Answered step by step

Verified Expert Solution

Question

1 Approved Answer

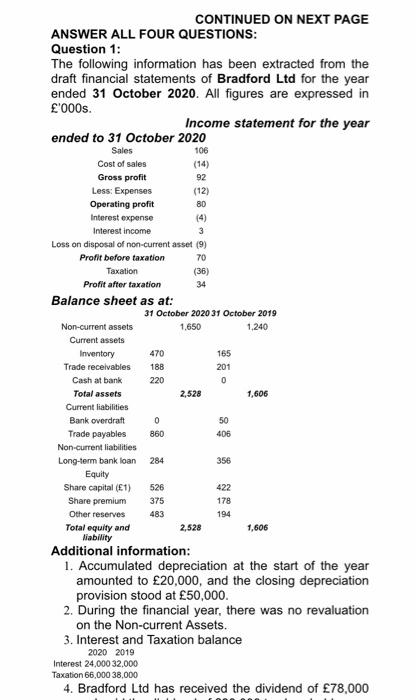

ANSWER ALL FOUR QUESTIONS: Question 1: The following information has been extracted from the draft financial statements of Bradford Ltd for the year ended 31

ANSWER ALL FOUR QUESTIONS:

Question 1:

The following information has been extracted from the draft financial statements of Bradford Ltd for the year ended 31 October 2020. All figures are expressed in 000s.

Income statement for the year ended to 31 October 2020

Sales

106

Cost of sales

(14)

Gross profit

92

Less: Expenses

(12)

Operating profit

80

Interest expense

(4)

Interest income

3

Loss on disposal of non-current asset

(9)

Profit before taxation

70

Taxation

(36)

Profit after taxation

34

Balance sheet as at:

31 October 2020

31 October 2019

Non-current assets

1,650

1,240

Current assets

Inventory

470

165

Trade receivables

188

201

Cash at bank

220

0

Total assets

2,528

1,606

Current liabilities

Bank overdraft

0

50

Trade payables

860

406

Non-current liabilities

Long-term bank loan

284

356

Equity

Share capital (1)

526

422

Share premium

375

178

Other reserves

483

194

Total equity and liability

2,528

1,606

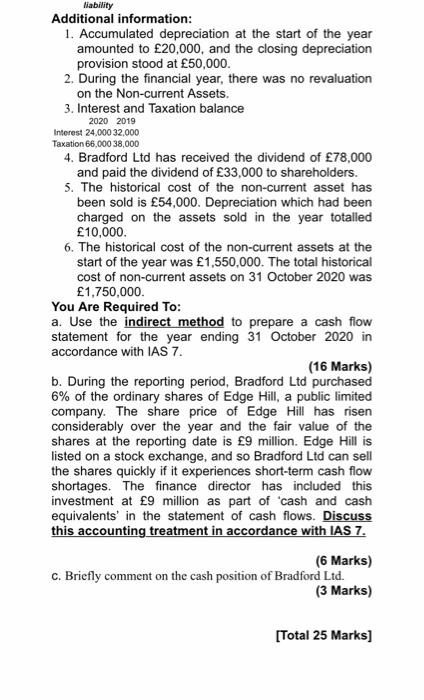

Additional information:

1. Accumulated depreciation at the start of the year amounted to 20,000, and the closing depreciation provision stood at 50,000.

2. During the financial year, there was no revaluation on the Non-current Assets.

3. Interest and Taxation balance

2020

2019

Interest

24,000

32,000

Taxation

66,000

38,000

4. Bradford Ltd has received the dividend of 78,000 and paid the dividend of 33,000 to shareholders.

5. The historical cost of the non-current asset has been sold is 54,000. Depreciation which had been charged on the assets sold in the year totalled 10,000.

6. The historical cost of the non-current assets at the start of the year was 1,550,000. The total historical cost of non-current assets on 31 October 2020 was 1,750,000.

You Are Required To:

a. Use the indirect method to prepare a cash flow statement for the year ending 31 October 2020 in accordance with IAS 7.

(16 Marks)

b. During the reporting period, Bradford Ltd purchased 6% of the ordinary shares of Edge Hill, a public limited company. The share price of Edge Hill has risen considerably over the year and the fair value of the shares at the reporting date is 9 million. Edge Hill is listed on a stock exchange, and so Bradford Ltd can sell the shares quickly if it experiences short-term cash flow shortages. The finance director has included this investment at 9 million as part of cash and cash equivalents in the statement of cash flows. Discuss this accounting treatment in accordance with IAS 7.

(6 Marks)

c. Briefly comment on the cash position of Bradford Ltd.

(3 Marks)

[Total 25 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started