answer all excel parts and final questions please

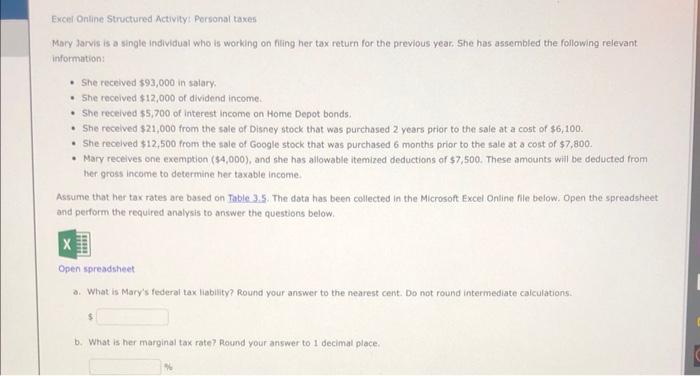

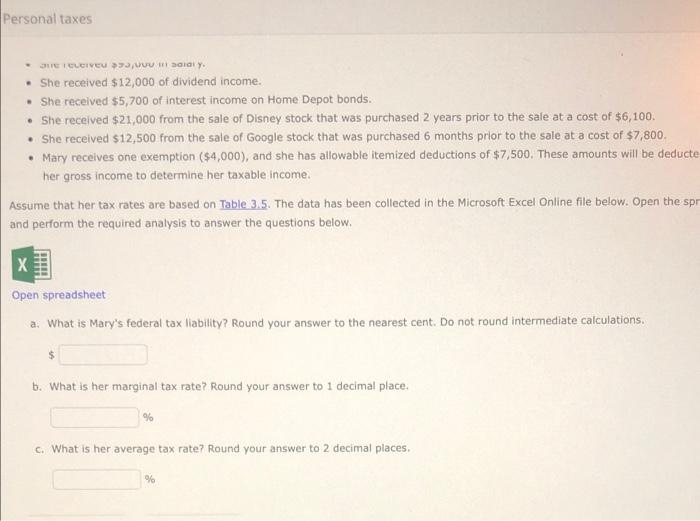

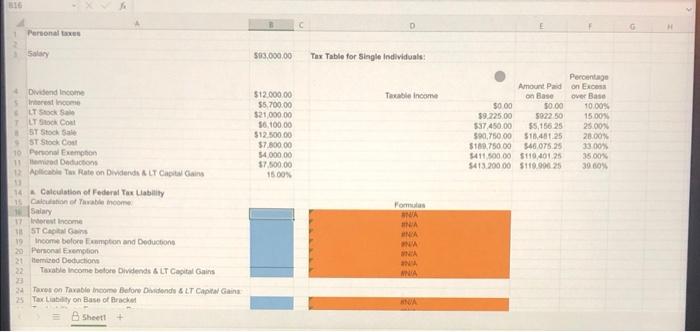

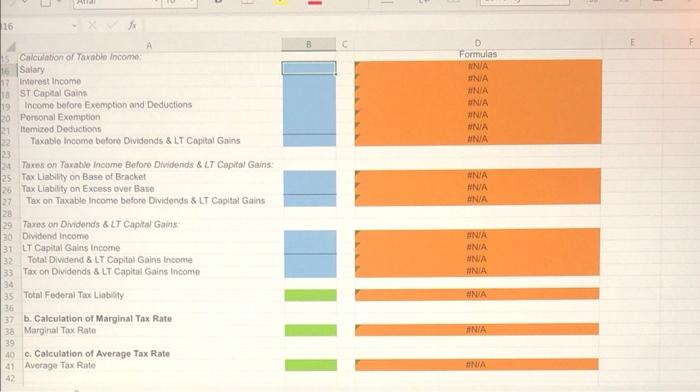

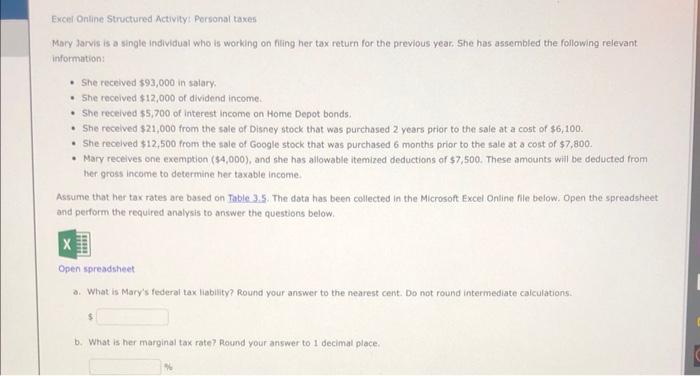

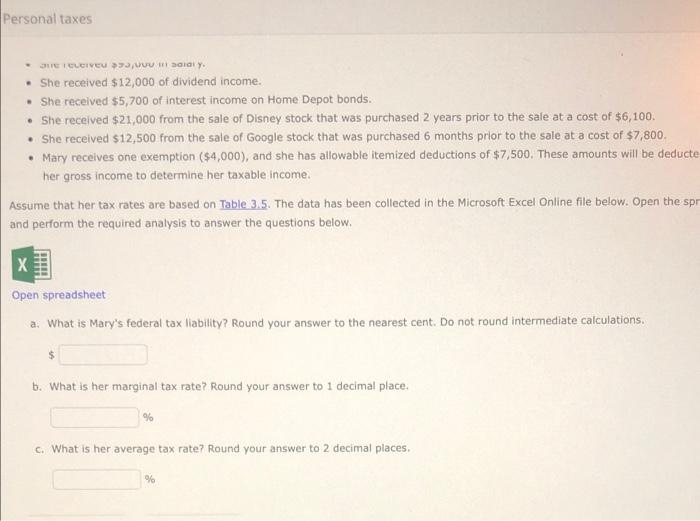

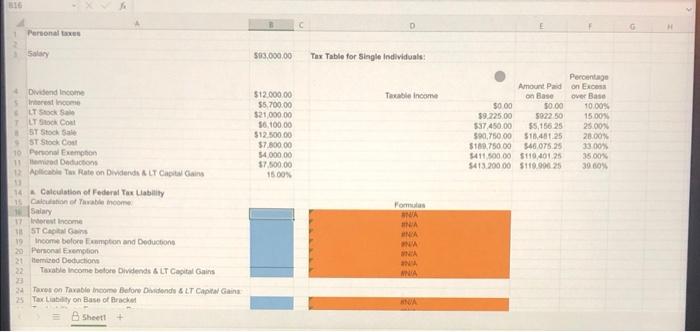

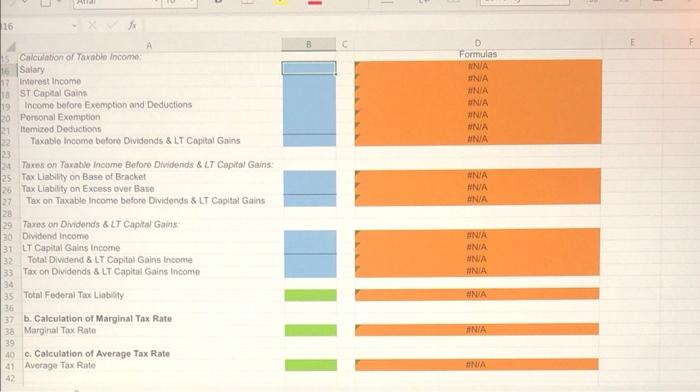

Excei Online Structured Activity. Porsonal taxes Macy larvis is a single individual who is working on filing her tax return for the previlous year, She has assembled the following relevant. information: - She received $93,000 in salary. - She recelved $12,000 of dividend income. - She received $5,700 of interest income on Home Depot bonds. - She recelved $21,000 from the sale of Disney stock that was purchased 2 years prior to the sale at a cost of $6,100. - She recelved \$12,500 from the sale of Google stock that was purchased 6 months priar to the sale at a cost of $7,800. - Mary recelves one exemption ($4,000), and she has allowable itemized deductions of $7,500. These amounts will be deducted from her gross income to determine her taxable income. Assume that her tax rates are based on Table 3.5. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet a. What is Mary's federal tax liability? Round your answer to the nearest cent. Do not round intermediate calculations. 