juner's list? (A) A deferred annuity is wailable for a wide variety of terminie GIC. (B) Rates offered on deferred annuities are generally much higher than those offered on GIC (C) The investor in a deferred any wts the deposit directly on the investor in a GK. (D) Deferred annuities offer protection froen creditor of a deceased autant as long ara descary has been namedder the contact 3. Assume that Justin is impressed with the advantages listed by Janet and invests the $100,000 in a 5% deferred Annuity for five years. Let's say that Justin seeks to withdraw the funds at the end of three years because he is going on a year-long around the wotdenuise. Which of the following is likely happen? 1 Dustin will have to pay an early withdrawal charge because the funds are being withdrawn from the contract prior to maturity 2 Justin will feature asistent to the interest rate that would have been made Tunds been originally invested for the terms that they actually remained ca deposit 3 Justin ay with an interest rate penalty in addition to carry withdrawal dargele ready (A) I only 012 Cindy D. 4. Robin is reviewing the information folder that his agent just handed to him, for his review before completing an application for an individual variable insurance contract (IVIC). What kind of information can Robin expect to receive through the Summary Information Folder that will provide him with pertinent details about the product he is about to purchase! 1 The benefits under the contract that are guaranteed and the benefits under the contract that are not guaranteed but fluiste with the market value of the assets of the segregated fund supporting them. 2 Charges on withdrewal, for full or partial surrender, and retention charges in dollars and units or as a percentage of premiums, as of the first, third and fifth year that the contract is in effect. 3 The tax status of the segregated fund and tax status of the contractholders, 4 A listing of all of the investments held by the segregated funds and their current fair market value (A) 1 and 2 only. (B) 1, 2 and 3 only (C) 2 and 3 only (D) 2 and 4 only 5. Andrew has just been hired as an actuary with XYZ insurance company at $90,000 per year. He has worked in the insurance industry for five years in product development and agency sales support. He has eamed his actuarial degree while continuing to work full time. His company is providing him with an employer paid defined benefit pension plan, so he does not have to worry about large RRSP contributions. At the same time he will have about $10,000 to invest each year and he is looking to earn the best retum that he can. He considers himself a knowledgeable investor with a high risk tolerance level. Which of the following investments might be find attractive? 1 Investments in options and futures index funds. 2 Direct Investments in oil and gas shares of Canadian Companies 3 Strip bondi 4 A balanced mutual fund (A) 1 and 2 only (8) 3 and 4 only (C)2 and only (D) and only Wanited wants toimest 10,000 of her onepestored saving in a product that will pay betaal strant of income with a relatively low end of whichowolowing pos of men will mily Wiatrod mentore! Clock 2 Preferred stock Try + C Savonds 3 Godfonds A. unty and only 7. Nancy is considering investing in an individual variable insurance contract (IVIC) and she is researching the product features of various companies. In particular, she is interested in the kinds of fees and charges that a plan might levy on the funds in which she intends to invest. She has heard about front- end load funds, back-end load funds and no-load funds. She intends to invest $25,000 as a single sum in a non-registered IVIC and keep the investment in the plan for at least 10 years. Based on her intentions, what type of fees and charges should she consider? (A) The front-end load will charge her an annual fee on her deposit of 1% to 2% (B) The back-end load will levy a charge on any withdrawals of 5% at any time she makes her withdrawal. (C) A no-load fund will allow her investment to grow without any charges levied against it (D) Fees or charges of some kind will diminish the investment returns on any of these plan types. 8. Max and his financial advisor, John, are discussing Management Expense Ratios (MERS). Max, being a businessman, is very aware of keeping costs down. He wants to know all about the MERs of the various types of segregated fund investments offered by John's financial services company. Which of the following correctly states the reality regarding MERS? (A) Smaller (in asset size) funds generally have lower MERs than larger funds. (B) Equity funds generally have lower MERs than bond funds. (C) Large-cap equity funds generally have higher MERs than small-cap equity funds. (D) Global funds generally have higher MERs than Canadian domestic funds. 