answer all correctly will leave thumbs up

answer all correctly will leave thumbs up

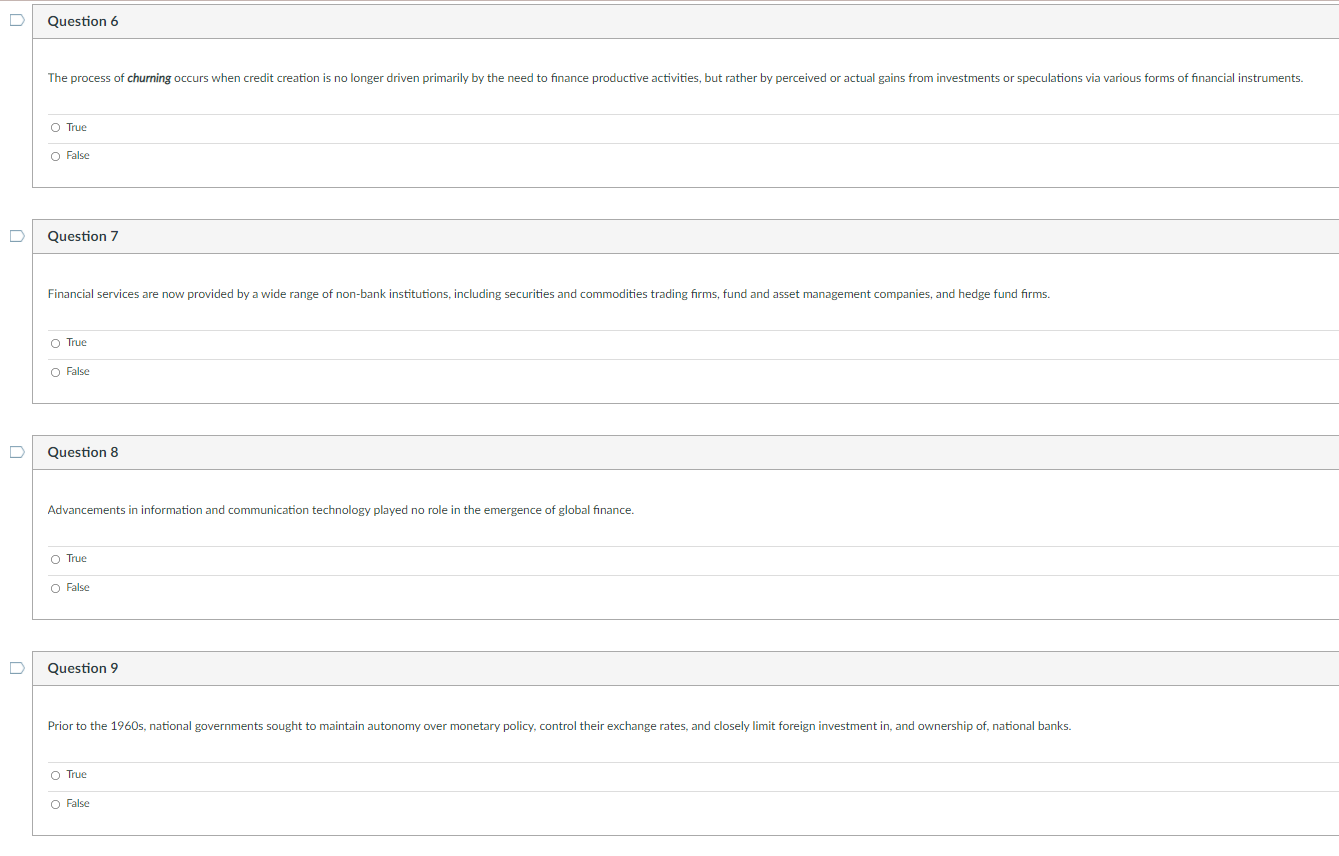

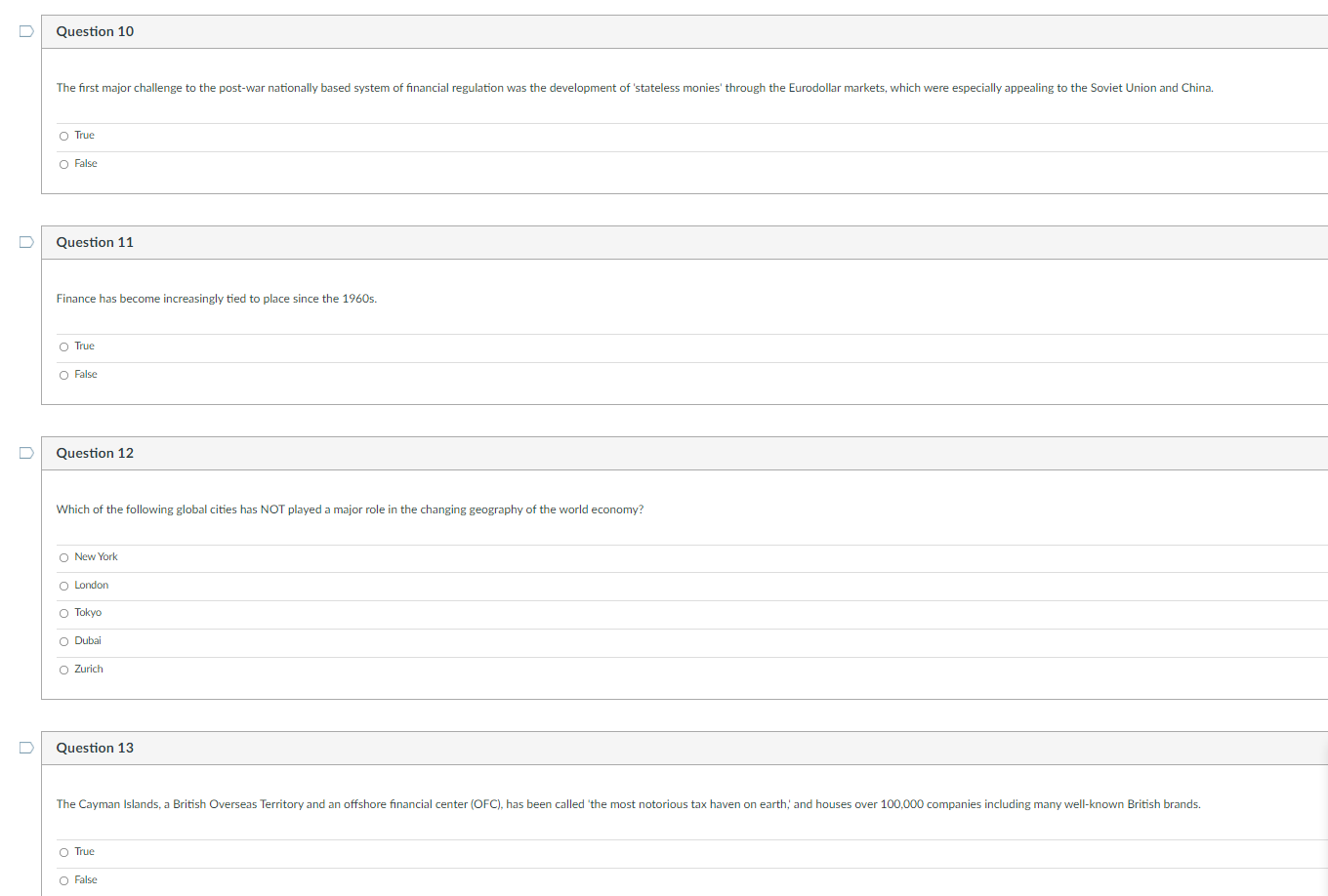

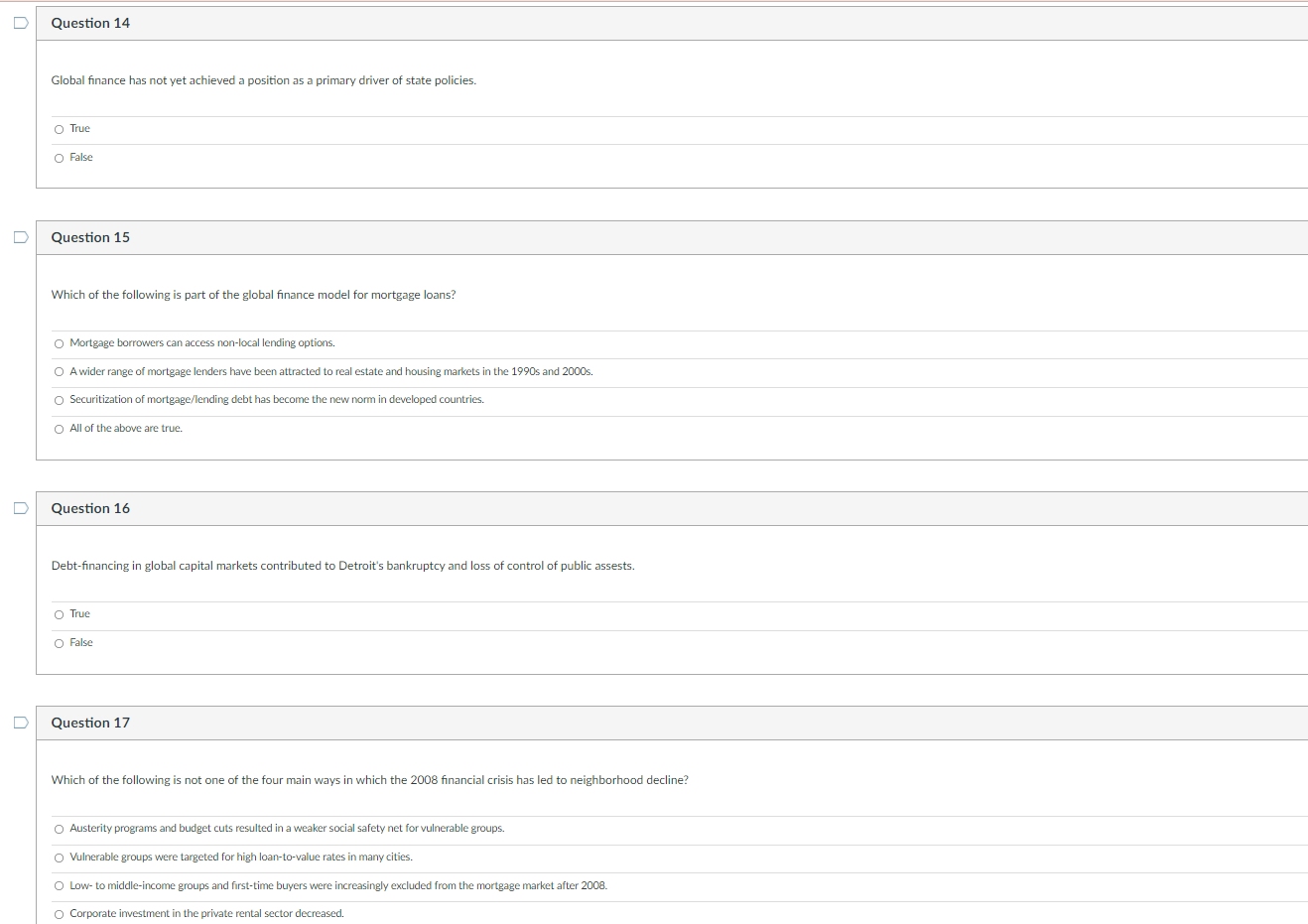

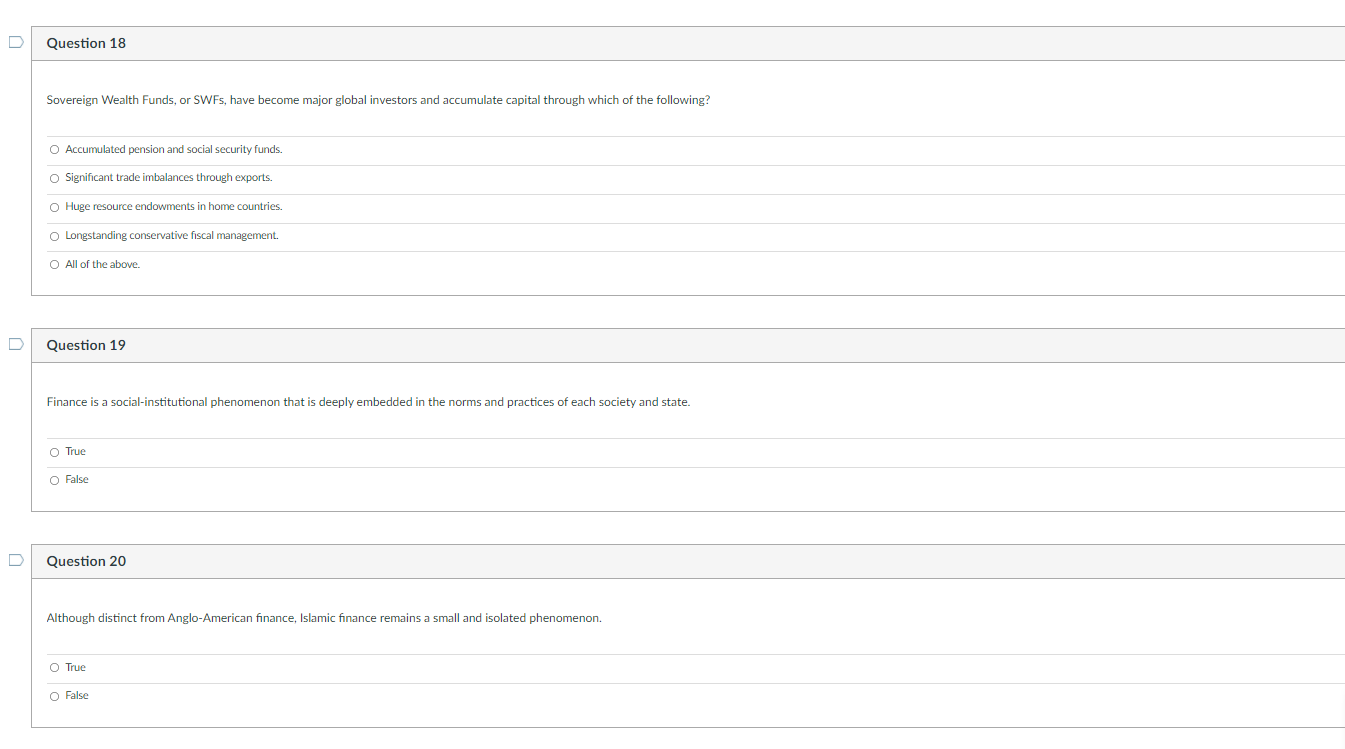

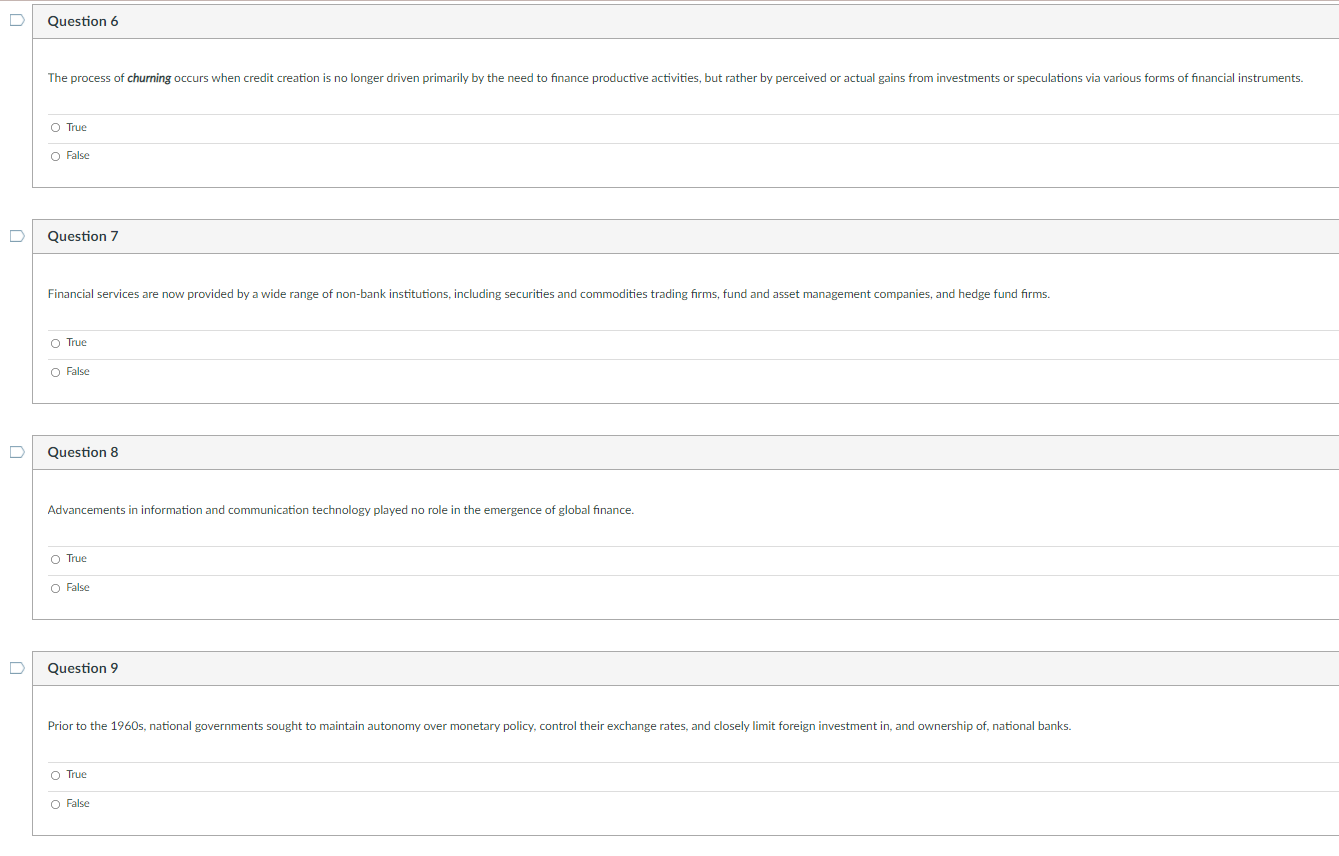

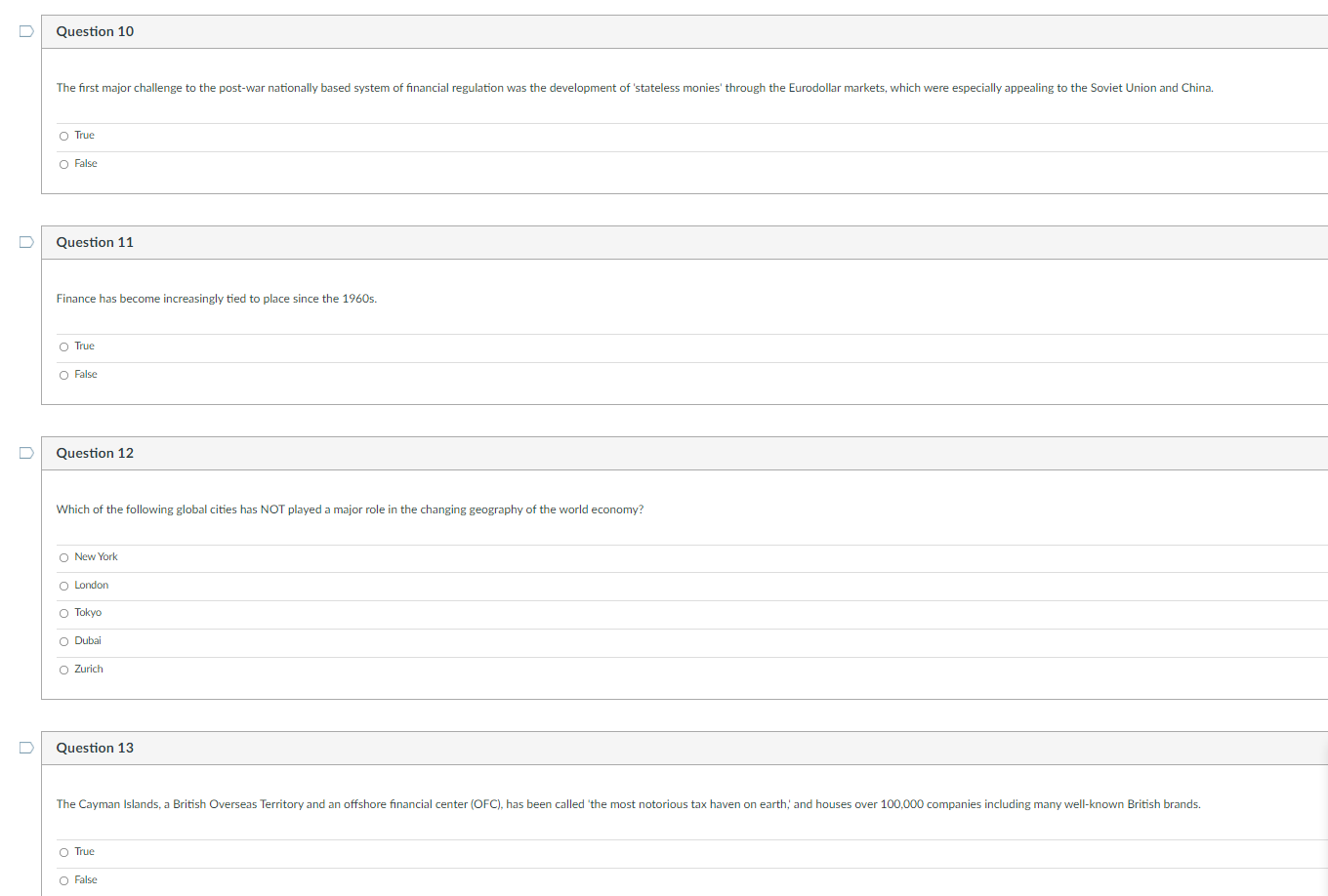

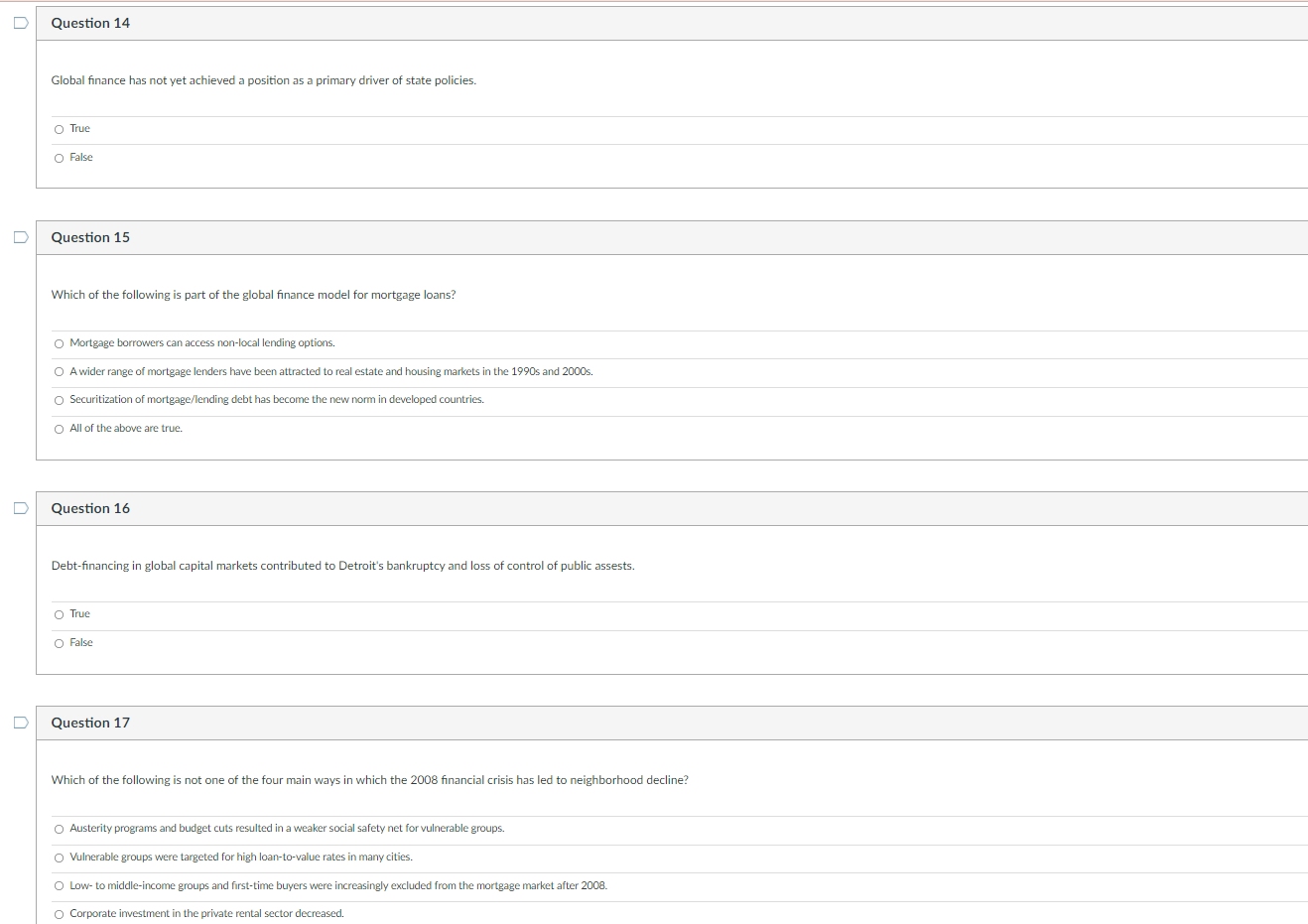

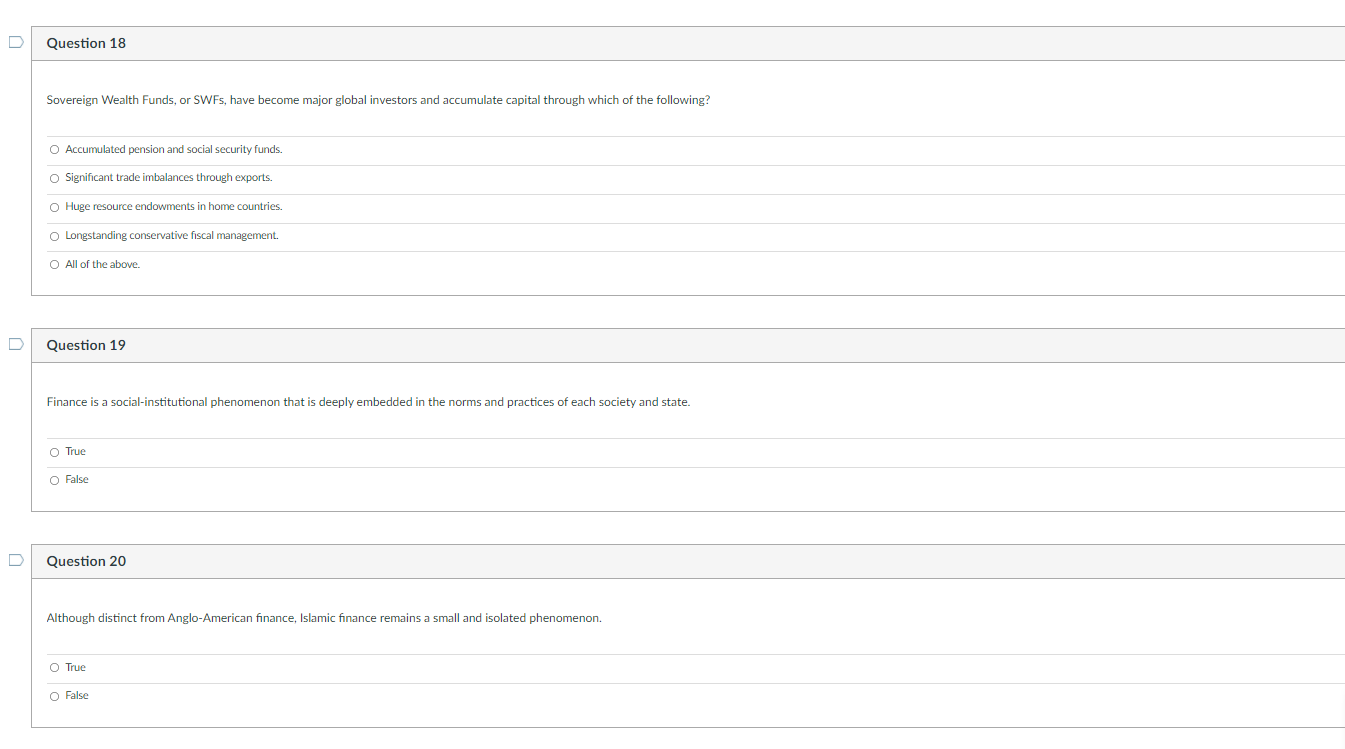

