Answer all 11 multiple choice questions. Only give answers

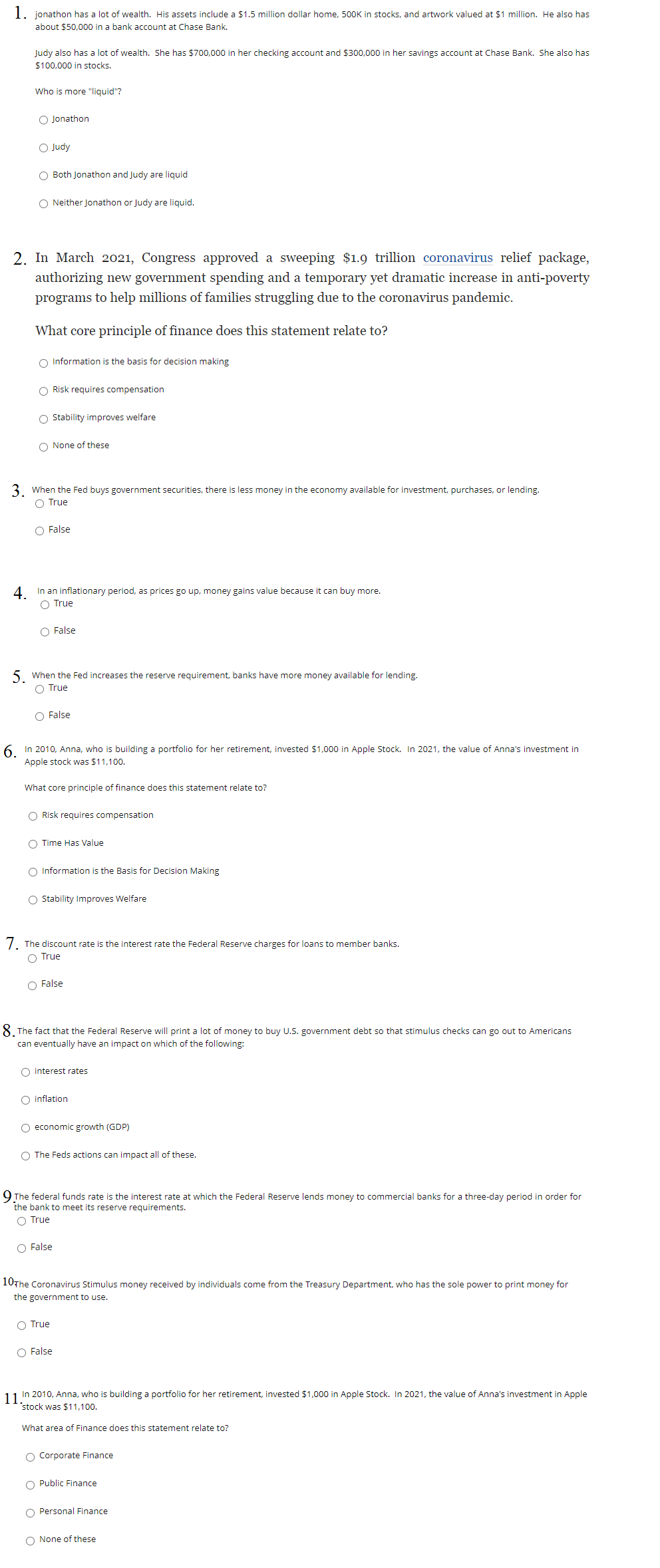

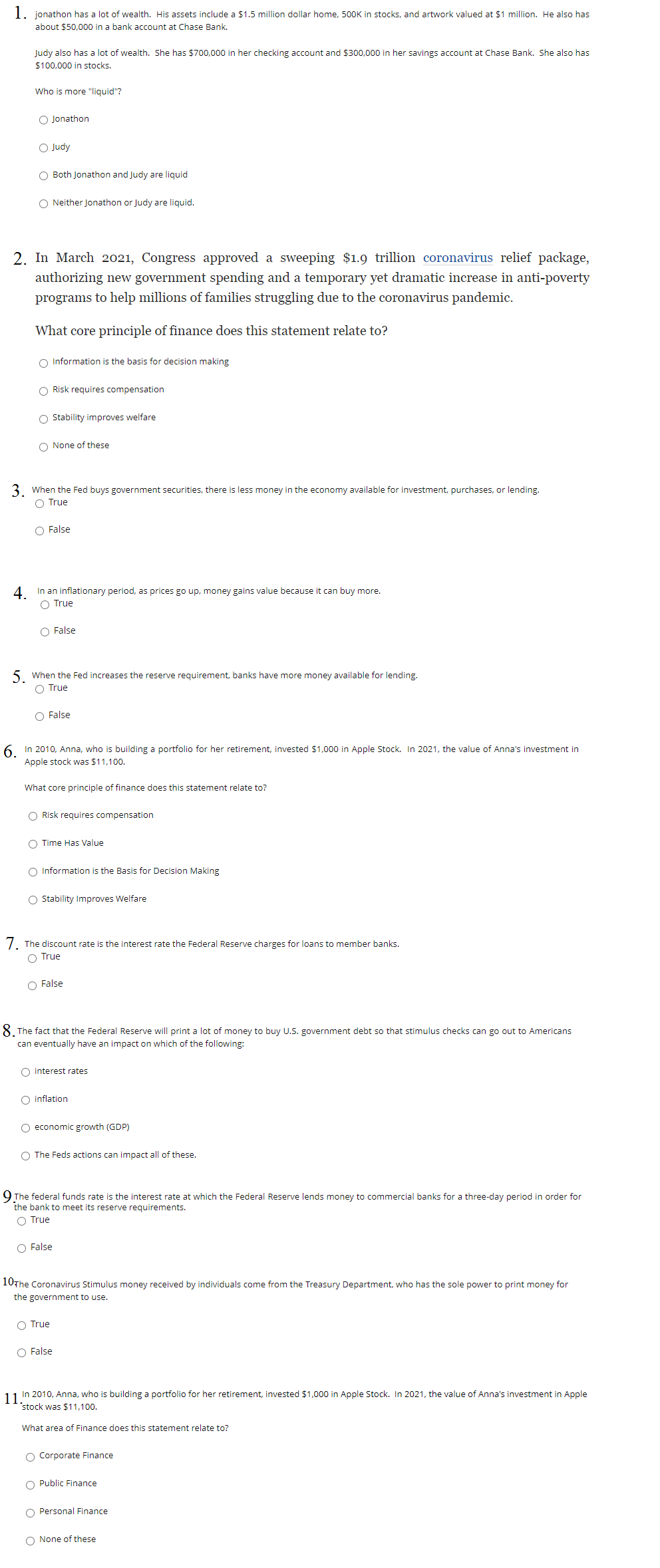

1. jonathon has a lot of wealth. His assets include a $1.5 million dollar home, 500K in stocks, and artwork valued at $1 million. He also has about $50,000 in a bank account at Chase Bank. Judy also has a lot of wealth. She has $700,000 in her checking account and $300,000 in her savings account at Chase Bank. She also has $100,000 in stocks. Who is more "liquid"? O Jonathon O Judy Both Jonathon and Judy are liquid Neither Jonathon or Judy are liquid. 2. In March 2021, Congress approved a sweeping $1.9 trillion coronavirus relief package, authorizing new government spending and a temporary yet dramatic increase in anti-poverty programs to help millions of families struggling due to the coronavirus pandemic. What core principle of finance does this statement relate to? Information is the basis for decision making Risk requires compensation Stability improves welfare O None of these 3. When the Fed buys government securities, there is less money in the economy available for investment, purchases, or lending. True False 4. In an inflationary period, as prices go up, money gains value because it can buy more. True O False 5. When the Fed increases the reserve requirement, banks have more money available for lending. O True O False 6. In 2010, Anna, who is building a portfolio for her retirement, invested $1,000 in Apple Stock. In 2021, the value of Anna's investment in Apple stock was $11,100. What core principle of finance does this statement relate to? Risk requires compensation O Time Has Value Information is the Basis for Decision Making O Stability Improves Welfare 7. The discount rate is the interest rate the Federal Reserve charges for loans to member banks. True False 8. The fact that the Federal Reserve will print a lot of money to buy U.S. government debt so that stimulus checks can go out to Americans can eventually have an impact on which of the following: O interest rates inflation O economic growth (GDP) The Feds actions can impact all of these. 9 The federal funds rate is the interest rate at which the Federal Reserve lends money to commercial banks for a three-day period in order for the bank to meet its reserve requirements. True O False 10the Coronavirus Stimulus money received by individuals come from the Treasury Department, who has the sole power to print money for the government to use. True O False 11.In 2010, Anna, who is building a portfolio for her retirement, invested $1,000 in Apple Stock. In 2021, the value of Anna's investment in Apple 'stock was $11,100. What area of Finance does this statement