9. Types of loads become a topic of discussion between Max and John. The funds available through John's financial services company are offered under a DSC arrangement. Max seeks an understanding of DSCs from John. Which of the following statements about DSCs is correct? (A) DSC refers to deferred sales charge, a charge paid when the fund is redeemed. (B) With funds sold through DSC, a charge is paid at the time the fund is bought. (C) DSCs would have an impact on the day-to-day performance of Max's investment. (D) DSCs are ideal for investors with a short-time horizon for their investments 10. Agent Allana has a number of clients to whom she is introducing individual variable insurance contracts (IVICs). She is particularly pleased with the recent performance of the equity fund in which the segregated fund is investing as one of the investment options. She is finding a lack of interest in her approach and she is wondering why more of her clients are not taking advantage of this opportunity. Which of the following considerations may be contributing to this failure? 1 Her clients may not be prepared to accept the risk of lost they might experience with this kind of fun. 2 Her clients may be looking for investments that offer a better guarantee, particularly if they are older and planning to use the IVIC as a retirement plan. 3 Her clients may be looking for an investment giving them the choice of where to place their money 4 Her clients may feel that they can acquire the same kind of investments directly without paying the sales and administration charges usually associated with an IVIC (A) I only (B) 1 and 2 only (C) 1.2 and 3 only (D) 1.2, 3 and 4 11. Miranda is concerned about the safety of her insurance and investment holdings in the event that one of the companies that she deals with becomes insolvent. She holds a 100.000 life insurance policy with a cash value of $10,000 with XYZ life. She holds a 10-year term deposit with ABC Bank and she has an investment with MNO securities dealer for $200,000. XYZ is a member of Assuris, ABC Bank is a member of CDIC and MNO Securities is a member of CIPF. Which of the following statements concerning the insolvency protection her holdings enjoy is correct? (A) $200,000 of her securities holdings is protected under CIPF. (B) Her 10-year term deposit is protected under CDIC. (C) Her $100.000 sum insured under her life insurance policy is peotected under Assuris but her cash value is not (D) Her cash value of $10.000) is protected under Assuris, but her sum insured of $100.000 is not 12. Tad owns a deferred annuity with a life insurance company that is invested in units of u segregated fund. Tad financed the annuity with a single deposit of $12.000 and invested the funds in a newly issued segregated fund with a sint value of 510. The ty that Tad owns offers a 75% guarantee on segregated fund deposits death of the tanto maturity of the plan. Tad has experienced a personal financial crisis and needs to withdraw 53.000 from his deferred annuity. What will the death benefit guarantee of the annuity become if Tad withdraws the $3,000 when the fundit locis 512. if annuitysses the proportional withdrawal method to adjust the wate? CA56.250 (B) 57.125 (C) 59.000 (DJ 59.500 10. Agent Allana has a number of clients to whom she is introducing individual variable insurance contracts (IVICs). She is particularly pleased with the recent performance of the equity fund in which the segregated fund is investing as one of the investment options. She is finding a lack of interest in her approach and she is wondering why more of her clients are not taking advantage of this opportunity. Which of the following considerations may be contributing to this failure? 1 Her clients may not be prepared to accept the risk of lost they might experience with this kind of fun. 2 Her clients may be looking for investments that offer a better guarantee, particularly if they are older and planning to use the IVIC as a retirement plan. 3 Her clients may be looking for an investment giving them the choice of where to place their money 4 Her clients may feel that they can acquire the same kind of investments directly without paying the sales and administration charges usually associated with an IVIC (A) I only (B) 1 and 2 only (C) 1.2 and 3 only (D) 1.2, 3 and 4 11. Miranda is concerned about the safety of her insurance and investment holdings in the event that one of the companies that she deals with becomes insolvent. She holds a 100.000 life insurance policy with a cash value of $10,000 with XYZ life. She holds a 10-year term deposit with ABC Bank and she has an investment with MNO securities dealer for $200,000. XYZ is a member of Assuris, ABC Bank is a member