5 b. What is her marginal tax rate? Round your answer to 1 decimal place. - Jie receiven p73, vor in saialy. - She received $12,000 of dividend income. - She received $5,700 of interest income on Home Depot bonds. - She received $21,000 from the sale of Disney stock that was purchased 2 years prior to the sale at a cost of $6,100. - She received $12,500 from the sale of Google stock that was purchased 6 months prior to the sale at a cost of $7,800. - Mary receives one exemption ($4,000), and she has allowable itemized deductions of $7,500. These amounts will be deducte her gross income to determine her taxable income. Assume that her tax rates are based on Table 3.5. The data has been collected in the Microsoft Excel Online file below. Open the spr and perform the required analysis to answer the questions below. Open spreadsheet a. What is Mary's federal tax liability? Round your answer to the nearest cent. Do not round intermediate calculations. b. What is her marginal tax rate? Round your answer to 1 decimal place, c. What is her average tax rate? Round your answer to 2 decimal places. Pereonal taxes c Salary 503.090.00 Tax Table for Siagle individuals: 14 A Calculation of Federal Tax Lability 15. Calciction of Tarabie moorse. 1. Saiary 11 interest tiocome I18 St Captan Gains 19 income belore Eumpton and Deductons 28. Parnonal Fremption Hemited Dectuctions Twable income belore Divelenas 4 LT Cagital Gains Tanes on Tavable inoome Before Dhidende 8 LT Capitar Gaing. Taxtlabilly on Base of Erackit 16fx Calculation of Taxable income