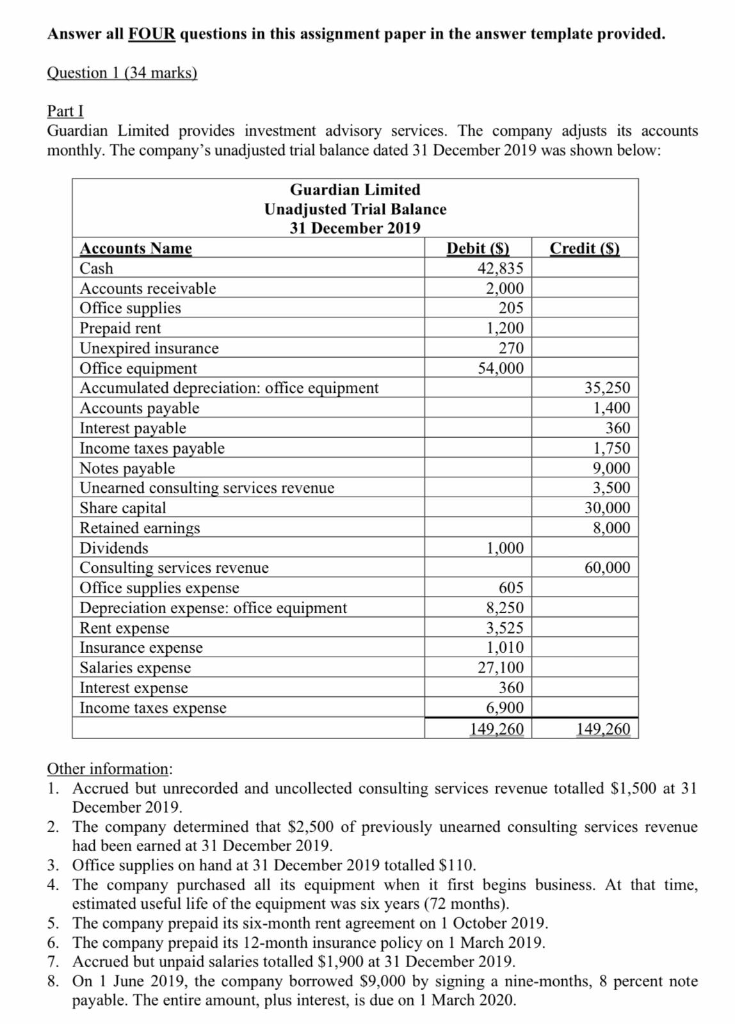

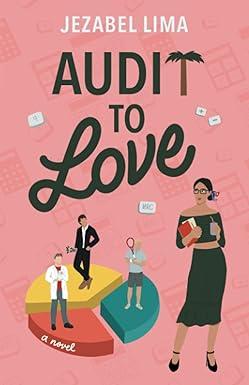

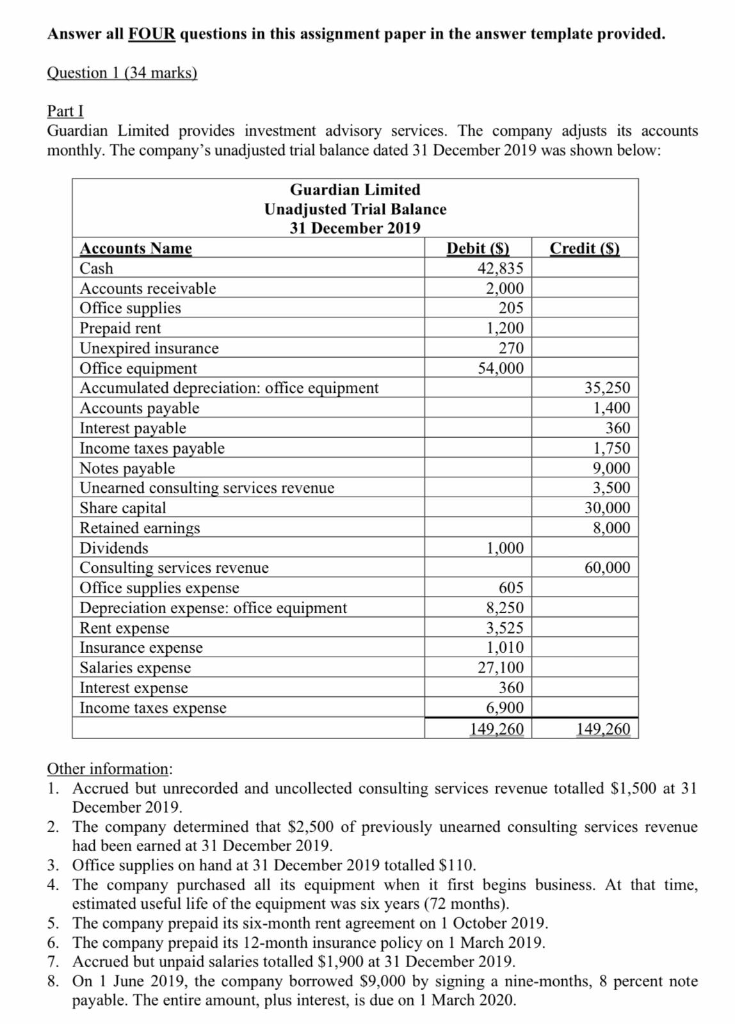

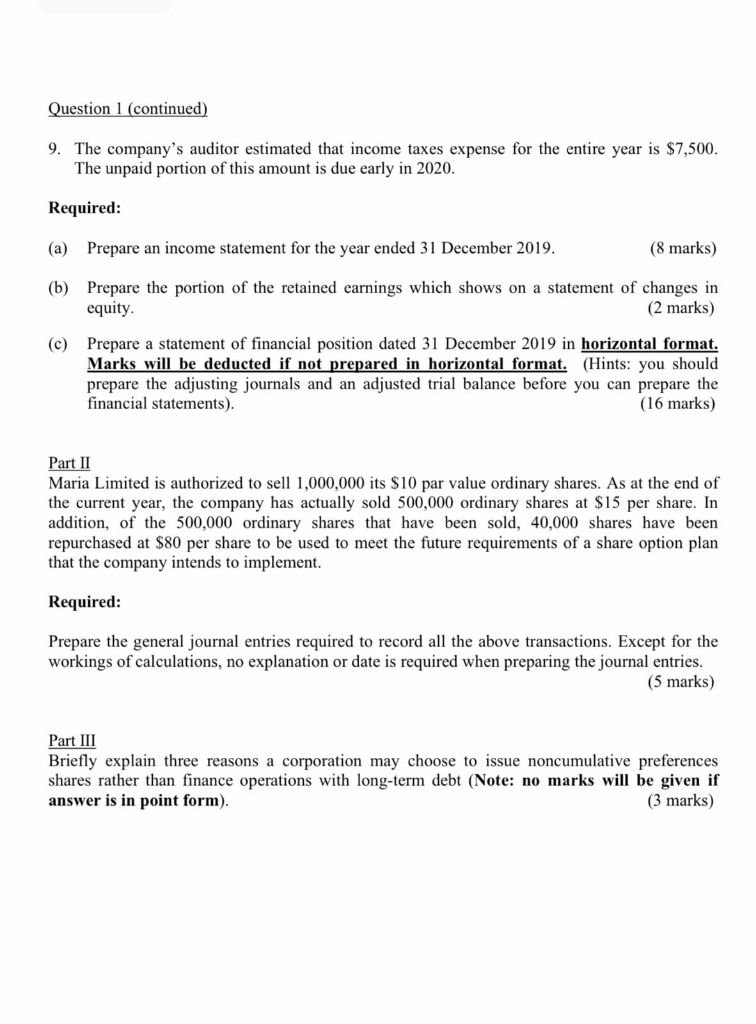

Answer all FOUR questions in this assignment paper in the answer template provided. Question 1 (34 marks) Part I Guardian Limited provides investment advisory services. The company adjusts its accounts monthly. The company's unadjusted trial balance dated 31 December 2019 was shown below: Credit (S) Guardian Limited Unadjusted Trial Balance 31 December 2019 Accounts Name Debit ($) Cash 42,835 Accounts receivable 2,000 Office supplies 205 Prepaid rent 1,200 Unexpired insurance 270 Office equipment 54,000 Accumulated depreciation: office equipment Accounts payable Interest payable Income taxes payable Notes payable Unearned consulting services revenue Share capital Retained earnings Dividends 1,000 Consulting services revenue Office supplies expense 605 Depreciation expense: office equipment 8,250 Rent expense 3,525 Insurance expense 1,010 Salaries expense 27,100 Interest expense 360 Income taxes expense 6,900 149,260 35,250 1,400 360 1,750 9,000 3,500 30,000 8.000 60,000 149,260 Other information: 1. Accrued but unrecorded and uncollected consulting services revenue totalled $1,500 at 31 December 2019. 2. The company determined that $2,500 of previously unearned consulting services revenue had been earned at 31 December 2019. 3. Office supplies on hand at 31 December 2019 totalled $110. 4. The company purchased all its equipment when it first begins business. At that time, estimated useful life of the equipment was six years (72 months). 5. The company prepaid its six-month rent agreement on 1 October 2019. 6. The company prepaid its 12-month insurance policy on 1 March 2019. 