of CDIC and MNO Securities is a member of CIPF. Which of the following statements concerning the insolvency protection her holdings enjoy is correct? (A) $200,000 of her securities holdings is protected under CIPF. (B) Her 10-year term deposit is protected under CDIC. (C) Her $100.000 sum insured under her life insurance policy is peotected under Assuris but her cash value is not (D) Her cash value of $10.000) is protected under Assuris, but her sum insured of $100.000 is not 12. Tad owns a deferred annuity with a life insurance company that is invested in units of u segregated fund. Tad financed the annuity with a single deposit of $12.000 and invested the funds in a newly issued segregated fund with a sint value of 510. The ty that Tad owns offers a 75% guarantee on segregated fund deposits death of the tanto maturity of the plan. Tad has experienced a personal financial crisis and needs to withdraw 53.000 from his deferred annuity. What will the death benefit guarantee of the annuity become if Tad withdraws the $3,000 when the fundit locis 512. if annuitysses the proportional withdrawal method to adjust the wate? CA56.250 (B) 57.125 (C) 59.000 (DJ 59.500 13. Lisa invests $50,000 in a segregated funds contract, which offers a 75% garantee on death or maharity. She purchases 5.000 units at $10 per unit. Three years later, each unit is worth 512 and the value of Lisa's contract is $60,000. She elects to withdraw 89,000 from the contract and most surrender 750 units. What would happen to the policy guarantee if the insurer uses the proportional reaction method of computing adjustments to the guarantee? (A) Since Lisa has withdrawn 18% of her original principal deposit, the guarantee will be reduced by 18% as well, from $37.500 to $30,750. (B) Since Lisa has withdrawn 18% of her original principal deposit, the guarantee will be reduced by 18% as well, from $50,000 to $41,000 (C) Lisa has had to surrender 15% of her 5,000 units in the segregated fund so her guarantee will be reduced by 15% as well, from $37,500 to $31,875. (D) Lisa has had to surrender 15% of her 5,000 units in the segregated fund so her guarantee will be reduced by 15% as well, from $50,000 to $42,500 14. Which of the following statements about the reset guarantee under an individual variable insurance contract is correct? (A) Exercise of the reset option also restarts the maturity period for the whole policy. (B) Exercise of the reset option resets the guarantee from 75% 10 100% (C) Exercise of the reset option establishes a new base for the death benefit guarantee but not the maturity benefit guarantee (D) Exercise of the reset option establishes the minimum guarantee to the amount of the original deposit if the fund Value has fallen below 75% of the onginal deposit 15. George wishes to invest $100,000 of non-registered funds in a fixed income security, from which be plans to draw an income eventually. He is considering a guaranteed investment certificate (GKC) His life insurance agent suggests that he consider investing in a deferred annuity as an alternative. Which of the following statements best describes a difference between a GIC and a deferred annuity that George may wish to consider when making his choice? . (A) The value of his deferred annuity will be backed by Assuris in the event of the financial institution's bankruptcy while he will have no similar guarantee if he purchases a GIC. (B) The value of his deferred annuity is protected from his creditors during his lifetime and after his death if the proceeds are paid to a named beneficiary, while the value of his GIC will be subject to seizure by his creditors at any time while he is alive and after his death (C) The death benefit value of his deferred musty is never subject to probate fees while the value of a GIC will always be included in the value of the estate for the purpose of calculating probate fees (D) George can weldraw the value orhidered any prior to the end of the deposit term without penalty, while he would be charged a market value justosent for an curly withdrawal from GIC 16. Which of the following factors apply in determining a market value adjustment when withdrawals are made from a deferred Annuity? 1 A surrender charge against the amount withdrawn based on a table of interest rates that decreases by the duration that the policy is in force. 2 An adjustment to the credited interest rate to reflect the applicable rate for the term that the deposit actually remained in effect. 3 An adjustment to the credited interest rate to reflect changes in interest rates between the date of deposit and the date of early withdrawal. 