Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer all 21. Which one of the following statements is NOT true about amortization? toward interest in the early periods. amortized loan, a smaller proportion

Answer all

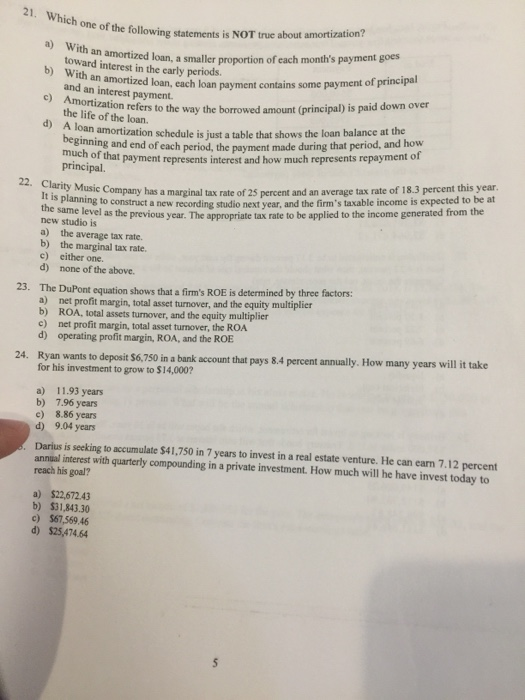

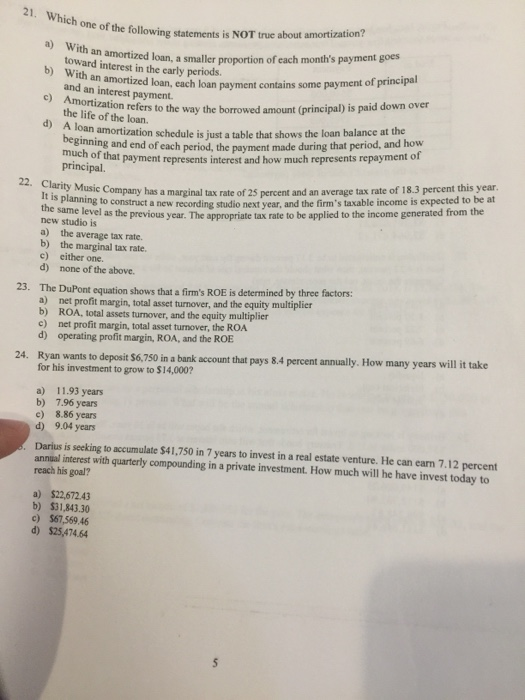

21. Which one of the following statements is NOT true about amortization? toward interest in the early periods. amortized loan, a smaller proportion of each month's payment goes b) With an amortized loan, each loan payment contains some payment of principal and an interest payment. c) n refers to the way the borrowed amount (principal) is paid down over the life of the loan. amortization schedule is just a table that shows the loan balance at the beginning and end of each period, the payment made during that period, and how ch of that payment represents interest and how much represents repayment o principal. 22. Clarity Music Company has a marginal tax rate of 25 percent and an average tax rate of 18.3 percent this year It is planning to construct a new recording studio next vear, and the firm's taxable income is expected to be at the new studio is a) the average tax rate. b) the marginal tax rate e) either one. d) none of the above. previous year. The appropriate tax rate to be applied to the income generated from the The DuPont equation shows that a firm's ROE is determined by three factors: a) net profit margin, total asset turnover, and the equity multiplier b) ROA, total assets turnover, and the equity multiplier c) net profit margin, total asset tunover, the ROA d) operating profit margin, ROA, and the ROE 23. yan wants to deposit S6,750 in a bank account that pays 8.4 percent annually. How many years will it take for his investment to grow to $14,000? a) 11.93 years b) 7.96 years c) 8.86 years d) 9.04 years Darius is seeking to accumulate $41,750 in 7 years to invest in a real estate venture. He can earn 7.12 percent annual interest with quarterly compounding in a private investment. How much will he have invest today to reach his goal? a) $22,672.43 b) $31,843.30 c) $67,569.46 d) $25,474.64

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started