Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer all 4 mcqs correct pls with logical answer. If try to solve only one then dont attempt. Chegg allows upto 4 parts. The advantage(s)

Answer all 4 mcqs correct pls with logical answer. If try to solve only one then dont attempt. Chegg allows upto 4 parts.

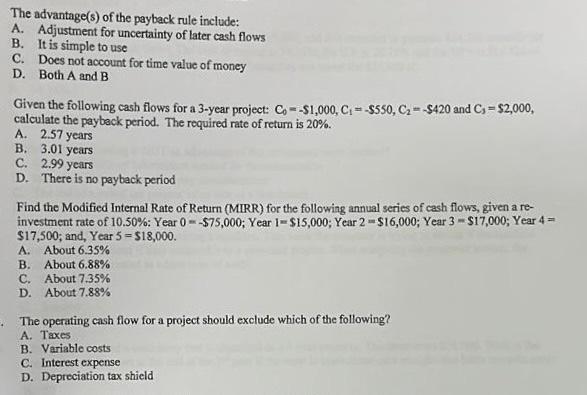

The advantage(s) of the payback rule include: A. Adjustment for uncertainty of later cash flows B. It is simple to use C. Does not account for time value of money D. Both A and B Given the following cash flows for a 3-year project: C0=$1,000,C1=$550,C2=$420 and C3=$2,000, calculate the payback period. The required rate of return is 20%. A. 2.57 years B. 3.01 years C. 2.99 years D. There is no payback period Find the Modified Internal Rate of Return (MIRR) for the following annual series of cash flows, given a reinvestment rate of 10.50% : Year 0=$75,000; Year 1=$15,000; Year 2=$16,000; Year 3=$17,000; Year 4= $17,500; and, Year 5=$18,000. A. About 6.35% B. About 6.88% C. About 7.35% D. About 7.88% The operating cash flow for a project should exclude which of the following? A. Texes B. Variable costs C. Interest expense D. Deprociation tax shield The advantage(s) of the payback rule include: A. Adjustment for uncertainty of later cash flows B. It is simple to use C. Does not account for time value of money D. Both A and B Given the following cash flows for a 3-year project: C0=$1,000,C1=$550,C2=$420 and C3=$2,000, calculate the payback period. The required rate of return is 20%. A. 2.57 years B. 3.01 years C. 2.99 years D. There is no payback period Find the Modified Internal Rate of Return (MIRR) for the following annual series of cash flows, given a reinvestment rate of 10.50% : Year 0=$75,000; Year 1=$15,000; Year 2=$16,000; Year 3=$17,000; Year 4= $17,500; and, Year 5=$18,000. A. About 6.35% B. About 6.88% C. About 7.35% D. About 7.88% The operating cash flow for a project should exclude which of the following? A. Texes B. Variable costs C. Interest expense D. Deprociation tax shield

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started