4 An adjustment to the credited interest rate on any funds remaining in the policy after the withdrawal. (A) 1 and 4 only (B) 3 and 4 only (C) 2 and 3 only (D) 2, 3, and 4 only 17. Ralph is age 55. He is a senior manager at an auto parts supplier. He cams S120,000 a year in salary and he is a member of a defined benefit pension plan under which he contributes 5% of his salary. The benefit is 2% of salary multiplied by Ralph's number of years of service. Ralph places $10,000 a year in a non-registered investment. He intends to use these funds to supplement his retirement income, Ralph wants the remainder to go to his adult son, Ed, directly if he dies before Ed. He is choosing between an individual variable insurance contract (IVIC) and a mutual fund investment as the best way of completing his plans. Which of the following statements is correct? 1 A mutual fund plan will allow him to appoint Ed as a successor owner. 2 If he appoints a named beneficiary under the IVIC, proceeds will be paid to the beneficiary outside the provisions of the will 3 Either plan requires a deemed disposition at his death with the taxable capital gain being reportable in his final return even if there is a named beneficiary. 4 As a life insurance policy, any proceeds of the IVIC are not subject to tax on death, while the mutual fund is deemed disposed of at its fair market value at death (A) I only (B) 1 and 2 only (C) 2 and 4 only (D) 2 and 3 only 18. Barbarn is a college student. Her grandparents have given her $20,000 to fund her college education. She is considering a short-term investment of no more than five years in a money market mutual fund or an individual variable insurance contract (IVIC). Which of the following statements about these investment vehicles is correct? (A) She has the benefit of the guarantee in the IVIC (B) Her investment in the mutual fund is protected from creditors (C) She will not be exposed to any annual taxation under either plan (D) Her IVIC guarantee is protected by Assuris. 19. Joanne is a partner in an employment counselling company. She is looking for a group RRSP for five employees. The management has decided to use an insurance company to administer the plan and they are choosing between individual variable insurance contracts (IVIC) and mutual funds as the investment vehicle. Which of the following statements are correct about these investment types? (A) There is taxation of income distributions under mutual funds and tax deferral under the IVIC (B) There is a guarantee of 75% under the IVIC during the duration of the investment. (C) There is protection of the administration of the plan by the securities commission in the company's province of residence for both investment types. (D) There is the ability to appoint a beneficiary under an IVIC and thereby avoid including the value of the IVIC in the owner's estate for probate. 20. Wilfred is considering investing in a "pooled" fund. His financial advisor describes two types of pooled funds, mutual funds and segregated funds, and the differences between them. Which of the following statements correctly describes differences between mutual fund and segregated fund investments? 1 A segregated fund guarantees to pay out at least 75% of an investor's deposits upon the investor's death or maturity of the contract. A mutual fund guarantees 100% of the principal, 2 Segregated fund investments are offered through a "prospectus" that must be filed with the provincial insurance regulators, Mutual fund investments are offered with an information folder" that is filed with the provincial securities commissions. 3 Segregated fund investments allow an owner to appoint a beneficiary for benefits payable if the owner dies, exempting the proceeds from probate fees. Mutual fund investment proceeds are paid to the deceased owner's estate and become subject to probate fees. 4 Segregated fund investments may be protected from seizure by the owner's creditors if the owner has appointed a family member as beneficiary for the proceeds on the owner's death. Mutual fund investments are subject to seizure by the owner's creditors without exception. (A) 1 and 2 only (B) 3 and 4 only (C) and 4 only (D) 2 and 4 only 1. Jody's financial affairs are not in good shape and she is concerned that if she should lose her job for even a short period of tine, her creditors would force her into bankruptcy and take over her. She wants to try and preserve the value of her inheritance for Fred particularly if she invests it is a GTC deferred Annuity. Which statements is correct in Jody's cate? (A) Since Fred could be the named beneficiary under either plan, the count value will be protected from Jody's creditors during her lifetime. (B) Although Fred could be the named beneficiary under either plan, the account Valae will not be protected from Jody's creditors while she is alive, but could be protected at her death (C) Only the defened annuity