Question 6 The process of churning occurs when credit creation is no longer driven primarily by the need to finance productive activities, but rather by perceived or actual gains from investments or speculations via various forms of financial instruments. O True O False Question 7 Financial services are now provided by a wide range of non-bank institutions, including securities and commodities trading firms, fund and asset management companies, and hedge fund firms. O True O False Question 8 Advancements in information and communication technology played no role in the emergence of global finance. O True 100 O False Question 9 Prior to the 1960s, national governments sought to maintain autonomy over monetary policy, control their exchange rates, and closely limit foreign investment in, and ownership of, national banks. O True O False Question 10 The first major challenge to the post-war nationally based system of financial regulation was the development of stateless monies through the Eurodollar markets, which were especially appealing to the Soviet Union and China. O True O False D Question 11 Finance has become increasingly tied to place since the 1960s. O True O False D Question 12 Which of the following global cities has NOT played a major role in the changing geography of the world economy? O New York O London Tokyo O Dubai O Zurich D Question 13 The Cayman Islands, a British Overseas Territory and an offshore financial center (OFC), has been called the most notorious tax haven on earth, and houses over 100.000 companies including many well-known British brands. O True O False D Question 14 Global finance has not yet achieved a position as a primary driver of state policies. O True O False D Question 15 Which of the following is part of the global finance model for mortgage loans? O Mortgage borrowers can access non-local lending options. O A wider range of mortgage lenders have been attracted to real estate and housing markets in the 1990s and 2000s. O Securitization of mortgage/lending debt has become the new norm developed countries. O All of the above are true. D Question 16 Debt-financing in global capital markets contributed to Detroit's bankruptcy and loss of control of public assests. O True O False D Question 17 Which of the following is not one of the four main ways in which the 2008 financial crisis has led to neighborhood decline? Austerity programs and budget cuts resulted in a weaker social safety net for vulnerable groups. O Vulnerable groups were targeted for high loan-to-value rates in many cities. O Low-to middle-income groups and first-time buyers were increasingly excluded from the mortgage market after 2008. O Corporate investment in the private rental sector decreased. D Question 18 Sovereign Wealth Funds, or SWFs, have become major global investors and accumulate capital through which of the following? O Accumulated pension and social security funds. O Significant trade imbalances through exports. O Huge resource endowments in home countries. O Longstanding conservative fiscal management. O All of the above. Question 19 Finance is a social-institutional phenomenon that is deeply embedded in the norms and practices of each society and state. O True O False Question 20 Although distinct from Anglo-American finance, Islamic finance remains a small and isolated phenomenon. O True O False

answer all correctly will leave thumbs up

answer all correctly will leave thumbs up