7. Accrued but unpaid salaries totalled $1,900 at 31 December 2019. 8. On 1 June 2019, the company borrowed $9,000 by signing a nine-months, 8 percent note payable. The entire amount, plus interest, is due on 1 March 2020. Question 1 (continued) 9. The company's auditor estimated that income taxes expense for the entire year is $7,500. The unpaid portion of this amount is due early in 2020. Required: (a) Prepare an income statement for the year ended 31 December 2019. (8 marks) (b) Prepare the portion of the retained earnings which shows on a statement of changes in equity. (2 marks) (c) Prepare a statement of financial position dated 31 December 2019 in horizontal format. Marks will be deducted if not prepared in horizontal format. (Hints: you should prepare the adjusting journals and an adjusted trial balance before you can prepare the financial statements). (16 marks) Part II Maria Limited is authorized to sell 1,000,000 its $10 par value ordinary shares. As at the end of the current year, the company has actually sold 500,000 ordinary shares at $15 per share. In addition, of the 500,000 ordinary shares that have been sold, 40,000 shares have been repurchased at $80 per share to be used to meet the future requirements of a share option plan that the company intends to implement. Required: Prepare the general journal entries required to record all the above transactions. Except for the workings of calculations, no explanation or date is required when preparing the journal entries. (5 marks) Part III Briefly explain three reasons a corporation may choose to issue noncumulative preferences shares rather than finance operations with long-term debt (Note: no marks will be given if answer is in point form)