could preserve the account value from Jody's creditors daring her lifetime, but neither plan could protect this asset at her death (D) Only the deferred annuity could preserve the account value from Jody's creditors during her lifetime and at her death Please use the following information tower gestions 2-3 Janet meets with her client, Justin. Justin is 56 years old and has $100,000 to invest. He is a conservative investor and thinks a guaranteed investment certificate (GIC) would be appropriate Janet is of the opinion that Justin should consider investing the money in a deferred annuity instead of a GIC. She prepares to list the merits of that alternative for Justin 2. Which of the following would comectly appear in Juner's list? (A) A deferred annuity is wailable for a wide variety of terminie GIC. (B) Rates offered on deferred annuities are generally much higher than those offered on GIC (C) The investor in a deferred any wts the deposit directly on the investor in a GK. (D) Deferred annuities offer protection froen creditor of a deceased autant as long ara descary has been namedder the contact 3. Assume that Justin is impressed with the advantages listed by Janet and invests the $100,000 in a 5% deferred Annuity for five years. Let's say that Justin seeks to withdraw the funds at the end of three years because he is going on a year-long around the wotdenuise. Which of the following is likely happen? 1 Dustin will have to pay an early withdrawal charge because the funds are being withdrawn from the contract prior to maturity 2 Justin will feature asistent to the interest rate that would have been made Tunds been originally invested for the terms that they actually remained ca deposit 3 Justin ay with an interest rate penalty in addition to carry withdrawal dargele ready (A) I only 012 Cindy D. 4. Robin is reviewing the information folder that his agent just handed to him, for his review before completing an application for an individual variable insurance contract (IVIC). What kind of information can Robin expect to receive through the Summary Information Folder that will provide him with pertinent details about the product he is about to purchase! 1 The benefits under the contract that are guaranteed and the benefits under the contract that are not guaranteed but fluiste with the market value of the assets of the segregated fund supporting them. 2 Charges on withdrewal, for full or partial surrender, and retention charges in dollars and units or as a percentage of premiums, as of the first, third and fifth year that the contract is in effect. 3 The tax status of the segregated fund and tax status of the contractholders, 4 A listing of all of the investments held by the segregated funds and their current fair market value (A) 1 and 2 only. (B) 1, 2 and 3 only (C) 2 and 3 only (D) 2 and 4 only 5. Andrew has just been hired as an actuary with XYZ insurance company at $90,000 per year. He has worked in the insurance industry for five years in product development and agency sales support. He has eamed his actuarial degree while continuing to work full time. His company is providing him with an employer paid defined benefit pension plan, so he does not have to worry about large RRSP contributions. At the same time he will have about $10,000 to invest each year and he is looking to earn the best retum that he can. He considers himself a knowledgeable investor with a high risk tolerance level. Which of the following investments might be find attractive? 1 Investments in options and futures index funds. 2 Direct Investments in oil and gas shares of Canadian Companies 3 Strip bondi 4 A balanced mutual fund (A) 1 and 2 only (8) 3 and 4 only (C)2 and only (D) and only Wanited wants toimest 10,000 of her onepestored saving in a product that will pay betaal strant of income with a relatively low end of whichowolowing pos of men will mily Wiatrod mentore! Clock 2 Preferred stock Try + C Savonds 3 Godfonds A. unty and only 7. Nancy is considering investing in an individual variable insurance contract (IVIC) and she is researching the product features of various companies. In particular, she is interested in the kinds of fees and charges that a plan might levy on the funds in which she intends to invest. She has heard about front- end load funds, back-end load funds and no-load funds. She intends to invest $25,000 as a single sum in a non-registered IVIC and keep the investment in the plan for at least 10 years. Based on her intentions, what type of fees and charges should she consider? (A) The front-end load will charge her an annual fee on her deposit of 1% to 2% (B) The back-end load will levy a charge on any withdrawals of 5% at any time she makes her withdrawal. (C) A no-load fund will allow her investment to grow without any charges levied against it (D) Fees or charges of some kind will diminish the investment returns on any of these plan types. 