relate to? Corporate Finance Public Finance Personal Finance None of these 1. jonathon has a lot of wealth. His assets include a $1.5 million dollar home, 500K in stocks, and artwork valued at $1 million. He also has about $50,000 in a bank account at Chase Bank. Judy also has a lot of wealth. She has $700,000 in her checking account and $300,000 in her savings account at Chase Bank. She also has $100,000 in stocks. Who is more "liquid"? O Jonathon O Judy Both Jonathon and Judy are liquid Neither Jonathon or Judy are liquid. 2. In March 2021, Congress approved a sweeping $1.9 trillion coronavirus relief package, authorizing new government spending and a temporary yet dramatic increase in anti-poverty programs to help millions of families struggling due to the coronavirus pandemic. What core principle of finance does this statement relate to? Information is the basis for decision making Risk requires compensation Stability improves welfare O None of these 3. When the Fed buys government securities, there is less money in the economy available for investment, purchases, or lending. True False 4. In an inflationary period, as prices go up, money gains value because it can buy more. True O False 5. When the Fed increases the reserve requirement, banks have more money available for lending. O True O False 6. In 2010, Anna, who is building a portfolio for her retirement, invested $1,000 in Apple Stock. In 2021, the value of Anna's investment in Apple stock was $11,100. What core principle of finance does this statement relate to? Risk requires compensation O Time Has Value Information is the Basis for Decision Making O Stability Improves Welfare 7. The discount rate is the interest rate the Federal Reserve charges for loans to member banks. True False 8. The fact that the Federal Reserve will print a lot of money to buy U.S. government debt so that stimulus checks can go out to Americans can eventually have an impact on which of the following: O interest rates inflation O economic growth (GDP) The Feds actions can impact all of these. 9 The federal funds rate is the interest rate at which the Federal Reserve lends money to commercial banks for a three-day period in order for the bank to meet its reserve requirements. True O False 10the Coronavirus Stimulus money received by individuals come from the Treasury Department, who has the sole power to print money for the government to use. True O False 11.In 2010, Anna, who is building a portfolio for her retirement, invested $1,000 in Apple Stock. In 2021, the value of Anna's investment in Apple 'stock was $11,100. What area of Finance does this statement relate to? Corporate Finance Public Finance Personal Finance None of these