8. Max and his financial advisor, John, are discussing Management Expense Ratios (MERS). Max, being a businessman, is very aware of keeping costs down. He wants to know all about the MERs of the various types of segregated fund investments offered by John's financial services company. Which of the following correctly states the reality regarding MERS? (A) Smaller (in asset size) funds generally have lower MERs than larger funds. (B) Equity funds generally have lower MERs than bond funds. (C) Large-cap equity funds generally have higher MERs than small-cap equity funds. (D) Global funds generally have higher MERs than Canadian domestic funds. 9. Types of loads become a topic of discussion between Max and John. The funds available through John's financial services company are offered under a DSC arrangement. Max seeks an understanding of DSCs from John. Which of the following statements about DSCs is correct? (A) DSC refers to deferred sales charge, a charge paid when the fund is redeemed. (B) With funds sold through DSC, a charge is paid at the time the fund is bought. (C) DSCs would have an impact on the day-to-day performance of Max's investment. (D) DSCs are ideal for investors with a short-time horizon for their investments 10. Agent Allana has a number of clients to whom she is introducing individual variable insurance contracts (IVICs). She is particularly pleased with the recent performance of the equity fund in which the segregated fund is investing as one of the investment options. She is finding a lack of interest in her approach and she is wondering why more of her clients are not taking advantage of this opportunity. Which of the following considerations may be contributing to this failure? 1 Her clients may not be prepared to accept the risk of lost they might experience with this kind of fun. 2 Her clients may be looking for investments that offer a better guarantee, particularly if they are older and planning to use the IVIC as a retirement plan. 3 Her clients may be looking for an investment giving them the choice of where to place their money 4 Her clients may feel that they can acquire the same kind of investments directly without paying the sales and administration charges usually associated with an IVIC (A) I only (B) 1 and 2 only (C) 1.2 and 3 only (D) 1.2, 3 and 4 11. Miranda is concerned about the safety of her insurance and investment holdings in the event that one of the companies that she deals with becomes insolvent. She holds a 100.000 life insurance policy with a cash value of $10,000 with XYZ life. She holds a 10-year term deposit with ABC Bank and she has an investment with MNO securities dealer for $200,000. XYZ is a member of Assuris, ABC Bank is a member of CDIC and MNO Securities is a member of CIPF. Which of the following statements concerning the insolvency protection her holdings enjoy is correct? (A) $200,000 of her securities holdings is protected under CIPF. (B) Her 10-year term deposit is protected under CDIC. (C) Her $100.000 sum insured under her life insurance policy is peotected under Assuris but her cash value is not (D) Her cash value of $10.000) is protected under Assuris, but her sum insured of $100.000 is not 12. Tad owns a deferred annuity with a life insurance company that is invested in units of u segregated fund. Tad financed the annuity with a single deposit of $12.000 and invested the funds in a newly issued segregated fund with a sint value of 510. The ty that Tad owns offers a 75% guarantee on segregated fund deposits death of the tanto maturity of the plan. Tad has experienced a personal financial crisis and needs to withdraw 53.000 from his deferred annuity. What will the death benefit guarantee of the annuity become if Tad withdraws the $3,000 when the fundit locis 512. if annuitysses the proportional withdrawal method to adjust the wate? CA56.250 (B) 57.125 (C) 59.000 (DJ 59.500 10. Agent Allana has a number of clients to whom she is introducing individual variable insurance contracts (IVICs). She is particularly pleased with the recent performance of the equity fund in which the segregated fund is investing as one of the investment options. She is finding a lack of interest in her approach and she is wondering why more of her clients are not taking advantage of this opportunity. Which of the following considerations may be contributing to this failure? 1 Her clients may not be prepared to accept the risk of lost they might experience with this kind of fun. 2 Her clients may be looking for investments that offer a better guarantee, particularly if they are older and planning to use the IVIC as a retirement plan. 3 Her clients may be looking for an investment giving them the choice of where to place their money 4 Her clients may feel that they can acquire the same kind of investments directly without paying the sales and administration charges usually associated with an IVIC (A) I only (B) 1 and 2 only (C) 1.2 and 3 only (D) 1.2, 3 and 4 11. Miranda is concerned about the safety of her insurance and investment holdings in the event that one of the companies that she deals with becomes insolvent. She holds a 100.000 life insurance policy with a cash value of $10,000 with XYZ life. She holds a 10-year term deposit with ABC Bank and she has an investment with MNO securities dealer for $200,000. XYZ is a member of Assuris, ABC Bank is a member of CDIC and MNO Securities is a member of CIPF. Which of the following statements concerning the insolvency protection her holdings enjoy is correct? (A) $200,000 of her securities holdings is protected under CIPF. (B) Her 10-year term deposit is protected under CDIC. (C) Her $100.000 sum insured under her life insurance policy is peotected under Assuris but her cash value is not (D) Her cash value of $10.000) is protected under Assuris, but her sum insured of $100.000 is not 12. Tad owns a deferred annuity with a life insurance company that is invested in units of u segregated fund. Tad financed the annuity with a single deposit of $12.000 and invested the funds in a newly issued segregated fund with a sint value of 510. The ty that Tad owns offers a 75% guarantee on segregated fund deposits death of the tanto maturity of the plan. Tad has experienced a personal financial crisis and needs to withdraw 53.000 from his deferred annuity. What will the death benefit guarantee of the annuity become if Tad withdraws the $3,000 when the fundit locis 512. if annuitysses the proportional withdrawal method to adjust the wate? CA56.250 (B) 57.125 (C) 59.000 (DJ 59.500 13. Lisa invests $50,000 in a segregated funds contract, which offers a 75% garantee on death or maharity. She purchases 5.000 units at $10 per unit. Three years later, each unit is worth 512 and the value of Lisa's contract is $60,000. She elects to withdraw 89,000 from the contract and most surrender 750 units. What would happen to the policy guarantee if the insurer uses the proportional reaction method of computing adjustments to the guarantee? (A) Since Lisa has withdrawn 18% of her original principal deposit, the guarantee will be reduced by 18% as well, from $37.500 to $30,750. (B) Since Lisa has withdrawn 18% of her original principal deposit, the guarantee will be reduced by 18% as well, from $50,000 to $41,000 (C) Lisa has had to surrender 15% of her 5,000 units in the segregated fund so her guarantee will be reduced by 15% as well, from $37,500 to $31,875. (D) Lisa has had to surrender 15% of her 5,000 units in the segregated fund so her guarantee will be reduced by 15% as well, from $50,000 to $42,500 14. Which of the following statements about the reset guarantee under an individual variable insurance contract is correct? (A) Exercise of the reset option also restarts the maturity period for the whole policy. (B) Exercise of the reset option resets the guarantee from 75% 10 100% (C) Exercise of the reset option establishes a new base for the death benefit guarantee but not the maturity benefit guarantee (D) Exercise of the reset option establishes the minimum guarantee to the amount of the original deposit if the fund Value has fallen below 75% of the onginal deposit 15. George wishes to invest $100,000 of non-registered funds in a fixed income security, from which be plans to draw an income eventually. He is considering a guaranteed investment certificate (GKC) His life insurance agent suggests that he consider investing in a deferred annuity as an alternative. Which of the following statements best describes a difference between a GIC and a deferred annuity that George may wish to consider when making his choice? . (A) The value of his deferred annuity will be backed by Assuris in the event of the financial institution's bankruptcy while he will have no similar guarantee if he purchases a GIC. (B) The value of his deferred annuity is protected from his creditors during his lifetime and after his death if the proceeds are paid to a named beneficiary, while the value of his GIC will be subject to seizure by his creditors at any time while he is alive and after his death (C) The death benefit value of his deferred musty is never subject to probate fees while the value of a GIC will always be included in the value of the estate for the purpose of calculating probate fees (D) George can weldraw the value orhidered any prior to the end of the deposit term without penalty, while he would be charged a market value justosent for an curly withdrawal from GIC 16. Which of the following factors apply in determining a market value adjustment when withdrawals are made from a deferred Annuity? 1 A surrender charge against the amount withdrawn based on a table of interest rates that decreases by the duration that the policy is in force. 2 An adjustment to the credited interest rate to reflect the applicable rate for the term that the deposit actually remained in effect. 3 An adjustment to the credited interest rate to reflect changes in interest rates between the date of deposit and the date of early withdrawal. 4 An adjustment to the credited interest rate on any funds remaining in the policy after the withdrawal. (A) 1 and 4 only (B) 3 and 4 only (C) 2 and 3 only (D) 2, 3, and 4 only 17. Ralph is age 55. He is a senior manager at an auto parts supplier. He cams S120,000 a year in salary and he is a member of a defined benefit pension plan under which he contributes 5% of his salary. The benefit is 2% of salary multiplied by Ralph's number of years of service. Ralph places $10,000 a year in a non-registered investment. He intends to use these funds to supplement his retirement income, Ralph wants the remainder to go to his adult son, Ed, directly if he dies before Ed. He is choosing between an individual variable insurance contract (IVIC) and a mutual fund investment as the best way of completing his plans. Which of the following statements is correct? 1 A mutual fund plan will allow him to appoint Ed as a successor owner. 2 If he appoints a named beneficiary under the IVIC, proceeds will be paid to the beneficiary outside the provisions of the will 3 Either plan requires a deemed disposition at his death with the taxable capital gain being reportable in his final return even if there is a named beneficiary. 4 As a life insurance policy, any proceeds of the IVIC are not subject to tax on death, while the mutual fund is deemed disposed of at its fair market value at death (A) I only (B) 1 and 2 only (C) 2 and 4 only (D) 2 and 3 only 18. Barbarn is a college student. Her grandparents have given her $20,000 to fund her college education. She is considering a short-term investment of no more than five years in a money market mutual fund or an individual variable insurance contract (IVIC). Which of the following statements about these investment vehicles is correct? (A) She has the benefit of the guarantee in the IVIC (B) Her investment in the mutual fund is protected from creditors (C) She will not be exposed to any annual taxation under either plan (D) Her IVIC guarantee is protected by Assuris. 19. Joanne is a partner in an employment counselling company. She is looking for a group RRSP for five employees. The management has decided to use an insurance company to administer the plan and they are choosing between individual variable insurance contracts (IVIC) and mutual funds as the investment vehicle. Which of the following statements are correct about these investment types? (A) There is taxation of income distributions under mutual funds and tax deferral under the IVIC (B) There is a guarantee of 75% under the IVIC during the duration of the investment. (C) There is protection of the administration of the plan by the securities commission in the company's province of residence for both investment types. (D) There is the ability to appoint a beneficiary under an IVIC and thereby avoid including the value of the IVIC in the owner's estate for probate. 20. Wilfred is considering investing in a "pooled" fund. His financial advisor describes two types of pooled funds, mutual funds and segregated funds, and the differences between them. Which of the following statements correctly describes differences between mutual fund and segregated fund investments? 1 A segregated fund guarantees to pay out at least 75% of an investor's deposits upon the investor's death or maturity of the contract. A mutual fund guarantees 100% of the principal, 2 Segregated fund investments are offered through a "prospectus" that must be filed with the provincial insurance regulators, Mutual fund investments are offered with an information folder" that is filed with the provincial securities commissions. 3 Segregated fund investments allow an owner to appoint a beneficiary for benefits payable if the owner dies, exempting the proceeds from probate fees. Mutual fund investment proceeds are paid to the deceased owner's estate and become subject to probate fees. 4 Segregated fund investments may be protected from seizure by the owner's creditors if the owner has appointed a family member as beneficiary for the proceeds on the owner's death. Mutual fund investments are subject to seizure by the owner's creditors without exception. (A) 1 and 2 only (B) 3 and 4 only (C) and 4 only (D) 2 and 4 only